Asian markets fell on Friday, as doubts lingered over the fate of Greece’s bailout package, even after lawmakers approved an austerity plan. The Nikkei declined .6% to 8947, the Kospi shed 1% to 1994, and the ASX 200 fell .9%. Chinese markets ended mixed, as the Hang Seng slumped 1.1% to 20784, while the Shanghai Composite rose .1%, despite disappointing import data.

Selling pressure accelerated in Europe. The CAC40 dropped 1.5%, the DAX sank 1.4%, and the FTSE lost .7%. Banking shares lost more than 3.4% as protests erupted in Greece over the proposed austerity measures, while European leaders demanded even steeper cuts.

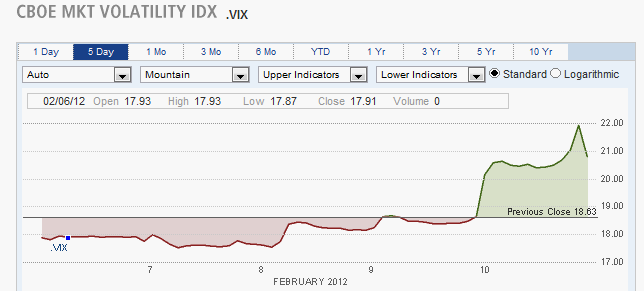

US stocks closed lower, as the Dow fell 89 points to 12801, its largest fall in 2012. The Nasdaq closed down .8%, and the S&P 500 dropped .7% to 1343, while the VIX surged 11.6% to 20.79.

VIX Surges 11.6% as Greek Tensions Spike

LinkedIn shares soared 17.8% after beating analyst profit forecasts and raising its outlook for the year. Nuance shares slumped 13% after profits fell short of estimates.

Currencies

The Dollar rallied as the currency markets shifted into “risk off” mode. The Australian Dollar was the largest loser, dropping 1.1% to 1.0673. The Euro fell .7% to 1.3188, the Pound lost .4% to 1.5755, and the Swiss Franc dropped .5% to 1.0915. The Canadian Dollar shed .7% to 1.0018, while the Yen bucked the trend, inching up .1% to 77.59.

Economic Outlook

The US trade deficit grew to $48.8 billion, slightly larger than expected, and up from last month’s $47.1 billion deficit. Consumer confidence fell more than expected to 72.5, from last month’s reading of 75.

Stocks Gain as Greece’s Passes Austerity Bill

Equities

Asian markets began the week on an up note, encouraged by Greece’s successful passage of an austerity bill. The Nikkei rose .6% to 8999, and the Kospi gained .6% as well, led by car makers. Australia’s ASX 200 rallied .9%, the Hang Seng advanced .5%, and the Shanghai Composite closed flat.

In Europe, stocks posted moderate gains, the region’s response to Greece’s austerity bill was muted.. The FTSE climbed .9%, as Cable & Wireless Worldwide soared 37% after Vodafone revealed it is considering a takeover bid for the company. The DAX gained .7%, and the CAC40 rose .3%.

Similar gains were achieved in the US. The Nasdaq led the advance climbing 1% to 2931. The Dow added 73 points to 12874, and the S&P 500 gained .7% to 1352.

Currencies

Currency markets traded in relatively narrow ranged on Monday. The Euro eased 8 pips to 1.3190, the Pound rose .1% to 1.5771, while the Yen and Swiss Franc traded flat. The Australian Dollar posted an outsized gain of .6% to 1.0734, and the Canadian Dollar rose .3% to .9992.

Economic Outlook

Tuesday’s economic calendar will include retail sales, import prices, and business inventories. Overseas, the ZEW economic sentiment index for Germany and the Euro zone is due.

