GROWTHACES.COM Forex Trading Strategies

Taken positions

AUD/NZD: long at 1.0950, target 1.1300, stop-loss 1.0830, risk factor **

AUD/JPY: long at 88.30, target 91.00, profit locked in at 89.70, risk factor **

More strategies - GrowthAces.com

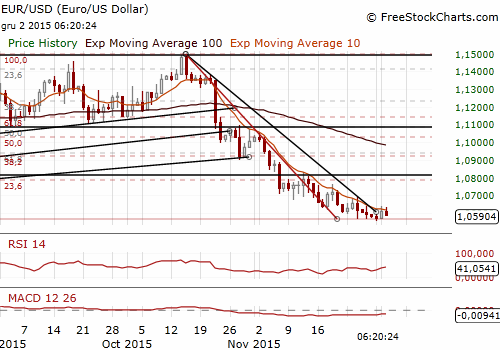

EUR/USD: Eurozone Inflation Below Expectations

- Consumer prices in the Eurozone increased by 0.1% yoy in November, the same pace as in October, and by less than the market consensus of 0.2%

- The main factor that capped price increases was a fall in energy costs, which were 7.3% lower this month than a year ago. Unprocessed food was 2.6% more expensive. Without these two volatile elements, the inflation measure that the European Central Bank calls core inflation, was 0.9% in November, down from an upwardly revised 1.0% in October.

- Industrial producer prices in the Eurozone were down by 3.1% yoy in October compared to the previous month.

- The ECB's Governing Council will meet on Thursday and is widely expected to bolster the quantitative easing programme. Considering the expected cut in interest rates, a cut of between 10-15 bp is priced in for the deposit rate, with the market leaning a little more toward a larger cut. There is, however, an impression, and also a track record, of doing more to surprise and so maintain an aura of being ahead of the market, so a larger cut is possible. This is especially true if a tiered system of cuts is engineered. So while a 15 bp cut in the depo rate would drop it down to -0.35%, there has been talk that a tiered system may see a more conventional cut of 10-15 bps, with an even bigger cut for some measure of excess deposits, down as far as a -0.50% rate. There are, however, issues with a tiered rate system, both operationally and potentially awkward politically. Regarding expanding the QE program, this option is less in favor by at least some members of the ECB Board vs. another cut in interest rates. The absolute minimum expected regarding the QE program is for an extension from its current end date of September 2016.

- We should know that Draghi’s track record, specifically his inclination to surprise, must by now have been incorporated into the market’s perception. Consequently, we think that investors are going to the meeting “well-prepared” even allowing for the possibility of some surprise. A bold ECB stimulus package may drive the EUR/USD below this-year minimum at 1.0457. A deeper cut in the deposit rate would mostly trigger a short-term psychological effect on the EUR/USD, pressuring it towards the 1.03-1.04 area.

- On the other hand, the Fed is widely expected to begin tightening monetary policy at its next meeting on December 15-16.

- Fed Governor Lael Brainard said that the Federal Reserve should go slow in raising rates, adding that there may be limits to the Fed's ability to tighten monetary policy while other central banks keep it loose. She added that weak growth abroad has pushed up the value of the USD, pushing down on inflation and the level of interest rates that the economy can withstand while still generating jobs and growth.

- Chicago Federal Reserve President Charles Evans said the Federal Reserve should use the communication tools at its disposal at its December meeting to spell out a gradual pace of rate increases.

- In our opinion, the EUR/USD recovery is likely after the December FOMC meeting – a hike is already priced in and the statement will be probably relatively dovish as the main mission for Fed policymakers is to convince markets that rate hiking path will be gradual.

- Watch today’s US ADP employment data (13:15 GMT) that may change expectations for US non-farm payrolls on Friday.

Significant technical analysis levels:

Resistance: 1.0640 (session high Dec 2), 1.0644 (10-day ema), 1.0689 (high Nov 25)

Support: 1.0558 (low Nov 30), 1.0521 (low Apr 13), 1.0457 (low Mar 16)

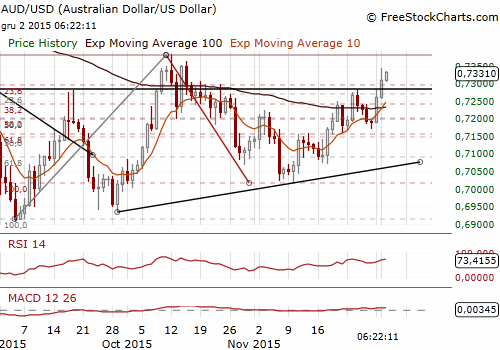

AUD/USD: Australian Economy Accelerates On Export Boost

- Australian GDP expanded 0.9% in the third quarter of 2015, as compared to an upwardly revised 0.3% growth in the previous quarter and above market consensus. The median forecast was at 0.8%. Positive contributions from net exports and final consumption expenditure offset a decline in investment.

- In the third quarter, final consumption expenditure grew 0.7%, adding 0.5 percentage points to GDP growth. Net exports contributed 1.5 percentage points to GDP growth. Exports of goods and services rose 4.6%, the largest increase since the third quarter of 2000. Meanwhile, imports of goods and services fell 2.4%. In contrast, gross fixed capital formation declined 4.0%, subtracting 1.0 percentage points from economic growth.

- Reserve Bank of Australia Governor Glenn Stevens said the latest reading on economic growth was above the bank's own forecasts and "not a bad outcome." He reiterated that there was scope to ease interest rates further if needed, but added that monetary policy had its limits. He repeatedly emphasised that he had no guidance to offer on the outlook for rates. Asked about the weakness of business investment outside of mining, Stevens said there was little to no evidence that lower interest rates would encourage investment spending.

- Interbank futures currently show only a one-in-five chance of a cut when the RBA next meets in early February. In our opinion, the RBA will not cut rates in the coming months and the next interest rate change will be a hike.

- Strong Australian macroeconomic data supported our AUD/JPY and AUD/NZD long positions. The AUD/JPY is in good shape now and we have locked in profit on this position at 89.70. We stay sideways on the AUD/USD because of risk of USD strengthening.

Significant technical analysis levels:

Resistance: 0.7342 (session high Dec 2), 0.7363 (high Oct 15), 0.7382 (high Oct 12)

Support: 0.7223 (low Dec 1), 0.7171 (low Nov 30), 0.7160 (low Nov 23)

Source: Growth Aces Forex Trading Strategies