Acceptance of its PMA application and notification of priority review status puts Epigenomics’ (ECX) bood-based Epi proColon on track for approval in Q413. Meanwhile, rival Exact Sciences has just filed a PMA application for its stool-based Cologuard test. The disparity in the market’s enterprise valuations of the two companies ($27m vs $750m) suggests that investors believe Exact’s test will dominate the market. However, Edison contends that Epi proColon still has a place in this market, and in this scenario, Epigenomics’ low valuation offers investors a geared upside.

Priority FDA review puts approval on target for Q4

The filing of the PMA and award of priority review status makes US approval of Epi proColon possible by Q413. The PMA was based on two large studies that showed sensitivity (across all CRC stages) of 68-72% at a specificity of 80-81%. However, the overall performance data may not be the key determinant of success in the market. The ability to identify early-stage CRC and the presumed patient preference for blood- vs stool-based tests may prove to be as important.

Not so exacting a rival?

Results from Exact Sciences’ DeeP-C trial showed an impressive 92% sensitivity at 87% specificity, but a mildly disappointing 42% sensitivity (given >50% had been targeted) for pre-cancerous polyps (albeit 66% for polyps ≥2cm). Exact recently submitted this final PMA module to the FDA, six months later than Epi proColon’s PMA application filing.

Funded to Q413

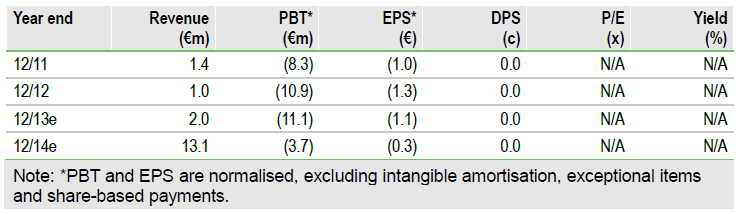

A rights issue and subsequent private placement in January raised €5m (gross), giving Epigenomics a cash runway until Q413; cash at the end of Q1 was €5.5m. However, investors should expect the company to seek to raise further equity finance in 2013.

Valuation: Risk-adjusted NPV of €84m

Our risk-adjusted NPV for Epigenomics remains unchanged at €84m. Our gross valuation model is based on prudent assumptions of Epi proColon’s probability of success, launch date, pricing and market penetration.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Epigenomics: Priority FDA Review Puts Approval On Target For Q4

Published 06/14/2013, 03:20 AM

Updated 07/09/2023, 06:31 AM

Epigenomics: Priority FDA Review Puts Approval On Target For Q4

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.