GROWTHACES.COM Trading Positions

EUR/USD: short at 1.2530, target 1.2350, stop-loss 1.2610

USD/CHF: long at 0.9620, target 0.9750, stop-loss 0.9550

NZD/USD: short at 0.7800, target 0.7550, stop-loss 0.7920

EUR/GBP: short at 0.7850, target 0.7670, stop-loss 0.7920

AUD/NZD: long at 1.1220, target 1.1500, stop-loss 1.1080

We encourage you to visit our website and subscribe to our newsletter to receive trading positions summary for major pairs and crosses.

EUR/USD: Will Draghi follow Kuroda?

(we keep our short position)

- The U.S. ISM Non-Manufacturing Index fell to 57.1 in October, a second straight monthly drop and the lowest reading since June. The reading was below the median forecast of 58.0. The new orders index fell for a third straight month, this time by 1.9 pts. The employment index rose another 1.1 pts to 59.6, the highest since August 2005 and the third highest reading in the 17-year history of the series.

- The ADP National Employment Report showed U.S. private companies added 230k jobs in October, up from 225k jobs in the previous month. That was the strongest growth since June. The Labor Department will release its non-farm payrolls data for October on Friday.

- German industrial orders rose just 0.8% mom in September, below the consensus of 2.3% mom. August industrial orders were upwardly revised to a fall of 4.2% mom from a previously reported drop of 5.7% mom.

- The ECB’s meeting is scheduled for today. The ECB has started pumping more money into the banking system through purchases of private debt and offers of long-term loans, aiming to boost its balance sheet by up to EUR 1 tr. There is growing doubt whether its current measures will be enough. Will Draghi follow BOJ’s Kuroda today? The ECB is unlikely to announce anything new today, but the policy statement will be eyed closely today. The ECB is expected to wait until it gets a clearer view of the economy and the impact of its asset purchases and four-year loans to banks before adding further stimulus.

- Traders and economists are awaiting December meeting, when the ECB will update its economic projections. It is likely that the ECB will step up its stimulus in December, probably by widening its asset purchases to include corporate bonds. More drastic measures in the form of outright purchases of sovereign bonds still remain distant in the euro zone, mainly due to political hurdles, especially in Germany. Austrian Governing Council member Ewald Nowotny is also the opinion that the ECB should not be swayed by market pressure.

- The EUR/USD traded in relatively tight range 1.2479-1494 in Asia. It broke above 1.2510 later on a plunge in the USD/JPY. In the opinion of GrowthAces.com the medium-term outlook for the EUR/USD is bearish. We keep our short position with the target of 1.2350.

Significant technical analysis' levels:

Resistance: 1.2577 (high Nov 4), 1.2591 (10-dma), 1.2617 (high Oct 31)

Support: 1.2439 (low Nov 3), 1.2431 (low Aug 22, 2012), 1.2342 (low Aug 21, 2012)

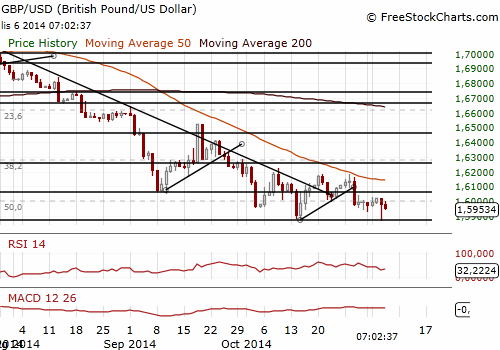

GBP/USD: No surprise from BOE

(we stay sideways)

- The Bank of England kept interest rates at 0.5%. The BoE also said it would maintain its asset purchase at GBP 375 bn. Both decisions were widely expected.

- Industrial output rose 0.6% mom and 1.5% yoy in September vs. the median forecast of 0.4% mom. Industrial output slowed from a gain of 2.2% yoy in August. British manufacturing output in September rose 0.4%, helped by a return to production at car plants which shut down for longer than usual over the summer.

- Data released by mortgage lender Halifax on Thursday showed British house prices unexpectedly fell last month and recorded their smallest quarterly increase in nearly two years, adding to signs that the housing market is cooling. House prices dropped 0.4% mom in October vs. the median forecast of a 0.4% mom rise. Annual house price inflation amounted to 8.8% yoy (vs. the peak in June at 10.2% yoy). The Bank of England said earlier that mortgage approvals for house purchase fell in September to the lowest level since July 2013.

- The GBP/USD rose to 1.6001 after better-than-expected industrial output reading. The recovery was short-lived and the rate fell below 1.5950 ahead of the BOE outcome. The decision of the monetary authorities was neutral for the GBP/USD. In the opinion of GrowthAces.com no positions on the GBP/USD are justified from the risk/reward perspective at the moment. We keep our short EUR/GBP position.

Significant technical analysis' levels:

Resistance: 1.6023 (high Nov 5), 1.6027 (high Nov 3), 1.6029 (10-dma)

Support: 1.5869 (low Nov 5), 1.5854 (low Nov 12, 2013), 1.5776 (low Sep 13, 2013)

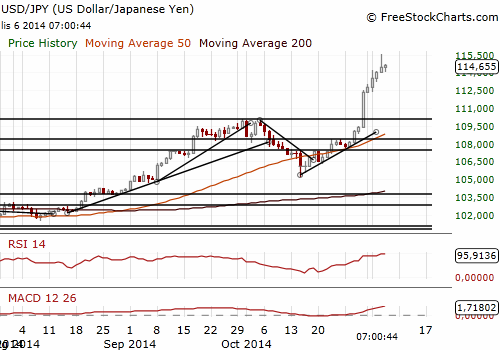

USD/JPY hit a fresh 7-year high

(we are looking to get long at 103.90)

- Minutes of the BOJ's October 6-7 meeting showed a few members expressed concern that inflation could be slowing due to a lack of momentum in consumer spending. Some members said inflation could dip below 1% due to falling energy prices. Most members agreed that inflation is likely to pick up again as the output gap improves. The minutes offered no hints of the BOJ's surprise decision on October 31 to expand its government debt purchases. At the October6-7 meeting, the BOJ left its quantitative easing programme unchanged. At a subsequent meeting on October 31 the BOJ shocked the market by increasing its government debt and risk asset purchases.

- Japan's index of coincident economic indicators rose a preliminary 1.4 points mom in September. The index of leading economic indicators, a gauge of the economy a few months ahead, gained 1.2 points mom.

- The USD/JPY was volatile today. The USD/JPY hit a 7-year high at 115.52 today in Asian session. We wait for a retreat in the USD/JPY with our bid at 113.90. In the opinion of GrowthAces.com longer term prospects for the USD/JPY remained bullish after BOJ Governor Haruhiko Kuroda said the central bank was ready to do even more to hit its 2% inflation goal.

Significant technical analysis' levels:

Resistance: 115.25 (hourly high Nov 6), 115.52 (high Nov 6), 115.93 (high Nov 1, 2007)

Support: 114.06 (session low Nov 6), 113.42 (low Nov 5), 113.15 (low Nov 4)

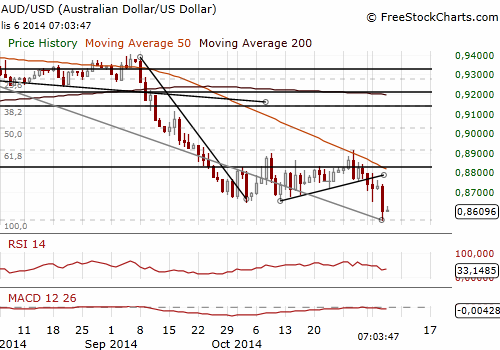

AUD/USD hit 4-year low, jobs data did not help a lot

(possible recovery in the short term, medium-term outlook remain bearish)

- The Australian Bureau of Statistics estimated employment rose 24.1k in October, recovering from a revised 23.7k drop the previous month. All the gains came in full-time jobs which climbed 33.4k. Unemployment rate remained at 6.2%.

- The central bank releases its quarterly outlook for the economy and policy on Friday. The market will be eyeing how it characterizes the drop in the currency. A fall in the AUD is welcomed by the Reserve Bank of Australia which has been agitating for a lower currency to help offset falling prices for the country's major commodity exports. Further depreciation of the AUD would only reinforce market expectations that interest rates would not be cut again, though a hike is still seen as a distant prospect.

- The AUD/USD dropped to four-year lows of 0.8554 on Thursday. It briefly rallied after a jobs report but the rally was short-lived. The AUD/USD broke above 0.8600 in European session on the retreat of USD/JPY. GrowthAces.com expects the AUD to recover slightly against the USD in the short term. Medium-term outlook remains bearish.

Significant technical analysis' levels:

Resistance: 0.8766 (high Nov 5), 0.8850 (high Oct 31), 0.8911 (high Oct 29)

Support: 0.8568 (hourly low Nov 6), 0.8554 (session low Nov 6), 0.8451 (low Jul 7, 2010)