GROWTHACES.COM Trading Positions

EUR/USD: short at 1.2530, target 1.2350, stop-loss 1.2610

USD/CHF: long at 0.9620, target 0.9750, stop-loss 0.9550

NZD/USD: short at 0.7800, target 0.7550, stop-loss 0.7920

EUR/GBP: short at 0.7850, target 0.7670, stop-loss 0.7920

AUD/NZD: long at 1.1220, target 1.1500, stop-loss 1.1080

We encourage you to visit our website and subscribe to our newsletter to receive trading positions summary for major pairs and crosses.

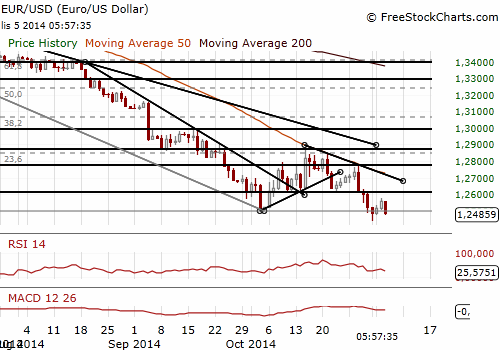

EUR/USD: Eyes on ISM today and Draghi tomorrow.

(the target of our short position is at 1.2350)

- New orders for US factory goods dropped 0.6% mom. August's orders were slightly revised to show a 10.0% mom fall instead of the previously reported 10.1% decline. September’s reading was in line with expectations. The decline in orders, which was led by aircraft, machinery, capital goods and computers and electronic products, is likely to be short-lived. A survey of national factories published on Monday showed a strong rebound in new order growth and backlogs in October.

- St. Louis Fed's President James Bullard who a few weeks ago proposed further monetary stimulus said on Tuesday the central bank in fact made the right decision last week in closing a bond-buying program. Bullard added that he was optimistic on U.S. economic growth due to currently low longer-term borrowing costs and the drop in oil prices, both "bullish" factors that could stimulate spending and expansion.

- Republicans won in places where Democrats were favored in U.S. midterm election on Tuesday, like a Senate race in North Carolina, pulled out victories where the going was tough, like a Senate battle in Kansas, and swept a number of governors' races in states where Democrats were favored, like Illinois. Republicans needed six seats to win control of the 100-member Senate, and by late evening they had seven.

- October’s Euro zone final composite PMI rose to 52.1 from 52.0 in September and was marginally lower than the flash reading of 52.2. Today’s data point to barely positive quarterly GDP growth of around 0.2%. The German composite PMI was revised down to 53.9 from the flash estimate of 54.3 and the French composite PMI was revised slightly up to 48.2 from the flash estimate of 48.0.

- Euro zone PMI showed that job losses were reported for the first time in almost a year. Cuts at service providers were only partly offset by a marginal gain in manufacturers’ payroll numbers. Moreover, PMI suggested that weaker market conditions and efforts to boost sales led to a solid reduction in selling prices in October.

- Eurozone retail sales fell by 1.3% mom in September following a downwardly-revised growth in August, from 1.2% to 0.9%.

- Today’s Euro zone numbers provided more evidence that the euro-zone economy remained weak in the third quarter. A threat of economic stagnation and rising deflationary risks will add to pressure on the ECB to do more to stimulate demand.

- The EUR/USD broke above the resistance level at 1.2565 (38.2% of 1.2770-1.2439) on Tuesday. However, the EUR depreciated again in the European session, in part because of weak PMI and retail sales data in the Euro zone and the EUR/USD trades below 1.2500. Investors are focused on ECB and US payrolls now. At GrowthAces.com we keep the target of our short position at 1.2350.

Significant technical analysis' levels:

Resistance: 1.2591 (hourly high Oct 31), 1.2614 (low Oct 23), 1.2617 (high Oct 31)

Support: 1.2439 (low Nov 3), 1.2431 (low Aug 22, 2012), 1.2342 (low Aug 21, 2012)

GBP/USD hit 1-year low after PMI data

(our long position reached the stop-loss at 1.5920)

- The GBP/USD fell to a 1-year low at 1.5869 on Wednesday after a PMI services index sank to a 17-month low of 56.2 in October from 58.7 in September. Composite PMI, a broader gauge of the economy that combines services, manufacturing and construction industries, fell to 56.4 from 58.1, its lowest level since June 2013.

- After GDP growth slowed to 0.7% in the third quarter, a 0.5% expansion is currently being signalled by the surveys for the fourth quarter. The surveys also point to lower inflation in coming months. The PMI showed average prices charged for goods and services fell for the first time since July 2012.