Moody’s Warns of Debt Downgrades for UK and France

Equities

Asian markets traded mixed on Tuesday. The Nikkei advanced .6% to 9052, as the Bank of Japan announced another $130 billion asset buying plan. The news weakened the yen, which pushed up exporters. Australian shares dropped 1%, weighed down by miners, and the Kospi eased .2%, as steel makers tumbled more than 3%. The Hang Seng ticked up .2% to 20918, while the Shanghai Composite slipped .3% to 2345.

Moody’s downgraded the debt of 6 European countries, and warned it may downgrade the debt of the UK, Austria, and France, all of which have Aaa ratings.

European shares traded slightly lower, unfazed by the rating move. The CAC40 slipped .3%, the DAX declined .2%, and the FTSE eased .1%.

US stocks closed little changed as the Dow rose 4 points to 12878, the Nasdaq traded flat, and the S&P 500 edged down .1%.

Currencies

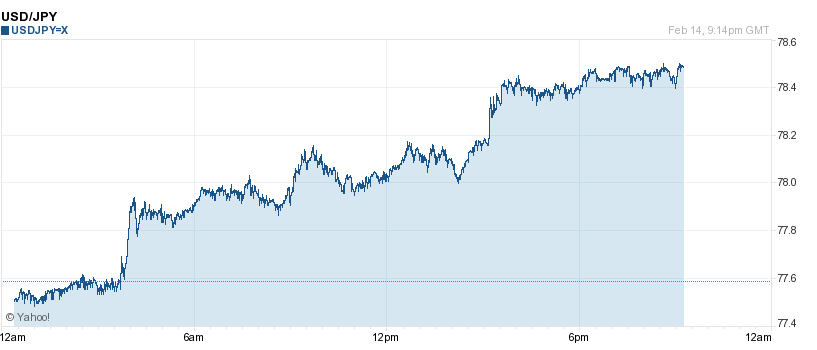

The Yen tumbled 1.2% to 78.51 falling to a 3-month low, while the Dollar traded modestly higher against other currencies. The Pound and Euro both slid .4%, and the Swiss Franc ticked down .3% to 1.0865. The Australian Dollar lost .3% to 1.0683, and the Canadian Dollar declined .2% to .9990.

Dollar Climbs 1.2% against the Yen as BOJ Announces More Stimulus

Economic Outlook

US retail sales data was disappointing, rising just .4% last month, as opposed to a forecast of .8%. On the bright side, core retail sales rose .7%, slightly more than the .6% expected. Business inventories and import prices were both inline with estimates.

Asian Stocks Rally, US Slides

Equities

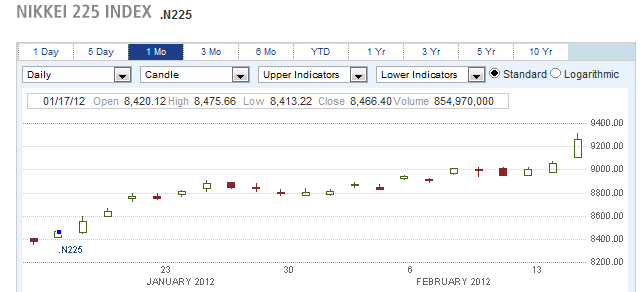

Asian markets jumped on Wednesday, as angst over Greece’s debt troubles waned. The Nikkei soared 2.3% to 9260, its highest level in August. In Korea,the Kospi rallied 1.1% to 2052, a 6-month high, as Samsung Electronics and Hynix Memory both surged more than 5%. Hong Kong’s Hang Seng rallied 2.1%, and the Shanghai Composite climbed .9%, encouraged by comments that China will continue to purchase European sovereign debt.

Nikkei Climbs 2.3% to 6-month High

European shares traded mixed. The CAC40 and DAX advanced .4%, while the FTSE slipped .1%. Heineken shares soared 3.7% and BNP Paribas jumped 4.1% after both companies exceeded analyst profit forecasts.

