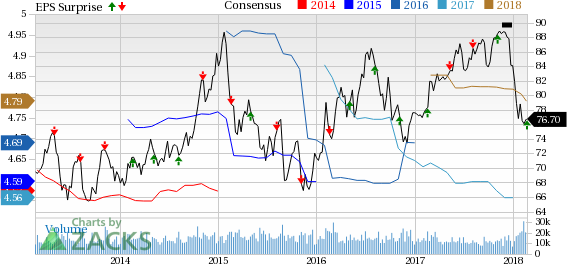

Duke Energy Corporation (NYSE:DUK) reported fourth-quarter 2017 adjusted earnings of 94 cents per share, beating the Zacks Consensus Estimate of 91 cents by 3.3%.

Earnings also improved 16% year over year driven by disciplined cost management and favorable weather conditions.

GAAP earnings were $1.00 in the fourth quarter, against loss of 33 cents in the prior-year quarter.

For 2017, the company reported adjusted earnings of $4.57 per share, beating the Zacks Consensus Estimate by a penny. The full-year earnings however dropped 2.6% from a year ago.

Total Revenues

In 2017, the company’s total operating revenues were $23.57 billion, up 3.6% from $22.74 billion a year ago. The reported figure however missed the Zacks Consensus Estimate of $23.82 billion.

The regulated electric unit’s revenues were $21.18 billion (down 0.2%), representing approximately 90% of total revenues in 2017.

Revenues from the regulated natural gas business totaled $1.73 billion (up 100.9%).

Non-regulated and Other segment generated revenues of $0.65 billion, down 0.8% year over year.

Operational Update

The company’s total operating expenses were $17.81 billion in 2017, up from $17.43 billion a year ago. Costs increased on higher cost of natural gas, depreciation and amortization expenses, property and other taxes as well as impairment charges. Also, costs related to fuel used in electric generation and purchased power led to higher operating expenses.

Operating income in 2017 increased 8.2% to $5.78 billion from $5.34 billion a year ago.

Interest expenses rose to $1.99 billion from $1.92 billion a year ago.

Quarterly Segmental Highlights

Electric Utilities & Infrastructure: Adjusted income in the fourth quarter was $609 million, up from $483 million a year ago. The upside was driven by favorable weather as well as lower operating and maintenance expenses.

Gas Utilities & Infrastructure: Adjusted income of $114 million at this segment demonstrated an improvement from $89 million in the year-ago quarter. The improvement was driven by customer growth and increased integrity management investments at Piedmont as well as higher earnings from increased investment in the Atlantic Coast Pipeline.

Commercial Renewables: This segment reported adjusted income of $15 million in the quarter compared with $10 million a year ago, courtesy of a new wind project brought on-line in late 2016 and improved wind resources.

Other: The segment includes corporate interest expenses not allocated to other business units, results from Duke Energy’s captive insurance company, and other investments.

Adjusted net expenses were $82 million, up from $57 million in the year-ago quarter.

Financial Condition

As of Dec 31, 2017, the company had cash & cash equivalents of $358 million, down from $392 million as of Dec 31, 2016. Long-term debt was $49 billion at the end of 2017, compared with $45.6 billion at 2016-end.

In 2017, net cash from operating activities was $6,634 million, compared with $6,817 million in the prior year.

Guidance

The company issued its earnings expectation for 2018. It expects adjusted earnings per share in the range of $4.55-$4.85.

Zacks Rank & Key Pick

Duke Energy carries a Zacks Rank #4 (Sell). A better-ranked stock in the same space is CenterPoint Energy, Inc. (NYSE:CNP) , with a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CenterPoint Energy has surpassed the Zacks Consensus Estimate for earnings in the trailing four quarters, the average beat being 6.42%. It boasts a solid long-term EPS growth of 6%.

Recent Peer Releases

PG&E Corporation’s (NYSE:PCG) adjusted operating earnings per share of 63 cents in fourth-quarter 2017 missed the Zacks Consensus Estimate of 69 cents by 8.7%.

NextEra Energy (NYSE:NEE) reported fourth-quarter 2017 adjusted earnings per share of $1.25, lagging the Zacks Consensus Estimate of $1.31 by 4.6%.

Can Hackers Put Money INTO Your Portfolio?

Earlier this month, credit bureau Equifax (NYSE:EFX) announced a massive data breach affecting 2 out of every 3 Americans. The cybersecurity industry is expanding quickly in response to this and similar events. But some stocks are better investments than others.

Zacks has just released Cybersecurity! An Investor’s Guide to help Zacks.com readers make the most of the $170 billion per year investment opportunity created by hackers and other threats. It reveals 4 stocks worth looking into right away.

Download the new report now>>

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

Duke Energy Corporation (DUK): Free Stock Analysis Report

Pacific Gas & Electric Co. (PCG): Free Stock Analysis Report

Original post

Zacks Investment Research