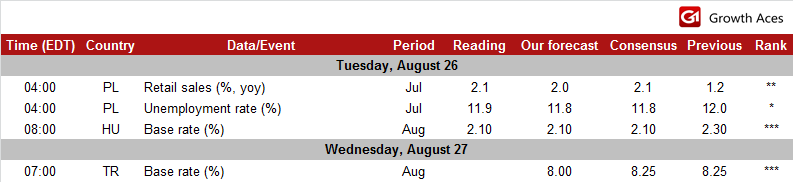

USD/TRY: Further monetary easing ahead

- The central bank of Turkey will hold meeting and announce decision on interest rates tomorrow. We expect the central bank to cut its policy rate by 25 bps to 8%, accompanied by a cut to the O/N borrowing rate of a proportional 25 bps to 7.25%.

- Better liquidity and market conditions continue to support an easing cycle, however, in smaller steps than in the past. Since the last policy rate decision, 5-year CDS has managed to stabilize at approximately 180 bps. Inflation remains, however, very high and further monetary easing is unjustified from that point of view. CPI went up in July to 9.3% yoy, exceeding significantly the market consensus of 8.9% yoy. Core inflation also rose above forecast.

- Despite still high inflation, we expect the central bank to cut rates further in the second half of the year, particularly if we fail to see a sharp correction in the foreign exchange rate. We forecast the rates at 7.50% at the end of the year. The main risk for the forecast comes from increasing global risk appetite and geopolitical uncertainty.

Significant technical analysis' levels:

Resistance: 2.1820 (high Aug 25), 2.1850 (high Aug 22), 2.1881 (high Aug 21)

Support: 2.1575 (low Aug 20), 2.1555 (low Aug 19), 2.1450 (low Aug 15)

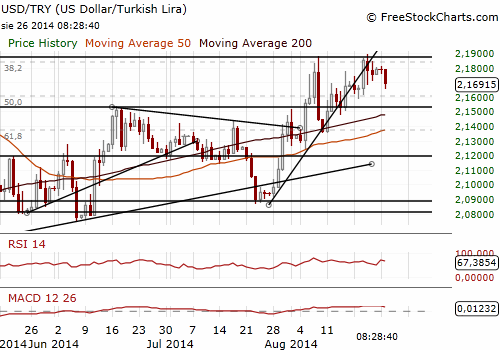

EUR/PLN: Retail sales data in line with forecasts

- Retail sales increased in July by 2.1% yoy vs. growth of 1.2% yoy in June. The reading was in line with the median forecast. In real terms sales rose by 3.1% yoy. Retail sales figures do not change much in the context of monetary policy. The likelihood of interest rate cuts is rising, however we still see stable rates until the end of the year as the most probable scenario.

- Poland's registered unemployment rate fell to 11.9% in July from 12.0% in June. The data were above expectations (11.8%).

- The EUR/PLN was little changed in the reaction to the data. We keep our short position.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Significant technical analysis' levels:

Resistance: 4.1890 (high Aug 25), 4.1926 (high Aug 22), 4.1939 (high Aug 21)

Support: 4.1720 (low Aug 25), 4.1690 (low Aug 15), 4.1600 (low Aug 5)

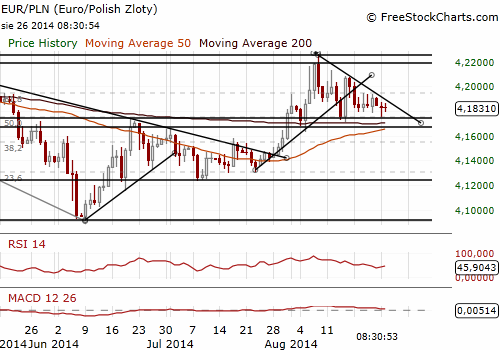

EUR/HUF: Central bank kept interest rates unchanged, as expected.

- The National Bank of Hungary kept its benchmark interest rate on hold at a record low 2.1% in line with its guidance announced last month, when it ended its two-year easing cycle.

- Nervousness over the Ukraine-Russia conflict has boosted the forint's volatility since July, and in early August the currency slipped to its weakest against the euro since early 2012 at 317.30. It has regained some ground since then. However, the monetary authorities tolerate forint weakness.

- The EUR/HUF remained unchanged in the reaction to the decision of the central bank.

Significant technical analysis' levels:

Resistance: 313.91(low Aug 25), 314.24 (high Aug 24), 314.76 (high Aug 21)

Support: 312.50 (low Aug 25), 311.71 (low Aug 15), 311.20 (low Aug 14)