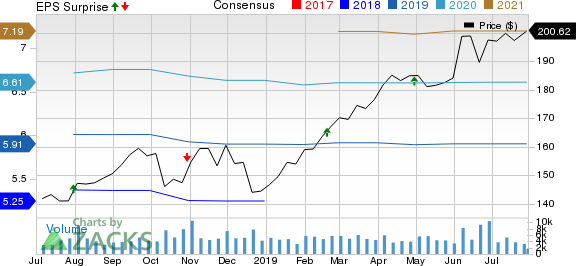

Ecolab Inc. (NYSE:ECL) reported second-quarter 2019 adjusted earnings per share (EPS) of $1.42, beating the Zacks Consensus Estimate by a penny. Its EPS rose 11.8% on a year-over-year basis.

This Zacks Rank #3 (Hold) company’s quarterly net sales amounted to $3.76 billion, up 1.9% from the year-ago quarter number. However, net sales lagged the Zacks Consensus Estimate of $3.78 billion.

Segmental Analysis

Global Industrial

Sales at the segment grew 4% year over year to $1.38 billion, driven by major growth from the Water and Life Sciences units. Geographically, all regions showed impressive sales growth in the quarter.

Global Institutional

Sales improved 1.2% year over year to $1.31 billion, led by robust growth in the Specialty business. Sales for the segment showed solid growth across all geographies.

Global Energy

Sales at the segment edged down 0.9% year over year to $837.3 million. Per management, the upstream sales were flat, owing to a decline in well-stimulation business. However, the decline was offset by impressive growth in production sales. Downstream sales showed solid growth in the quarter.

Other

Sales rose 4.1% year over year to $229.5 million, reflecting strong gains in both Pest Elimination and Colloidal Technologies across all geographies.

Margin Analysis

Ecolab registered gross profit of $1.56 billion, up 0.5% year over year. As a percentage of revenues, gross margin in the second quarter was 41.3%, down 50 basis points (bps) year over year. On an adjusted basis, gross margin in the quarter was 41.5%, down 30 bps.

Adjusted operating income in the quarter was $566 million, up 14.8% year over year. Adjusted operating margin in the quarter was 14.8%, which expanded 120 bps year over year.

Guidance

Ecolab kept its earlier-provided guidance for 2019.

Adjusted EPS is expected to be $5.80-$6.00, suggesting 10-14% rise over 2018 reported figure. The Zacks Consensus Estimate for the same is pegged at $5.90, near the high end of the company’s guidance.

However, it expects foreign currency translation to have an unfavorable impact of 11 cents on EPS.

Adjusted gross margin is expected to be 42%.

For the third quarter of 2019, Ecolab expects EPS to be $1.65-$1.75, indicating a year-over-year improvement of 8-14%.

Unfavorable foreign exchange rates are expected to dent the bottom line by 2 cents in the third quarter.

Adjusted gross margin is expected to be 42-43%.

Our Take

Ecolab ended the second quarter on a tepid note. The company continues to gain from its core Global Industrial and Global Institutional segments. It also benefited from strength in Pest Control and Colloidal technologies in the quarter, which drove its Other segment.

Management is optimistic about the spin-off of its Upstream Energy business as a stand-alone publicly-traded company and acquisitions, which are likely to drive segmental gains in the quarters ahead. Ecolab’s cost-efficiency initiative is expected to result in approximately $200 million of SG&A savings by 2021. Expansion in operating margin is encouraging as well.

On the flip side, softness in the Global Energy arm raises concern. Quarterly EPS was negatively impacted by unfavorable currency movement. In fact, management expects foreign exchange to mar EPS in the quarters ahead. Contraction in gross margin and highly competitive markets add to the woes.

Earnings of Other MedTech Majors at a Glance

Some better-ranked stocks, which posted solid results this earnings season, are Stryker Corporation (NYSE:SYK) , Baxter International Inc. (NYSE:BAX) and Intuitive Surgical, Inc. (NASDAQ:ISRG) .

Stryker delivered second-quarter 2019 adjusted EPS of $1.98, beating the Zacks Consensus Estimate by 2.6%. Its revenues of $3.65 billion surpassed the Zacks Consensus Estimate by 1.4%. The company currently carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Baxter delivered second-quarter 2019 adjusted EPS of 89 cents, which surpassed the Zacks Consensus Estimate of 81 cents by 9.9%. Its revenues of $2.84 billion outpaced the Zacks Consensus Estimate of $2.79 billion by 1.9%. The company currently has a Zacks Rank #2.

Intuitive Surgical reported second-quarter 2019 adjusted EPS of $3.25, which beat the Zacks Consensus Estimate of $2.85. Its revenues were $1.1 billion, surpassing the Zacks Consensus Estimate of $1.03 billion. The company sports a Zacks Rank #1 at present.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Ecolab Inc. (ECL): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Baxter International Inc. (BAX): Free Stock Analysis Report

Stryker Corporation (SYK): Free Stock Analysis Report

Original post

Zacks Investment Research