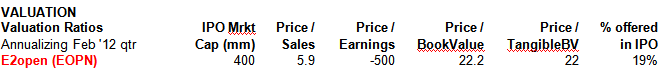

Based in Foster City, California, E2open (EOPN) scheduled a $75 million IPO with a market capitalization of $400 million at a price range mid-point of $16, for Friday, July 27, 2012.

CONCLUSION

Because EOPN is a cloud based company operating at almost breakeven, EOPN should do well on its IPO. IPOdesktop’s recommendation is to get EOPN on the IPO and sell as soon as possible, because it will likely trade on a fully valued based in the immediate IPO aftermarket.

Based in Foster City, California, E2open (EOPN) scheduled a $75 million IPO with a market capitalization of $400 million at a price range mid-point of $16, for Friday, July 27, 2012.

July 13, 2012 [S-1]

UNDERWRITERS

Manager, Joint Managers: BofA Merrill Lynch

Co Managers: William Blair; Pacific Crest Securities; Canaccord Genuity; Needham

SUMMARY

EOPN provides cloud-based, on-demand software solutions delivered on an integrated platform. EOPN’s platform enables companies to collaborate with trading partners to procure, manufacture, sell and distribute products more efficiently.

EOPN generates negative cash flow, and has a $316 million net operating loss carryforward. EOPN has raised $306 million from venture capital firms.

Sequential revenue growth is lumpy, and profits are also inconsistent, see below.

Glossary of financial terms

$316 million Net Operating Loss

As of February 29, 2012, EOPN had net operating loss, or NOL, carryforwards for federal income tax purposes of $316.5 million, which begin to expire in fiscal 2023, and have NOL carryforwards for state income tax purposes of $118.3 million, which begin to expire in fiscal 2013. In order to utilize the NOLs, EOPN must generate consolidated taxable income which can offset such carryforwards. S-1 page 70

PRE-IPO EQUITY

EOPN has raised $306 million from venture capital firms and as of February 29, 2012 had a negative net worth of -$33 million

RECENT DEVELOPMENTS

Revenue increased from $11.2 million for the three months ended May 31, 2011 to $15.5 million for the three months ended May 31, 2012.

IPOdesktop comment: May 2012 quarter revenue was about the same as November 2011 revenue, when EOPN showed a loss.

For the three months ended May 31, 2012, total bookings was $37.8 million compared to $15.8 million for the three months ended May 31, 2011, representing a 139.1% increase. Additionally, from March 1, 2008 through May 31, 2012, EOPN increased backlog from $24.4 million to $102.6 million, representing a 320.3% increase.

BUSINESS

EOPN is a provider of cloud-based, on-demand software solutions delivered on an integrated platform that enables companies to collaborate with trading partners to procure, manufacture, sell and distribute products more efficiently.

Customers use EOPN’s solutions to gain visibility into and control over their trading networks through the real-time information, integrated business processes and advanced analytics that we provide.

EOPN believes its solutions enable customers and their trading partners to overcome problems arising from communications across disparate systems by offering a reliable source of data, processes and analytics.

Customers represent a wide range of industries and include many of the Fortune 500, among them five of the top eight as designated in the Gartner Supply Chain Top 25, and spans several industries including many large multinational companies such as Boeing, Cisco, Dell, the Gap, GE, Flextronics, IBM, Lab126 (part of the Amazon.com, Inc. group of companies), Motorola and Vodafone.

The E2open Business Network is a community comprised of customers, over 30,000 unique registered trading partners and over 88,000 unique registered users.

MARKETS

EOPN’s collaborative execution solutions address an opportunity comprised of three markets that include integration brokerage software, supply chain execution software and supply chain planning software.

These three markets are forecasted by Gartner, Inc. to grow collectively at an 11.1% compound annual growth rate from $5.5 billion in 2010 to $9.3 billion in 2015.

TARGETS

To date, EOPN’s target markets have been Technology, Telecommunications, Aerospace and Defense, and Consumer Products.

EOPN has found that the challenges presented by managing inventory, orders and planning are similar across many industries which makes its solutions applicable to a wide array of industry verticals.

EOPN intends to leverage its experience, expertise and proven customer success within current key verticals to accelerate entry into and delivery of solutions to new vertical markets.

CUSTOMERS

EOPON’s customer base includes companies that represent seven of the top ten supply chains in the world, according to Gartner, Inc., and spans several industries including many large multinational companies such as Boeing, Cisco, Dell, the Gap, GE, Flextronics, IBM, Lab126 (part of the Amazon.com, Inc. group of companies), Motorola and Vodafone. To date, target markets have been Technology, Telecommunications, Aerospace and Defense, and Consumer Products.

As of May 31, 2012, EOPN had 248 customers, of which 58 were Enterprise Customers. For fiscal 2012, Enterprise Customers represented 99.3% of total revenue. During fiscal 2012, the average annual billing for Enterprise Customers was $1.1 million.

