Here’s a hoot. A Wall Street Survey shows Economists Expect December Rate Hike.

Why? Because economic uncertainty will allegedly vanish between September and December.

A consensus is forming among economists that the Federal Reserve will hold off on its next interest-rate increase until December.

About 71% of the 62 economists surveyed by The Wall Street Journal this month said the Fed will next raise short-term rates at its Dec. 13-14 meeting. That is a sharp rise from the July survey, where half said policy makers would next move in December, and from the June survey, where just 7.8% held that view.

In a July 31 speech, New York Fed President William Dudley argued “for caution in raising U.S. short-term interest rates.” Yet he added “it is premature to rule out further monetary policy tightening this year.”

Two days later, Atlanta Fed chief Dennis Lockhart called the economic picture “ambiguous,” but said, “I can imagine conditions in which we could have a rate hike.”

Charles Evans, the Chicago Fed president, said last week he would prefer to see inflation pick up more before moving, but noted: “I could see one more rate increase even If I would prefer none.”

Economists in the survey indicated they doubted the uncertainty in the economic outlook would clear up in time for the Fed to raise rates at its meeting Sept. 20-21. By December, however, the picture should be clearer, they said.

John Silvia, chief economist at Wells Fargo (NYSE:WFC), said waiting until December would offer “greater clarity on a host of issues.”

Mount Everest of Uncertainty.

The same geniuses who figure things will become more certain between September and December also say Election-Induced Uncertainty Harming U.S. Economy.

For the first time in this election cycle, most economists surveyed by The Wall Street Journal believe uncertainty from the coming election is crimping economic activity.

While every election spurs some economic uncertainty, more than 80% of respondents to the Journal’s latest survey of economists rate the current cycle as presenting an unusual muddle. A majority—57%—said the economy has suffered, at least somewhat, as a result.

“This election introduces a Mount Everest of uncertainty,” said Kevin Swift, chief economist at the American Chemistry Council.

Economists have long believed that, in general, uncertainty has the potential to restrain consumer spending and business investment, if people and businesses have significant questions about the taxes and regulations they will face down the road.

Until this month’s survey, however, the majority of economists thought even an election like this year’s didn’t rise to the level of posing a macroeconomic problem.

Things Will Become More Certain Between September and December

Curiously, just as Hillary’s odds soar through the stratosphere according to Nate Silver Election Odds at 86% as of August 11, economists suddenly discovered a “Mount Everest” of election uncertainty.

Uncertainty “Greater in the Abstract”

“The range of potential political outcomes is much greater in the abstract,” said Lou Crandall, chief economist at Wrightson ICAP (LON:IAP). “The market has doubts about how that uncertainty will translate into concrete action.”

Somehow this will clear up between September and December even though Hillary will likely face a Republican Congress.

Uncertain Measures of Uncertainty

This talk of uncertainty is beyond preposterous.

Caroline Baum, one of my favorite economic writers (on Bloomberg for many years until they stopped using much of her material in favor of garbage), had an excellent column on uncertainty on MarketWatch in April: Uncertainty is a Fact of Life, So Get Used to It.

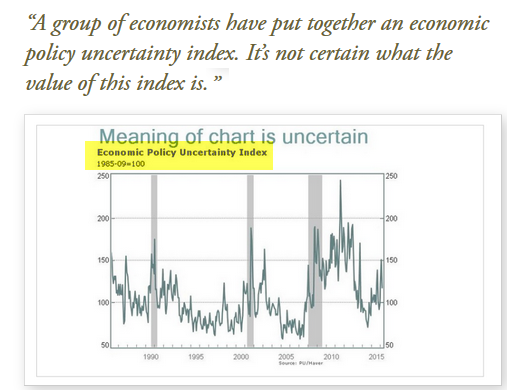

I discussed that chart and other uncertainty silliness in Uncertain Measures of Uncertainty.

Please give it a look.

Fed Uncertainty Principle

Also consider one of all-time favorite posts called the Fed Uncertainty Principle.

The Observer Affects The Observed

The Fed, in conjunction with all the players watching the Fed, distorts the economic picture. I liken this to Heisenberg’s Uncertainty Principle where observation of a subatomic particle changes the ability to measure it accurately.

The Fed, by its very existence, alters the economic horizon. Compounding the problem are all the eyes on the Fed attempting to game the system.

Here is a recap of the Fed Uncertainty Principle and its corollaries as I wrote them on April 3, 2008, before the crash.

Fed Uncertainty Principle:

The fed, by its very existence, has completely distorted the market via self reinforcing observer/participant feedback loops. Thus, it is fatally flawed logic to suggest the Fed is simply following the market, therefore the market is to blame for the Fed’s actions. There would not be a Fed in a free market, and by implication there would not be observer/participant feedback loops either.

Corollary Number One:

The Fed has no idea where interest rates should be. Only a free market does. The Fed will be disingenuous about what it knows (nothing of use) and doesn’t know (much more than it wants to admit), particularly in times of economic stress.

Corollary Number Two:

The government/quasi-government body most responsible for creating this mess (the Fed), will attempt a big power grab, purportedly to fix whatever problems it creates. The bigger the mess it creates, the more power it will attempt to grab. Over time this leads to dangerously concentrated power into the hands of those who have already proven they do not know what they are doing.

Corollary Number Three:

Don’t expect the Fed to learn from past mistakes. Instead, expect the Fed to repeat them with bigger and bigger doses of exactly what created the initial problem.

Corollary Number Four:

The Fed simply does not care whether its actions are illegal or not. The Fed is operating under the principle that it’s easier to get forgiveness than permission. And forgiveness is just another means to the desired power grab it is seeking.

If and when the economists are ever “certain” about the economy, I am certain they will be wrong. Meanwhile ….