Pre-Open Market Analysis

I said before the open yesterday that there was an increased chance of a bear trend day after 3 days in a tight bull channel on the 5-minute chart. Furthermore, the 3-week rally is a Small Pullback Bull trend. Hence, the odds are that any reversal will only last a couple of days. The probability is that the rally will continue up to 2800 before falling below the April low.

However, since the daily chart is in a 3-month trading range, any pullback can be deep. In addition, it could last a week or more. Therefore, it can make traders wonder if it is a reversal instead of a bull flag. Even if it does, the bulls will likely buy it and create a higher low.

By closing the gap below Tuesday’s low, the bears ended the island bottom. In addition, since yesterday gapped down, it created a 2 day island top. Island tops and bottoms are common in trading ranges. They therefore do not have much significance. Yet, the 3 week island bottom at major support is a more important sign than a 2-day island top. The probability still favors the bulls.

Weekly support And Resistance

Today is Friday and therefore weekly support and resistance are important. The most important price is the open of the week at 2675.25. This is because a close below that will turn the week into a bear bar on the weekly chart. The bears will then see this week as a sell signal bar for next week.

Alternatively, the bulls not only want a bull body, they want the week to close on its high. However, that is probably too far above. At a minimum, they want the bar on the weekly chart to have a bull body. That means a close above the open of the week.

Overnight Emini Globex Trading

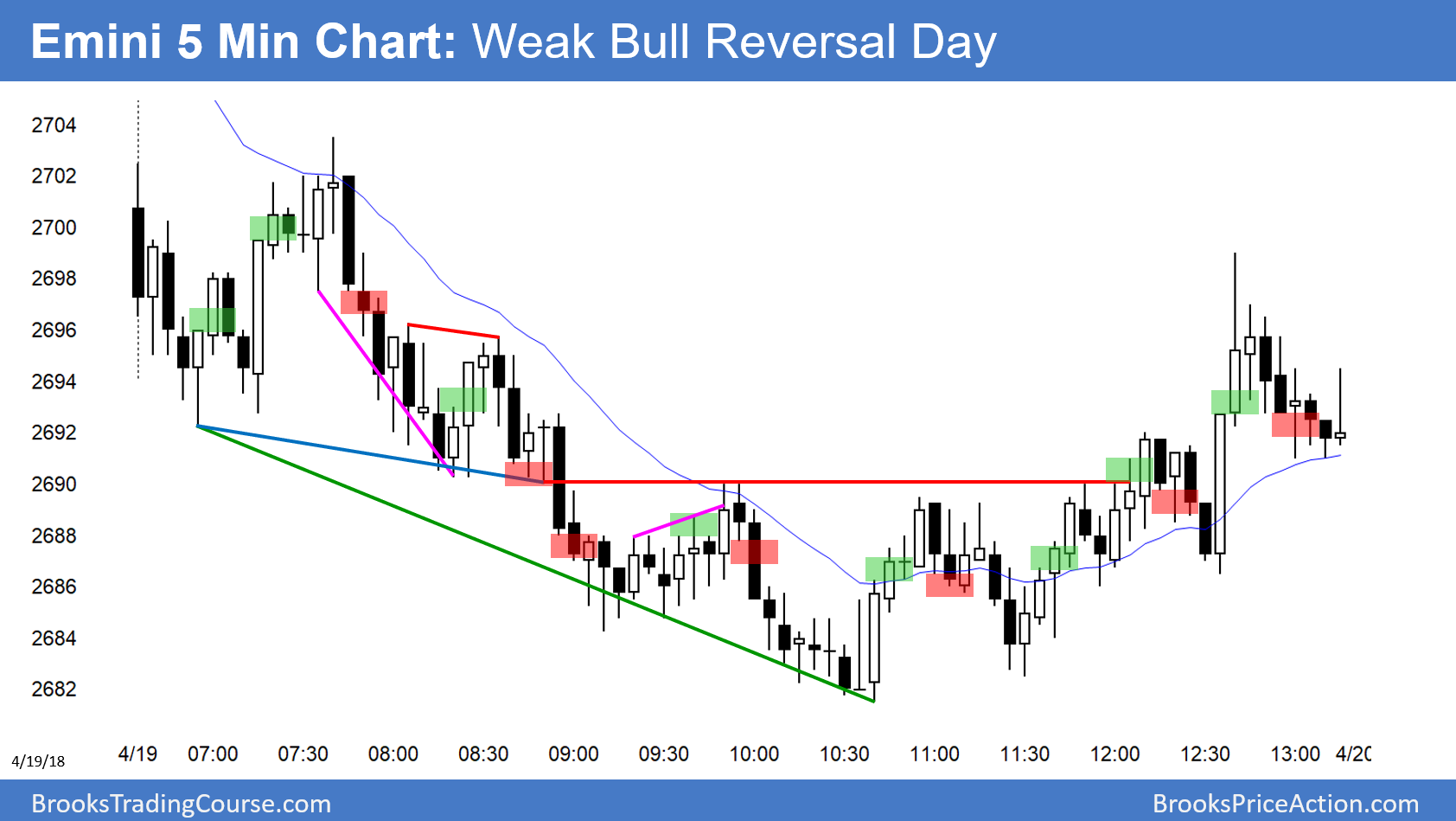

The Emini Island Top After Island Bottom is down 1 point in the Globex session. The bulls want a 2nd leg up from yesterday’s strong rally in the final hour on the 5-minute chart. But, the bears want it to be a blow-off top and the start of a swing down.

Today will provide useful information. If the bulls can prevent a strong break below yesterday’s low, yesterday will simply be another small, brief pullback in a 3-week Small Pullback Bull Trend. On the other hand, if the bears can get strong bear trend days today and Monday, the Emini will probably retrace more than 50% of the 3-week rally within 2 weeks.

Since the past 8 days have been mostly sideways, the odds favor another trading range day today. The open of the week is the key price. It is below yesterday’s low and 17 points below yesterday’s close. It therefore might be too far below for the bears to get there today. Consequently, the odds are that the week will end up as a small bull trend bar on the weekly chart.

Yesterday’s Setups