US stocks dropped, as investors shrugged off upbeat economic data. The Dow skidded 97 points to 12781, the Nasdaq dropped .6%, and the S&P 500 fell .5%. The minutes from the last FOMC meeting revealed that some Fed officials believe another round of asset buying will be needed to prop up the economy, spooking investors.

Currencies

The Euro fell .5% to 1.3067, and the Swiss Franc declined .3% to 1.0834. The Pound, Australian Dollar, and Canadian Dollar all closed within .1% of their previous close. The Yen ticked up .1% to 78.35 after Tuesday’s steep drop.

Economic Outlook

The Empire state manufacturing survey jumped to 19.5, blowing past forecasts of 14.7, and a sharp advance from last month’s 13.5 reading. The NAHB housing market index rose to 29, its highest level since 2007, another sign that the real estate market is turning around. Industrial production came in flat, below estimates for a .7% gain.

US Stocks Rally on Upbeat Economic Data

Equities

Asian markets skidded on Thursday, as another delay in Greece’s bailout package unnerved investors. The Kospi slumped 1.4% to 1997 as shipbuilders dropped, and the ASX 200 shed 1.7%, pulled down by disappointing earnings from Westpac, a major bank. The Hang Seng and Shanghai Composite both fell .4%, and the Nikkei edged down .2%.

European markets closed little changed, as an afternoon rally helped erase earlier losses. The FTSE and DAX declined .1%, while the CAC40 gained .1%. Greece reached an agreement with lenders on additional budget cuts for 325 million euro, bringing the resolution of the situation a step closer.

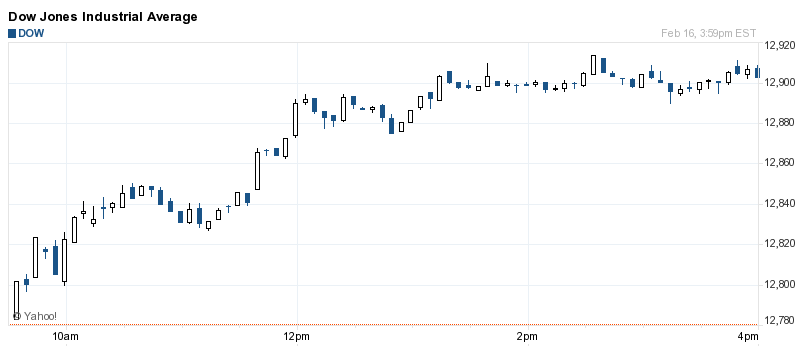

US stocks rallied thanks to upbeat economic data, led by tech shares. The Nasdaq jumped 1.5%, the Dow climbed 123 points to 12904, and the S&P 500 advanced 1.1% to 1358.

Dow Rallies 123 Points

GM shares soared 9% after reporting record profits, even though the figure fell shy of expectations. Groupon shares jumped 4.1% after announcing plans for a new VIP subscription service.

Currencies

The US Dollar skidded on Thursday, as market participants shifted in to “risk on” mode. The Pound climbed .7% to 1.5802, the while the Euro, Swiss Franc, and Australian Dollar all advanced .6%. The Canadian Dollar rose .3% to .9970. Bucking the uptrend, the Yen dropped .7% to 78.91, extending its recent declines.

Economic Outlook

Thursday’s busy economic calendar was full of positive economic news. Weekly jobless claims unexpectedly fell by 13K to 348K. Analysts had expected a slight increase to 364K from last week’s 361K. Housing starts also surprised analysts, climbing to 700K, from last month’s annualized rate of 690K. Building permits rose to 680K, inline with estimates, and PPI jumped to .4% from last month’s .1% increase. Finally the Philly Fed manufacturing index blew past estimates, jumping to 10.2 from last month’s 7.3 reading.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Doubts over Greek Bailout Weigh on Equities

Published 02/19/2012, 02:01 AM

Updated 05/14/2017, 06:45 AM

Doubts over Greek Bailout Weigh on Equities

Equities

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.