Based in Pittsburgh, PA, EQT Midstream Partners, LP (EQM), EQT Midstream Partners, LP (EQM) scheduled a $250 IPO with a market capitalization of $708 million at a price range mid-point of $20, for Wednesday June 27, 2012.

EQM is one of four IPOs scheduled for the week of June 25th. Full IPO Calendar here.

EQM's [S-1] was updated June 18, 2012.

EQM's original S-1 filed February 13, 2012

UNDERWRITERS

Manager, Joint Managers: Citigroup; Barclays.

SUMMARY

EQM is a growth-oriented limited partnership formed by EQT Corporation (NYSE: EQT) to own, operate, acquire and develop midstream assets in the Appalachian Basin.

EQM's General Partner

EQT Corporation , $7.6 billion market cap, is EQM's general partner, sponsor, largest customer and is one of the largest natural gas producers in the Appalachian Basin.

EQM's projected minimum annual payout at the price range mid-point of $20 is 7%.

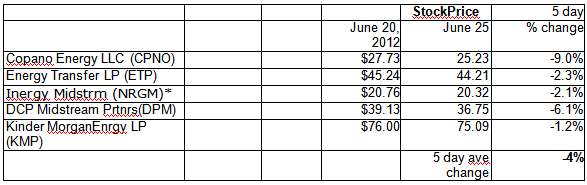

As of Monday, June 25 the five stocks we use for sector comparisons are down an average of 4% in the last five calendar days.

* NRGM IPO'd Dec 15, 2011 at $17, below price range mid-point of $20

Even so, some IPO sources are suggesting EQT might go to a 50 cent premium from the price range mid-point of $20.

Based on the 5 day, 4% sector decline our conclusion is that EQT should be priced lower than the price range-midpoint of $20, to minimize sector risk - unless Obamacare is neutered later this week, in which case the stock market is expected to go up.

And at 7% annual minimum payout EQM is not offering a particularly high payout rate relative to other midstream LPs, but the price is at the lower end of the price-to-book value range.

PARTNERS' CAPITAL

EQM's proforma partners' capital is $434mm, post IPO. S-1, page 60. Post-IPO EQM's market capitalization would be $708 million at the price range mid-point of $20.

BUSINESS

EQM is a growth-oriented limited partnership formed by EQT Corporation to own, operate, acquire and develop midstream assets in the Appalachian Basin, for natural gas transmission and storage.

EQM provides substantially all of its natural gas transmission, storage and gathering services under contracts with fixed reservation and/or usage fees, with a significant portion of revenues being generated from long-term firm contracts.

EQM initially focuses operations in the Marcellus Shale fairway in southern Pennsylvania and northern West Virginia, a rapidly growing natural gas play and the core operating area of EQT.

EQT Corporation , $7.6 billion market cap, is EQM's general partner, sponsor, largest customer and is one of the largest natural gas producers in the Appalachian Basin.

ABOUT EQT Corporation

EQT Corporation conducts its business through three business segments: EQT Production, EQT Midstream and Distribution. EQT Production is a natural gas producer in the Appalachian Basin with 5.4 trillion cubic feet equivalent of proved reserves across 3.5 million acres, as of December 31, 2011.

CONTRACT RATES

As of March 31, 2012 54% of EQM's contracted transmission firm capacity was subscribed at the maximum recourse rate allowed under the tariff.

The remaining 46% of contracted transmission firm capacity was subscribed by customers under negotiated rate agreements at rates generally above the maximum recourse rate under the tariff.

COMPETITION

Principal competitors in the natural gas transmission and storage market include companies that own major natural gas pipelines, such as Dominion Transmission (D), Columbia Gas Transmission Corp., National Fuel Gas Company (NFG) and Texas Eastern, division of Spectra Energy (SE). In addition, EQM competes with companies such as Caiman Energy a division of Williams Partners L.P. (WPZ), M3 Midstream, LLC, Superior Pipeline Company, LLC and MarkWest Energy Partners (MWE), who are building high pressure gathering facilities that are not subject to FERC jurisdiction to move volumes to interstate pipelines.

DISTRIBUTION POLICY

EQM's partnership agreement requires EQM to distribute all available cash quarterly.

EQM anticipates that distributions from the operating surplus will generally not represent a return of capital. EQM does not anticipate that it will make any distributions from capital surplus.

INTERCONNECTIONS

EQM depends upon third-party pipelines and other facilities that provide receipt and delivery options to and from EQM's transmission and storage system.

USE OF PROCEEDS

EQT expects to net $230 million. Proceeds are allocated as follows:

- To fund a cash distribution of approximately $182 million to EQT, in part for reimbursement of capital expenditures associated with EQM's assets;

- To provide $14 million in working capital to replenish amounts distributed by Equitrans to EQT, in the form of trade and other accounts receivable, in connection with the closing of this offering;

- To pre-fund $32 million of maintenance capital expenditures, the majority of which is expected to be incurred over the next two years, related to two identified regulatory compliance initiatives; and

- Pay $2 million in revolving credit facility origination fees.