Entertainment One’s (LON:ETO) H118 results delivered a 36% increase in EBITDA driven by an outstanding performance in Family with Peppa Pig making its mark in China and the rapid global roll out of PJ Masks establishing it as a global brand. Management has reiterated that the company is on track to deliver full year expectations; we have updated our forecasts for mix effects but leave our overall EBITDA forecast unchanged.

Strong growth in profitability

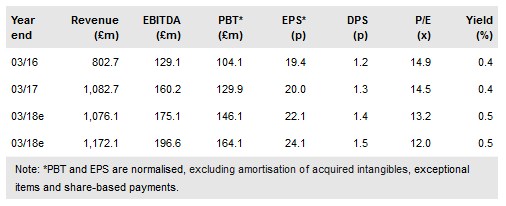

eOne’s strategy to build a more balanced content and brand business paid dividends in the first half with an outstanding performance from Family (revenues +64%) and Television (+17%), offsetting the impact of a weak release slate in the Film division (-29%). Overall revenues, broadly flat, saw the mix swing significantly in favour of these higher-margin divisions, enabling a 36% increase in adjusted EBITDA to £51m and a 53% increase in adjusted PBT to £36m. Differences in the timing of major releases in Film compared to last year meant that cash conversion remained weak resulting in an increase in net debt to £312.8m.

To read the entire report Please click on the pdf File Below: