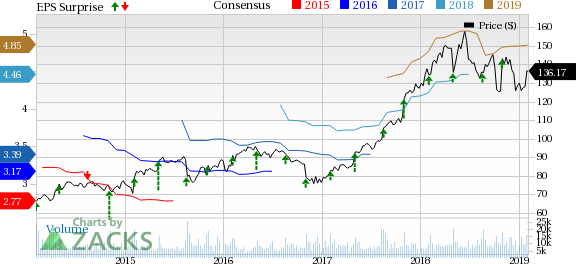

The Estee Lauder Companies Inc. (NYSE:EL) delivered a sturdy second-quarter fiscal 2019 show, wherein both top and bottom lines improved year over year and surpassed estimates. During the reported quarter, the company maintained stellar performances across most categories and brands. Notably, this marks the company’s 18th and eighth straight quarter of earnings and sales beat, respectively.

Additionally, the company raised its sales and earnings view for fiscal 2019, as it is confident of solidifying its position in the prestige beauty space. Given the spectacular results and raised outlook, shares of the company moved up more than 9% during the pre-market trading session.

Notably, management now envisions adjusted earnings for fiscal 2019 to be $4.92-$5.00 per share, up from the earlier projection of $4.73-$4.82. We note that the updated guidance is well above the current Zacks Consensus Estimate of $4.84.

Quarter in Detail

The company posted adjusted earnings per share (EPS) of $1.74 that surged 14.5% year over year and easily beat the Zacks Consensus Estimate of $1.54. The upside was mainly driven by a robust top-line performance. Earnings improved 25% on a constant-currency (cc) basis and on adjusting for the new accounting standard.

Estee Lauder’s net sales of $4,005 million surpassed the Zacks Consensus Estimate of $3,923 million. Moreover, sales increased approximately 7% from the prior-year quarter’s figure. The quarterly results continued to depict growth across most brands, geographic regions and product categories. Management remained particularly impressed with its skin care category, the Asia-Pacific region, travel retail, online channels, and performance of most brands like Estee Lauder, La Mer and MAC, among others. Notably, sales advanced 9% at cc.

Adjusted operating income improved 18% year over year.

Product-Based Segment Results

Skin Care reported sales growth of 16% year over year (up 18% at cc) to $1,732 million, owing to improvements in most brands, channels and regions. From a brand perspective, contributions from Estee Lauder, La Mer and Origins were quite significant.

Makeup revenues were up 3% (up 5% at cc) to $1,560 million on the back of robust performance of brands such as Estée Lauder, MAC, Tom Ford Beauty and BECCA. These were partially offset by declines in Smashbox and Clinique.

In the Fragrance category, revenues declined 5% (2% at cc) to $537 million, owing to soft sales of various designer fragrances and the impact of the company’s holiday season promotional strategy. This was somewhat compensated by growth in brands like Jo Malone London, Le Labo, By Kilian and Tom Ford Beauty.

Hair Care sales amounted $154 million that advanced 7% (8% at cc), driven by higher sales of the Aveda brand.

Regional Results

Sales in the Americas declined 7% (down 6% at cc) to $1,218 million. The performance was negatively impacted by the adoption of new accounting standard and currency headwinds. Nevertheless, sales improved in online and North American specialty-multi store businesses. Operating income in the region declined, owing to soft sales and technology related investments.

Sales in Europe, the Middle East & Africa region improved 13% (up 16% at cc) to $1,767 million. This was driven by growth in the Middle East (particularly Turkey), strong Russia sales and solid travel retail sales. These upsides were somewhat offset by lower sales in the U.K. Operating income in the region improved on the back of strong travel retail, partially offset by declines in the U.K.

In the Asia-Pacific region, sales rallied 17% (up 20% at cc) to $1,020 million. The upside was driven by broad-based growth. Further, higher sales propelled rise in operating income.

Other Financial Updates

The company ended the quarter with cash and cash equivalents of $1,876 million, long-term debt of $3,373 million and total equity of $4,333 million.

Net cash flows generated from operating activities during the six months ended Dec 31, 2018, were $1,273 million, while the company incurred capital expenditures of $292 million.

In a separate press release, management announced a quarterly dividend of 43 cents per share on its Class A and Class B shares, which is payable on Mar 15, 2019.

Guidance

Management is encouraged with its quarterly performance, which was fueled by growth in most of the segments and brands. Even amid a tough environment, the cosmetics giant expects continued growth opportunities in the global prestige beauty industry, which is expected to grow 5-6% in fiscal 2019. In fact, management expects to grow ahead of the industry.

Also, the company is on track with the implementation of the Leading Beauty Forward initiative, directed toward efficient management of costs and operations. Estee Lauder is on track to make further investments in the next six months toward innovations, premium products, efficient commercial execution and well-chalked advertising strategy.

Estee Lauder is cautious about certain factors like tariff impacts in China, various store closures in the United States and the U.K., costs related to Brexit, and moderation of sales growth in China and Travel Retail channel. Nonetheless, the company is confident about expanding its share in the prestige beauty space, backed by solid investments and growth plans. That said, management raised its fiscal 2019 outlook.

The company now expects net sales growth of 5-6%, including negative impact of 3% from currency fluctuations and no impact from the new accounting standard. Excluding these impacts, net sales are expected to rise 8-9%. Earlier, net sales were projected to grow 4-5% and adjusted net sales were expected to increase 7-8%. Also, the company raised its earnings outlook, as discussed above.

Management also provided an outlook for the third quarter of fiscal 2019. Net sales for the quarter are expected to rise 5-6%. This includes an expected 5% negative impact from currency movements and 2% benefit from accounting changes. On adjusting for these items, net sales are likely to grow 8-9%. Further, adjusted EPS for the quarter is projected to be $1.26-1.28, which is above the consensus mark of $1.24.

This Zacks Rank #3 (Hold) stock has gained 3.5% in a month, outperforming the industry’s growth of 3%.

Greedy for Consumer Staples Stocks? Check These

Blue Apron Holdings’ (NYSE:APRN) bottom line surpassed the Zacks Consensus Estimate by average of about 19% in the trailing four quarters. The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Nomad Foods (NYSE:NOMD) , with long-term earnings per share growth rate of 11%, presently carries a Zacks Rank #2.

Lamb Weston (NYSE:LW) , with a Zacks Rank #2, has long-term earnings per share growth rate of 12%.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

See Latest Stocks Today >>

The Estee Lauder Companies Inc. (EL): Get Free Report

Lamb Weston Holdings Inc. (LW): Free Stock Analysis Report

Blue Apron Holdings, Inc. (APRN): Get Free Report

Nomad Foods Limited (NOMD): Get Free Report

Original post

Zacks Investment Research