- The meeting of the Bank of England is scheduled for Thursday. It is widely expected that the central bank will keep interest rates unchanged. The soft PMI number is a boost for the BOE MPC’s dovish majority who are in no hurry to raise interest rates.

- Our long position on the GBP/USD reached its stop-loss level at 1.5920. The GBP is likely to remain relatively strong vs. other major currencies. However, in the opinion of GrowthAces.com no positions on the GBP/USD are justified from the risk/reward perspective at the moment.

Significant technical analysis' levels:

Resistance: 1.5928 (low Nov 3), 1.6023 (10-dma), 1.6027 (high Nov 3)

Support: 1.5869 (low Nov 5), 1.5854 (low Nov 12, 2013), 1.5776 (low Sep 13, 2013)

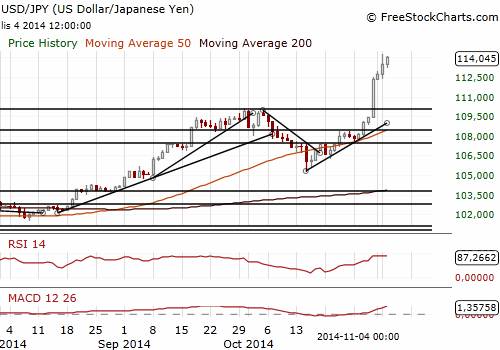

USD/JPY: Kuroda ready to do more

(we have placed our bid offer at 113.90)

- Bank of Japan Governor Haruhiko Kuroda, who shocked financial markets last week by expanding a massive monetary stimulus programme, said the central bank is ready to do more to hit its 2% target. He said: “There are no limits to our policy tools, including purchases of Japanese government bonds.”

- On the JPY's plunge against the USD after last week's monetary expansion, Kuroda reiterated his view that overall, a weak JPY was positive for Japan's economy. He is the opinion that while some households and service-sector firms could feel the pinch from higher import costs, a weak JPY tends to push up export volumes and boosts profits of Japanese companies with overseas operations.

- Kuroda’s comments sent the USD/JPY above Monday’s peak of 114.21. The nearest barrier is seen at 114.79 a retreat is likely at this level. We have placed our bid at 113.90 and we see a possibility of a rise even to 117.95 (high, October 2007).

Significant technical analysis' levels:

Resistance: 114.79 (daily High Nov 7, 2007), 114.82 (daily high Nov 5, 2007), 115.00 (psychological level)

Support: 113.42 (session low Nov 5), 113.15 (low Nov 4), 112.42 (low Nov 3)

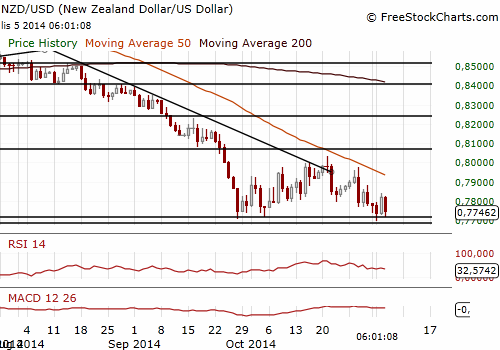

NZD/USD: The target is 0.7550

(we have taken short position, the target is 0.7550)

- The NZD/USD ended yesterday’s New York session at 0.7810 after jobless rate had fallen to 5.4%, its lowest since the first quarter of 2009, from 5.6% in the previous month. The reading was in line with expectations. The number of people employed rose by 0.8% qoq vs. the median forecast of 0.6%. The labour cost index, rose 0.5% qoq, as forecast. The NZD/USD reached a day’s high at 0.7842 in Asia today.

- Investors were also eyeing Fonterra auction on Tuesday. Fonterra's GDT Price Index dipped 0.3% vs. a rise by 1.4% at the previous sale. A total of 45,499 tonnes was sold at the latest auction, falling 10.5% from the previous one. The dairy sector generates more than 7% of New Zealand's GDP. The next auction is scheduled for November 18.

- We used the higher level to get short on the NZD/USD. We have taken short position at 0.7800, in line with our trading strategy. Our target is 0.7550 and stop-loss is 0.7920. The nearest support levels are at 0.7711 (low Nov 4) and 0.7700 (low Nov 3).

Significant technical analysis' levels:

Resistance: 0.7842 (session high Nov 5), 0.7959 (high Oct 28), 0.8000 (psychological level)

Support: 0.7711 (low Nov 4), 0.7700 (low Nov 3), 0.7670 (low Aug 5, 2013)