Customers represent a wide range of industries and include many of the Fortune 500, among them seven of the top ten as designated in the Gartner Supply Chain Top 25. The E2open Business Network is a community comprised of customers, with over 32,000 unique registered trading partners and over 94,000 unique registered users.

CUSTOMER CONCENTRATION

For the year ended February 29, 2012, EOPN’s top ten customers accounted for 72.9% of revenue. Two customers each accounted for at least 10% of revenues.

CUSTOMER RETENTION

During the year ended February 29, 2012, EOPN retained 97.7% of its Enterprise Customers and the total dollars billed to these customers was over 100% of the dollars billed to the same customers for the prior year.

This reflects EOPN’s ability to both retain and increase the revenue generated from existing customers. EOPN believes it has yet to significantly penetrate its customer base and has a significant opportunity to up-sell additional solutions to existing customers.

CUSTOMER AGREEMENTS

EOPN’s agreements with customers are typically three years in length with annual billings in advance.

The annual contract value for each customer agreement is largely related to the size of the customer, the number of solutions the customer has purchased, the number of the customer’s unique registered users, and the maturity of EOPN’s relationship with the customer.

The average annual contract value can therefore fluctuate period to period depending upon the size of new customers and the pace at which EOPN up-sells additional solutions and services to existing customers.

New and up-sell customer agreements can create significant variability in the aggregate annual contract value of agreements signed in any given fiscal quarter.

INTERNATIONAL

EOPN is headquartered in Foster City, California and continues to expand operations internationally.

EOPN currently generates a portion of our revenue outside the United States, including through offices in the United Kingdom, Germany, China, Malaysia and Taiwan.

For fiscal 2010, fiscal 2011 and fiscal 2012, the percentage of revenue generated from customers outside the United States was 22.9%, 36.9% and 38.2%, respectively.

As part of the growth strategy, EOPN expects the percentage of revenue generated outside of the United States to continue to increase.

In 2011, EOPN grew its sales team in Europe, and intends to hire additional sales personnel in Germany, France and the Nordic countries. In fiscal 2012, EOPN opened an office and established a direct sales force and a sales, hosting and distribution alliance with a local partner in China.

LONG SALES CYCLE

EOPN’s products have lengthy sales cycles, which typically extend from four to 12 months and may in some instances take longer than one year.

Sources of Revenue, p47

INTELLECTUAL PROPERTY

As of May 31, 2012, EOPN had eight U.S. and one foreign issued patents and had one U.S. patent application pending.

COMPETITION

EOPN faces competition from the following types of companies:

ERP vendors:

Companies such as Infor, Oracle and SAP offer ERP extension solutions that provide features similar to a limited subset of EOPN’s offerings in the area of trading partner portals. These companies may include those solutions as part of their larger ERP or business application offerings.

As each trading partner is likely to have some form of existing ERP system, EOPN is are able to provide

a common platform tying these disparate systems together as a business network.

EOPN’s solutions generally do not replace the current functionality of existing ERP systems and therefore tend not to undermine customers’ investments in their existing business applications.

EOPN’s customers have found that its solutions extend and enhance the value of their existing ERP systems by adding integration, multi-enterprise processes, and real-time collaboration capabilities. Therefore, EOPN does not believe traditional ERP vendors view EOPN’s solutions as a competitive alternative to their own offerings.

Multi-enterprise B2B infrastructure vendors:

Companies like GXS Corporation, IBM/Sterling Commerce and SPS Commerce provide point solutions in the B2B integration space. EOPN does not view these offerings as competitive with EOPN’s solutions.

Niche applications vendors:

Companies like JDA Software Group, Inc. have specialized functionality for specific process areas such as transportation management, demand planning or network design. Niche applications may provide important functionality for enterprises, but they typically are not built for multi-enterprise process management or a multi-tier environment.

Internally developed solutions:

Potential customers with large in-house IT departments are capable of developing applications customized for their businesses and many have. Typically, these applications lack complete functionality required to run complex, multi-tier trading networks.

VENTURE CAPITAL

Pre-IPO 70% owned by venture capital firms:

Entities affiliated with Crosspoint Venture Partners, 19.9%

JBM 2009 Irrevocable Trust, 18.2%

Seagate Technology LLC, 12.4%

Entities affiliated with JK&B Capital Group, 7%

Entities affiliated with Invesco Private Capital, Inc., 6.4%

B&M Ventures, LLC, 5.7%

EMPLOYEES

As of May 31, 2012, we employed 351 people, including 73 in sales and marketing, 177 in operations and professional services, 57 in product development and 44 in general and administrative functions.

USE OF PROCEEDS

EOPN expects to net $53 million from its IPO from the sale of 3.75 million shares. Shareholders intend to sell 938,000 shares. IPO proceeds are allocated to general corporate purposes and other operating expenses.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

E2open (EOPN) IPO Report

Published 07/26/2012, 04:11 AM

Updated 07/09/2023, 06:31 AM

E2open (EOPN) IPO Report

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.