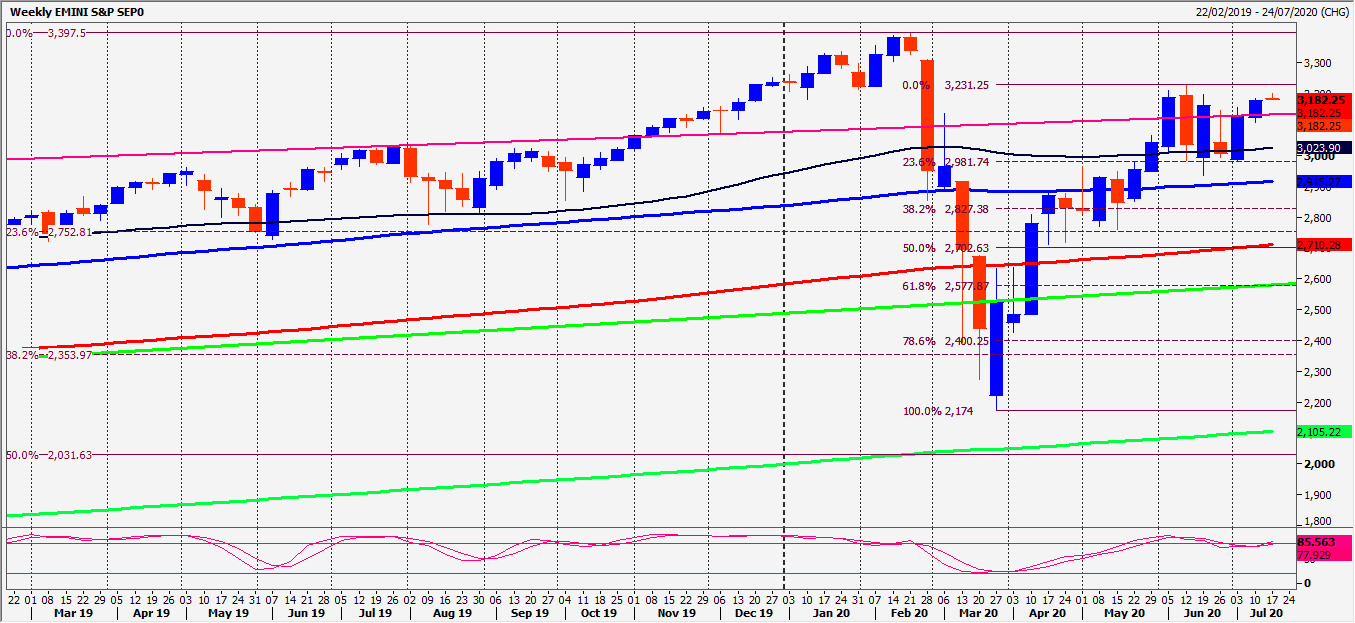

Emini S&P September Futures we wrote: holding what is key resistance at 3154/56 on the bounce today, risks a slide back to 3138/35. If we continue lower look for 3126/23 then a buying opportunity at 3110/05…

We reversed from 3154/56 but missed 3110 by just a point before we shot higher through 3154/56 to 3172/74 and 3182/84, now reaching resistance at 3 week highs at 3193/96 on the open.

Nasdaq September Futures bulls remain in full control of course. Unfortunately, we missed the buying opportunity at 10600/590 by just 25 points before we shot higher to all our targets to 10880/90.

Today’s Analysis

Emini S&P reaches resistance at 3 week highs at 3193/96. A break above 3200 targets 3210 and resistance at June recovery high at 3227/31. Shorts need stops above 3135. A break higher is a buy signal of course.

Holding 3193/96 in what is still a short term sideways trend targets 3185/83 with first support at 3175/73. Try longs with stops below 3165. Next target & support at 3152/48. Longs need stops below 3141. Next target is 3132/30.

Nasdaq new all time high just above our 10880/90 target at 10909 as I write. Bulls do not care that we are severely overbought. Further gains target the big 11,000 number.

First support at 10780/760 then 10700/670. Longs here need stops below 10620.

Trends

- Weekly outlook is positive

- Daily outlook is positive

- Short Term outlook is neutral