The EUR/USD has continued its solid movement as it has bounced off support at 1.32 and moved through 1.33 to a new three month high. It is significant that the Euro has been able to find support at the 1.32 level and push higher as it maintains the break above this level. It has enjoyed a solid last couple of weeks moving from support around 1.28 and surging through the 1.33 level and to levels not seen since February. It did touch 1.33 before easing back a little bit and finding support at 1.32. It was only last week that the 1.31 level was standing up and proving itself to be a brick wall of resistance, however this level has now obviously been cleared. A couple of weeks ago the Euro did very well as it used the solid support at 1.28 and surged higher not only through 1.29 but also the significant level of 1.30, before just easing back to close out the week. Over the last couple of weeks it has made several attempts to move through the 1.30 level only to be turned away by stiff resistance. At the same time the 1.28 level has provided solid support.

About a month ago, the Euro fell considerably from near 1.32 down to six week lows near 1.28. Back at the beginning of April the Euro received solid support around 1.28 and this level has been called upon over the last couple of weeks to provide additional support. A few weeks ago the Euro traded ever so slightly below 1.2800 and this level represented the lowest levels it had traded to since early April. Over the last month the 1.32 level has become quite significant and has been an obstacle to the Euro moving higher (evident in the left hand half of the daily chart below), which is why its recent movement through this level is important. During this time, it has had some periods of little movement followed by sharp bursts. Just as quickly, it fell away and moved down to the six week low below 1.28. Prior to that, it was quiet and spent the most part of two weeks ago trading within a narrow range between 1.30 and 1.31, which reinforced how significant this two cent range was.

Over the last month or so the Euro has done well to weather the storm through February and March which saw it fall sharply from around 1.37, although its decline in the middle of May threatened to reverse this good fortune. Despite its strong rally in the first half of April, it was only a couple of months ago that the Euro dropped to its lowest level since the middle of November around 1.2750, so it did very well of late to move back strongly above 1.30. The Euro has spent the best part of the last month consolidating above the key 1.30 and 1.29 levels after its decline throughout February which has set itself up well for the recent strong surge higher. Sentiment has completely changed with the Euro and the last couple of months has seen a rollercoaster ride for the Euro as it continued to move strongly towards levels not seen in over 12 months above 1.37 before falling very sharply to below 1.28 and setting a 14 week low a month ago.

EUR/USD has picked up where it left off on Monday, posting modest gains against the dollar on Tuesday. Recent ECB policy meetings have resulted in strong volatility from the euro, and last week’s meeting was no exception. EUR/USD sparkled after Thursday’s policy meeting, gaining about 150 points, as the euro tested the 1.33 level. As expected, the ECB maintained its benchmark rate at 0.50% and deposit rates at 0%. There has been talk of lowering deposit rates into negative territory, but so far the ECB has not taken any action in this direction. In his remarks, ECB President Mario Draghi downgraded the forecast for Eurozone growth in 2013 from 0.6% to 0.5%. However, for 2014, Draghi hiked the forecast from 1.0% to 1.1%. The markets seemed pleased with Draghi’s comments, and the euro surged against the dollar, which was broadly weaker against the major currencies.

EUR/USD June 12 at 02:30 GMT 1.3310 H: 1.3317 L: 1.3231

During the early hours of the Asian trading session on Wednesday, the Euro is consolidating in a narrow trading range right above 1.3310 after having recently surged up higher through the 1.33 level. Since the start of February, it has fallen sharply from new highs above 1.37, although it has experienced some strong rallies in that time trying to claw back lost ground. Current range: trading above 1.33 around 1.3310.

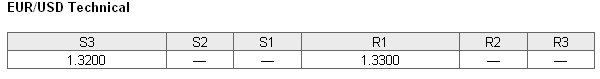

Further levels in both directions:

• Below: 1.3200.

• Above: 1.3300.

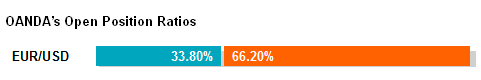

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio has moved lower as the Euro has surged to above 1.33. The trader sentiment remains in favour of short positions.

Economic Releases

- 00:30 AU Westpac Consumer Confidence (Jun)

- 05:00 JP BoJʼs Monthly Economic Report for June

- 08:30 UK Average Earnings (incl. bonus) (Apr)

- 08:30 UK Claimant Count Change (May)

- 08:30 UK Claimant Count Rate (May)

- 08:30 UK ILO Unemployment Rate (Apr)

- 09:00 EU Industrial production (Apr)

- 12:15 CA Housing starts (May)

- 18:00 US Budget (May)