Scale delivers higher margins

Entertainment One Ltd's (LONDON:ETO) FY14 results were in line with expectations with l-f-l 21 May 2014 EBITDA up 24%, benefiting from the Alliance synergies and Peppa Pig’s growth. Our FY15 estimates are unchanged and we expect cash flows to strengthen now that the Alliance integration is complete and as margins continue to rise. We also believe the Television division is on the cusp of a material step-up in scale and profitability. The shares have retreated from recent highs and the FY15e EV/EBITDA of 9.7x looks good value.

Maiden dividend declared

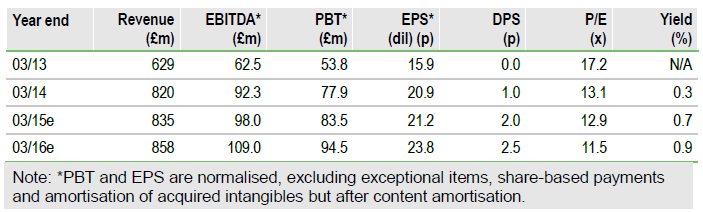

Reported results showed very strong growth, including a full year of Alliance Film (acquired in January 2013). Television performed particularly strongly with l-f-l EBITDA up 44%, while digital sales now account for 21% of group revenues. Normalised PBT was a touch below our estimate due to higher interest but this was offset by lower tax to leave normalised EPS 31% up on FY13 at 20.9p (Edison estimate 20.7p). eOne continues to invest in new content for international exploitation and operating cash flow was less than we expected, but this was partly due to year-end working capital swings, which should reverse in FY15. Year-end adjusted net debt was lower than we expected at £111.1m, helped by favourable currency translation. Management’s confidence is reflected in the inaugural dividend of 1.0p/share.

Strong global demand for content

eOne is very well placed to capitalise on the strong worldwide demand for content (see our Outlook report dated 14 April 2014). With the infrastructure in place to scale up and a shift in the business mix towards digital and television, we expect EBITDA margins to increase from 9.3% in FY13 (pro forma) to over 12.5% in FY16. FY15 growth is slightly restrained by currency headwinds but we still expect over 7% normalised PBT growth, rising to 13% in FY16.

To Read the Entire Report Please Click on the pdf File Below