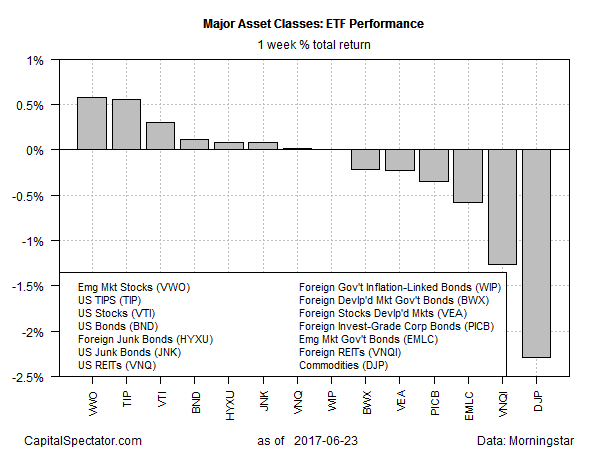

Equities in emerging markets rebounded last week, posting the strongest gain among the major asset classes, based on a set of exchange-traded products.

Vanguard FTSE Emerging Markets (NYSE:VWO) climbed 0.8% over the five trading days through June 23. The rise marks the first weekly increase so far this month for the ETF.

One source of support for emerging-markets equities: last week’s decision by MSCI to add Chinese mainland companies to the firm’s Emerging Markets Index. Reuters noted on Friday that “China Shenzen-listed stocks are up almost 3 percent for the week, after MSCI gave the green light for the inclusion of 222 China-listed stocks, paving the way for some $20 billion of inflows.”

Last week’s biggest loser: broadly defined commodities. iPath Bloomberg Commodity (NYSE:DJP) slumped 2.3%, pushing the exchange-traded note to its lowest close in more than a year.

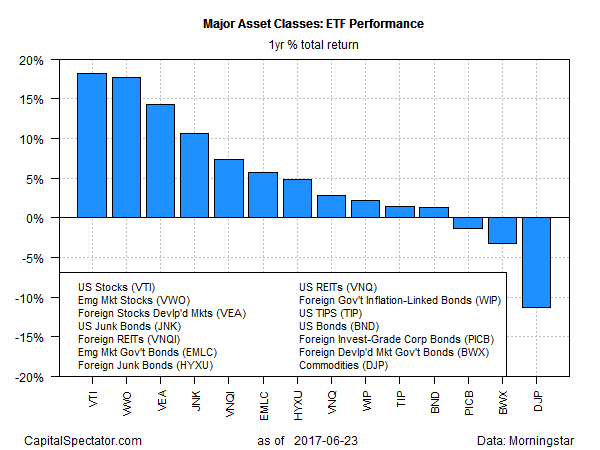

For one year results, US stocks hold the top spot. Vanguard Total Stock Market (NYSE:VTI) is up 18.2% on a total return basis. At last week’s close, VTI closed near a record high.

Strong earnings are a key factor in the ongoing rally in US equities, advises Bryan Reilly, senior investment analyst for CIBC Atlantic Trust Private Wealth Management. “Corporate earnings have been coming on very strong of late — gone are the headwinds of currency and weakening international economies,” he tells FT.

Meanwhile, commodities continue to languish in last place for trailing one-year performances among the major asset classes. The latest dip in prices has left DJP off by 11.3% for the past 12 months as of June 23.

A major weight on commodities: falling oil prices. “Oil demand has failed to improve at the speed required to rebalance the global oil market,” Bank of America-Merrill Lynch advised in a research note on Friday. “We doubt that demand growth will accelerate sufficiently to break the current downward price momentum.”

Disclosure: Originally published at Saxo Bank TradingFloor.com