The euro is continuing to slowly ease back after its amazing surge higher touching 1.32 briefly and a three week high last week. It presently finds itself consolidating between 1.30 and 1.31, as it has found some solid support at 1.30 over the last couple of days to finish out last week.

It has been some time since the euro has experienced a 24 hour period with as much range as the period last week when it surged higher. Prior to that jump, the euro had been in a very solid medium term downtrend after succumbing to the resistance at 1.29 and moving down below the key long term level of 1.28. This resulted in it trading at a multi-year low near 1.2750. After reaching a four month high above 1.34 a few weeks ago, the EUR/USD was in the midst of a very solid medium term downtrend which has seen it fall sharply. Its decline was slowed a little over the last couple of weeks as it traded between 1.30 and 1.31, however a couple of weeks ago it fell strongly again moving down to below 1.28.

It was only a couple of weeks ago that the 1.30 level was standing up and proving itself to be a brick wall of support, and even though it failed a couple of weeks ago leading to the new lows, it has since been called upon again to offer support. Throughout May and most of June the euro surged higher to a four month high above 1.34. Before that in the first half of May, the euro fell considerably from near 1.32 down to six week lows near 1.28. Back at the beginning of April the euro received solid support around 1.28 and this level was called upon to provide additional support. Throughout this year the euro has moved very strongly in both directions. Throughout February and March the euro fell sharply from around 1.37 down to its lowest level since the middle of November around 1.2750. Sentiment has completely changed with the euro over the last few weeks and the last couple of months has seen a rollercoaster ride for the euro as it continued to move strongly towards 1.34 before falling very sharply to below 1.29 and setting a 6 week low.

The euro has been struggling badly since mid-June, and looked lost on Tuesday as it dropped into 1.27 territory. There was an expectation that we would see some volatility after the release of the Fed minutes, but few would have predicted that the euro would rocket upwards and flirt with the 1.32 line. The minutes indicated that Federal Reserve policymakers remain deeply divided over when to scale down the current round of QE, whereby the Fed purchases $85 billion in assets each month. About half of the Fed policymakers favor scaling down QE before the end of 2013, while others feel that the employment market is still too fragile for the Federal Reserve to take any action.

Meanwhile, the dollar continued to lose ground as Federal Reserve chair Bernanke gave a speech in which he said that the Fed would maintain a loose monetary policy for the foreseeable future, due to low levels of inflation and a high US unemployment rate.

EUR/USD July 14 at 23:15 GMT 1.3058 H: 1.3080 L: 1.3056

During the early hours of the Asian trading session on Monday, the euro is trading within a narrow range right around 1.3060 as it has been consolidating after its amazing surge higher touching 1.32 briefly and a three week high last week. Since the middle of June, it has fallen sharply from new highs above 1.34, and has been looking to return back to the significant lows around 1.2800. Current range: trading right above 1.3060.

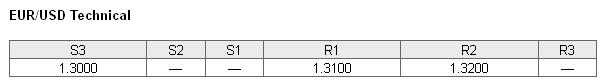

Further levels in both directions:

• Below: 1.3000.

• Above: 1.3100 and 1.3200.

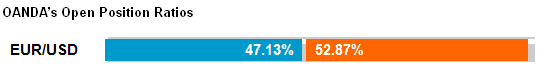

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio has settled below the 50% level as the euro has just eased back a little from 1.32 after its surge higher last week. The trader sentiment remains in favour of short positions.

Economic Releases

- 01:30 AU New motor vehicle sales (Jun)

- 12:30 US Empire State Survey (Jul)

- 12:30 US Retail Sales (Jun)

- 14:00 US Business inventories (May)