Morning Notes

US futures are pointing lower this morning by nearly -1% while European stocks trade lower over -1.5% on renewed concerns of global economic growth after the Eurozone slashed its estimates for the next two years. Asian stocks closed mostly mixed.

Technicals

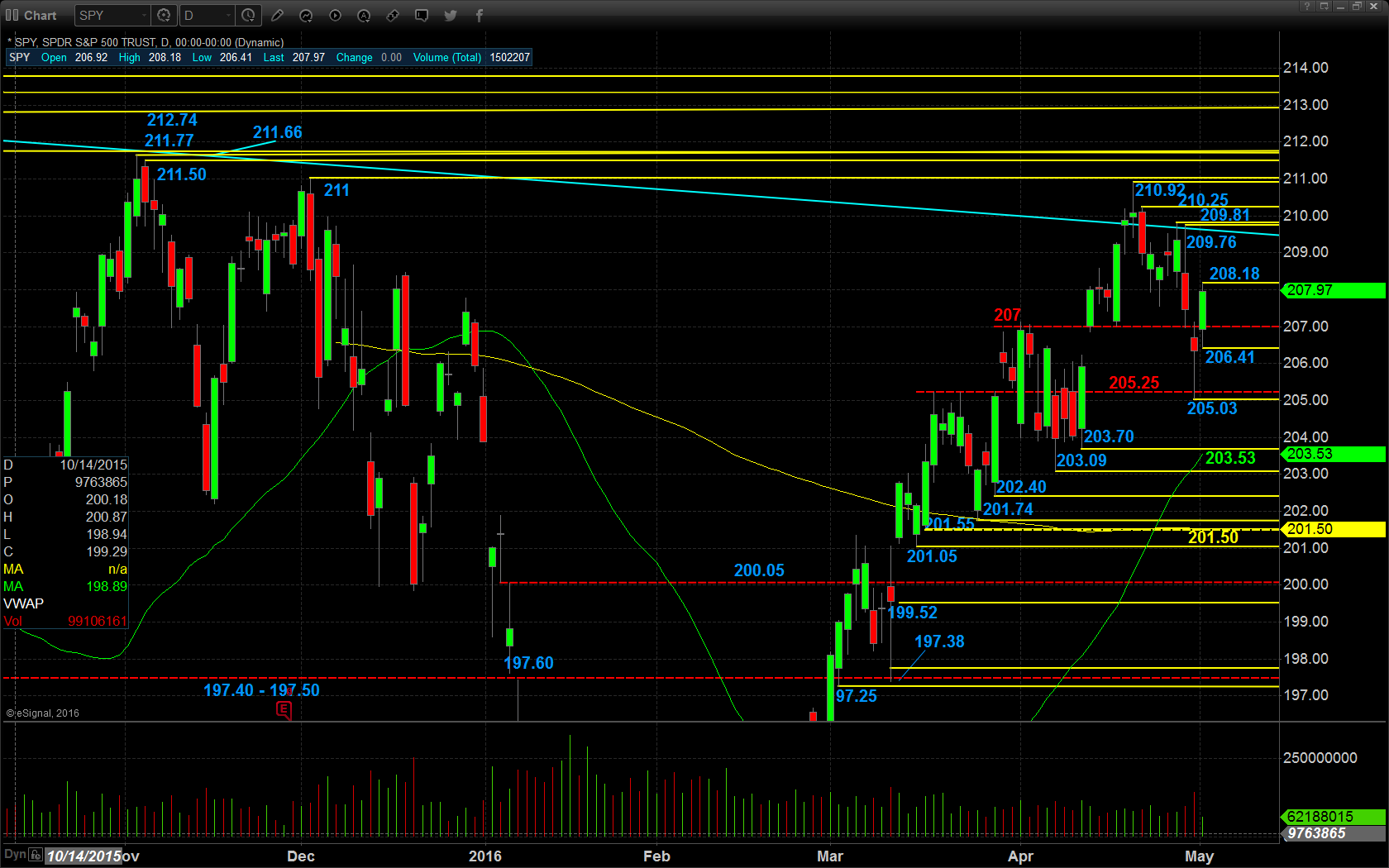

The SPDR S&P 500 (NYSE:SPY) pushed higher off the $207 pivot in yesterday’s session but is gapping sharply lower and back below. Support will lie at the low of yesterday’s range at $206.41, followed by the critical support pivot of $205.25 and then the low of Friday’s range at $205.03. Resistance will lie at the critical resistance pivot of $207 followed by yesterday’s high at $208.18.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

Valeant Pharmaceuticals International Inc (NYSE:VRX)

Yelp Inc (NYSE:YELP)

Economic Calendar

9:45 Apr New York ISM, Mar -3.2 to 50.4

Notable Earnings Before Open

MYL: Mylan (NASDAQ:MYL) – EPS Est. $.75, Rev Est. $2.23B

HAL: Halliburton (NYSE:HAL) – EPS Est. $.04, Rev Est. $4.16B

CVS: CVS Health (NYSE:CVS) – EPS Est. $1.16, Rev Est. $43.01B

MNK: Mallinckrodt (NYSE:MNK) – EPS Est. $1.72, Rev Est. $871.47M

HOT: Starwood Hotels (NYSE:HOT) – EPS Est. $.58, Rev Est. $1.34B

CLX: Clorox (NYSE:CLX) – EPS Est. $1.10, Rev Est. $1.41B

Notable Earnings After Close

NONE

May 3rd Swing Watch List

Heron Therapeuti (NASDAQ:HRTX) – On watch for a breakout over the 200 EMA here as it curls up on support just under resistance. Room here is to 23.50 and then 25 short term. Long entry is over 22.55, stop 22.00.

iShares Nasdaq Biotechnology (NASDAQ:IBB) – Will be watching for a bull call spread here. IBB has sold off sharply to support, and if it holds, should give us a nice bounce. We nailed this one last month and will look to do so again. Peeping a Jun16 275/280 call spread (debit around 2.35-2.50).

Alaska Air Group Inc (NYSE:ALK) – Still on reversal watch. Long is over 71, stop 70.00. Room is to 72.50, and then 85.

Greenbrier Companies Inc (NYSE:GBX) – On short watch for a break down here below big time support. The short entry level is 28.28, stop 29.00. Room here is down to 25 or so short term. Nice relative volume as it tests support.