Google (NASDAQ:GOOGL) has activated its plan to blacklist ad content "including but not limited to initial coin offerings (ICO), cryptocurrency exchanges, cryptocurrency wallets, and cryptocurrency trading advice.” The ban applies to Google’s own and affiliated ad platforms. In the previous months, both Twitter Inc (NYSE:TWTR) and Facebook (NASDAQ:FB) have executed bans on ICO and cryptocurrency related ads as part of efforts to halt the proliferation of content that might deceive unsavvy investors.

However, ICOs and cryptocurrencies are not the enemy – for every one ICO scam, there are possibly hundreds of companies with verifiable products and services trying to bypass the bottlenecks on Wall Street to raise funds through an ICO. In fact, many existing startups and traditional companies are entering the blockchain ecosystem.

The ICO market by the numbers

Many people have been quick to assume that the clampdown on ICOs by government agencies and traditional digital ads network would spell doom for the industry. However, the data suggests that even though there’s a drop in the ICO funding, the ICO market is still enjoying decent cash inflows from crypto investors and traditional ones as well. In fact, one could argue that the drop in ICO funding is due to the weakness in the cryptocurrency market at large and not because of supposed negative connotations around ICOs.

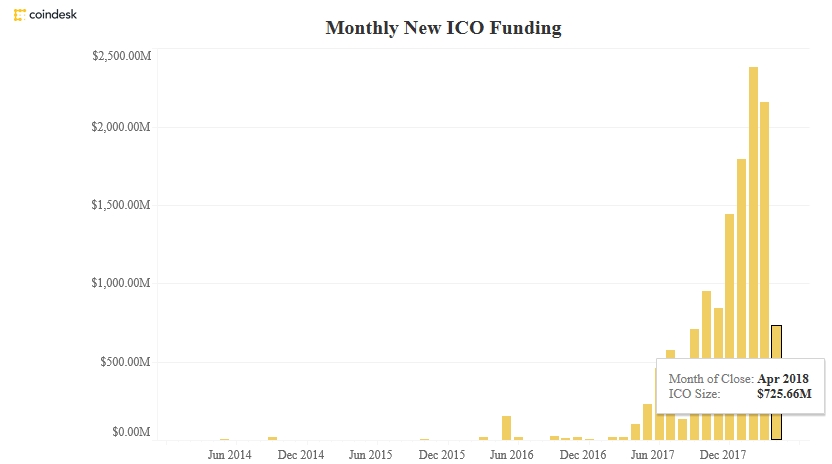

To start with, the all-time accumulative ICO funding totaled $12.83B as of April 30, 2018. Data from Coindesk shows that monthly ICO funding in April stood at $725.66M down from $1.79B in January 2018 as seen in the chart below.

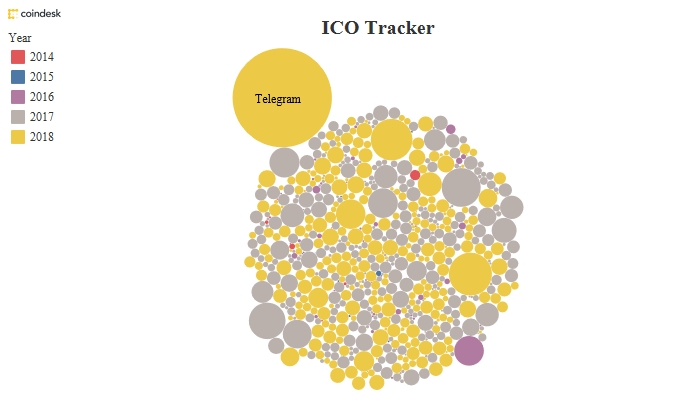

However, the number of monthly new ICOs has climbed between February 2018 and April 2018 to 69 new ones despite the initial decline from 75 ICOs recorded in January 2018. 2018 still remains the year in which startups and companies have raised the most money by taking the ICO route. The ICO tracker scatter plot below shows how much money companies have raised through ICOs in 2018 relative to the previous years.

Existing firms are ignoring Wall Street to raise funds via ICOs

ICOs are powerful tools for driving economic growth because they can unlock previously used capital from the coffers of retail investors to propel entrepreneurial innovation. Rather than jump through the hoops and hurdles of the financial gatekeepers on Wall Street, many businesses are starting to pay attention to how they can leverage ICOs to fund their operations.

Overstock.com Inc (NASDAQ:OSTK): incredibly resilient

Overstock CEO, Patrick Byrne is one of the most vocal supporters of Blockchain technology amidst the understandable skepticism of traditional businesses. His decision to have Overstock accept Bitcoin turned out to be a smashing success and now, he wants to pivot Overstock into a blockchain hub of sorts called tZero. The company revealed that it planned to build a distributed ledger platform for capital markets and it wants to fund the project via an ICO.

The firm has raised around $114 million in its tZERO coin, and it is on track to complete its crowd sale once it finds its way out of some regulatory challenges. In a statement, the firm notes that “as we transition to the Subsequent Sale Period, we are one step closer to our financing goals, including the use of a portion of proceeds of the offering toward leveraging our blockchain experience and expertise to develop a trading system…”

Ask.fm: In the making

Ask.fm, the popular question and answer social network in Europe is also pivoting from its internet-based model to a blockchain-based platform where anyone can ask questions and get answers openly or anonymously. With a registered user base of 215 million users, 3.5 million daily active users, 10 million monthly active users, and 600 million questions/answers in 49 languages and across 168 countries – Ask.fm is already a budding success story even before adding blockchain to the narrative.

Ask.fm wants to leverage the decentralized nature of blockchain technology to build a community economy where users can ask their most pressing questions and incentivize other users or experts to answer them. Using the ASKT, the firm aims to tokenize Q&A social networking while simultaneously breaking down communication barriers and encouraging social interaction. In addition, the pivot of Ask.fm to a blockchain ecosystem will potentially increase the mass-market adoption of blockchain because its 215 million users will want to experiment with crypto transactions which they might not have wanted to do beforehand.

Telegram: done and dusted

When Telegram debuted, it had all the right features to make it an instant hit over other instant messaging products such as WhatsApp, Facebook Messenger, or Skype. Telegram facilitates encrypted conversations between people globally and it goes out of its ways to ensure that none of their data is stored or shared with third parties – including governments. Telegram now wants to enshrine the independence, security, and anonymity of its platform by leveraging blockchain technology for security and financial transactions between users.

Telegram raised about $1.7 billion from the private sale of its TON (Telegram Open Network) tokens to exceed its original plan of raising $1.2B in an iinvitation only private sale and eventual crowdsale. The firm has reportedly suspended its crowd sale because it has raised enough money to build TON and it doesn’t want to risk running afoul of SEC regulations.