- Clear hints during previous weeks on end to bond buying

- Optimism on euro zone recovery

- Possible prelude to July update on forward guidance

Remarks last Wednesday by European Central Bank chief economist Peter Praet that the eurozone economy's "underlying strength" had bolstered his confidence that inflation would move toward the ECB's target, have boosted expectations for a shift in the ECB's forward guidance on Thursday. Praet added that officials will debate whether to end bond purchases later this year at this week's meeting, which begins today.

This underscores the view of policymakers that recent eurozone weakness is temporary rather than the start of a broader trend. ECB forward guidance—which will be delivered in Riga, Latvia at the close of its two-day Governing Council session—generally includes the central bank's outlook on its asset purchase program, known as quantitative easing, and interest rates.

According to Carsten Brzeski, chief economist at ING Germany, those remarks also signaled that this week's policy meeting could be "an exciting one." Indeed, he characterized Praet's speech as "remarkable."

“The Governing Council will have to assess whether progress so far has been sufficient to warrant a gradual unwinding of our net purchases,” Praet also said, noting that it will be a “judgment” call.

The remarks were echoed by Jens Weidmann, president of Germany’s Bundesbank and a member of the ECB’s governing council, who said market expectations that the ECB would halt its vast bond-buying program by the end of this year were “plausible.”

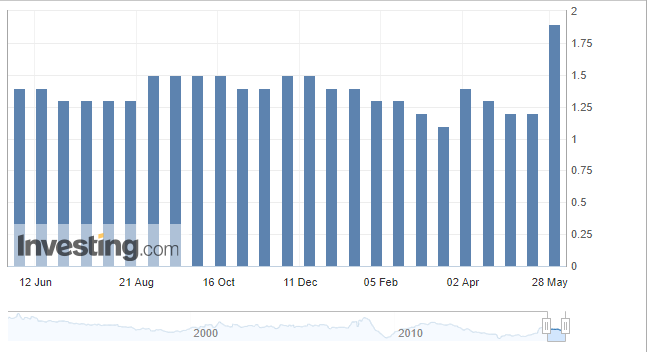

Inflation in the euro area surged to 1.9% in May, to hit the ECB’s target as energy prices jumped, but core inflation, which strips out volatile food and energy prices, rose just 1.1%. While the ECB tends to look past oil price shocks, the increase in headline inflation, even as a result of higher energy costs, still supports the case for scaling back stimulus.

The ECB meeting on Thursday, will also result in the publication of the central bank's latest forecasts for economic growth and inflation, but a decision on whether to wind down its bond purchasing program is more likely to come at its July meeting, according to Brzeski.

“Clear hints at an end of QE, while keeping full flexibility...still seems the most likely outcome,” Brzeski said. “Then, the July meeting could bring the announcement of a QE extension at a lower pace at least until December. If underlying inflation really creeps up in the second half of the year, QE could then be stopped in December,” he added.

In a note to investors, analysts at Barclays (NYSE:BCS) said they also believe the decision on the end of QE will most likely be communicated at the July meeting.

While analysts and investors are near unanimous in expecting the ECB to end bond purchases by December after a short taper, forecasts for the bank's first rate hike have shifted quite sharply since the hawkish ECB comments reinforced the notion that monetary policy normalization is still on track.

Money markets have now almost fully priced in the probability of an ECB rate hike by June 2019, while the probability that the ECB will raise interest rates by July 2019 has risen to around 70%, up from around 50% at the start of last week.

The euro has been recovering from political shocks that sent it to eleven month lows in late May and was trading at $1.1744 early Wednesday despite expectations for an upcoming policy shift.

The somewhat muted reaction in the euro is likely indicative of a combination of investor concerns over international trade tensions; political turmoil in Italy which reignited market turbulence last month and a fresh spell of Brexit uncertainty.

Barclays analysts “strongly believe” that the ECB will not alter its monetary policy path as a result of the volatility brought about by the increased political risk in Italy in recent weeks.

“Even though there seems to be a general understanding on an end to QE, the devil is definitely in the detail,’ Brzeski concludes.