The euro has posted slight gains in the Friday session. Currently, EUR/USD is trading at 1.1170. On the release front, German and Eurozone Manufacturing PMIs both pointed to expansion. In the US, today’s highlight is New Home Sales, which is expected to climb to 599 thousand.

A stronger global economy has spurred demand for exports from the euro-area, and this has boosted the manufacturing sectors in Germany and the eurozone. German Manufacturing PMI ticked lower to 59.3 in May, above the forecast of 59.1 points. Germany’s manufacturing sector continues to show strong growth, and the April reading of 59.4 was the highest since March 2011. The news was also positive in the eurozone, as Manufacturing PMI improved for a tenth straight month, climbing to 57.3 points. This beat the estimate of 56.9 points. On Thursday, the ECB’s economic bulletin projected solid growth in the euro-area in the second quarter, buoyed by low inflation rates and stronger domestic demand.

The Federal Reserve has surprised the markets with its hawkish stance, as underscored by last week’s rate statement. The statement mentioned that the Fed plans to reduce its balance sheet later in 2017, although it did not provide further specifics. The balance sheet has ballooned to $4.5 trillion, which accumulated after the 2008 financial crisis, when the Fed went on a bond-buying spree to stimulate the economy.

The reduction will be gradual, but still marks an important change in direction for the central bank. On Wednesday, FOMC member Patrick Harker said that he was in favor of the reduction commencing in September. The Fed has hinted at one more rate hike in the second half of 2017, and the markets have circled December as the most likely date for a rate move. The CME Group has pegged the odds of a September hike at just 13%, compared to 18% a week ago. However, the odds for a December increase are at 49%, and this could increase if Fed policymakers continue to wax positive about the economy.

EUR/USD Fundamentals

Friday (June 23)

- 3:00 French Flash Manufacturing PMI. Estimate 54.1. Actual 55.0

- 3:00 French Flash Services PMI. Estimate 57.1. Actual 55.3

- 3:30 German Flash Manufacturing PMI. Estimate 59.1. Actual 59.3

- 3:30 German Flash Services PMI. Estimate 55.4. Actual 53.7

- 4:00 Eurozone Flash Manufacturing PMI. Estimate 56.9. Actual 57.3

- 4:00 Eurozone Flash Services PMI. Estimate 56.2. Actual 54.7

- 9:00 Belgian NBB Business Climate. Estimate -0.8

- 9:45 US Flash Manufacturing PMI. Estimate 53.1

- 9:45 US Flash Services PMI. Estimate 53.9

- 10:00 US New Home Sales. Estimate 599K

- 14:15 US FOMC Member Jerome Powell Speaks

*All release times are EDT

*Key events are in bold

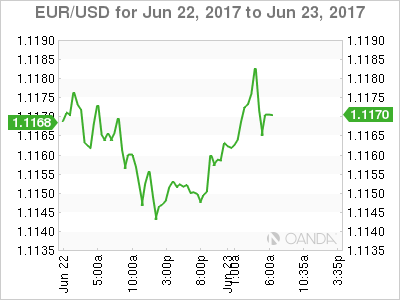

EUR/USD for Friday, June 23, 2017

EUR/USD Thursday, June 23 at 5:15 EDT

Open: 1.1152 High: 1.1188 Low: 1.1145 Close: 1.1166

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0873 | 1.0985 | 1.1122 | 1.1242 | 1.1366 | 1.1465 |

EUR/USD has edged higher in the Asian and European sessions

- 1.1122 continues to provide support

- 1.1242 is the next resistance line

Further levels in both directions:

- Below: 1.1122, 1.0985 and 1.0873

- Above: 1.1242, 1.1366, 1.1465 and 1.1534

- Current range: 1.1122 to 1.1242

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged in the Friday session. Currently, short positions have a majority (68%), indicative of EUR/USD reversing directions and moving lower.