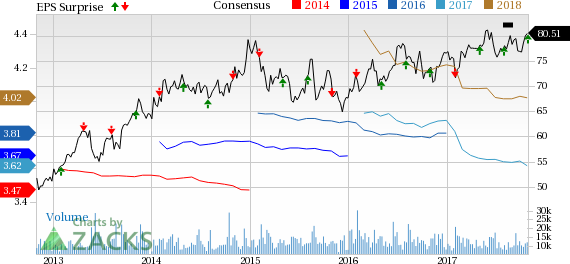

Dominion Energy Inc. (NYSE:D) reported third-quarter 2017 operating earnings of $1.04 cents per share, beating the Zacks Consensus Estimate by a penny. Earnings were within management’s guidance range of 95 cents to $1.15 per share.

However, operating earnings decreased 8.8% from $1.14 earned a year ago. The decline was primarily due to milder weather in its regulated service territory, a fall in solar investment tax credits and a reduction of Cove Point import contract revenues.

GAAP earnings were $1.03 per share compared with $1.10 in the year-ago quarter. The difference between GAAP and operating earnings was due to transition and integration costs associated with the Dominion Energy Questar combination.

Total Revenues

Dominion’s total revenues came in at $3,179 million, lagging the Zacks Consensus Estimate of $3,327 million by 4.5%. However, quarterly revenues were up 1.5% year over year.

Highlights of the Release

Total operating expenses decreased 0.4% year over year to $1,979 million primarily due to a drop in other operation and maintenance expenses.

Interest and related charges in the reported quarter were $305 million, up 22% from the year-ago quarter.

In the reported quarter, Power Delivery’s electric customer base increased 24,463 from the prior-year quarter. However, electricity consumption volumes dropped marginally year-over-year due to milder weather in its service territories.

Financial Update

Dominion exited the third quarter with cash and cash equivalents of $227 million, down from $261 million as of Dec 31 2016.

Total long-term debt as of Sep 30, 2017 was $30.88 billion compared with $30.23 billion at the end of 2016.

Cash from operating activities in the first nine months of 2017 was $3.66 billion, up 8.2% from $3.38 billion in the year-ago period.

Looking Ahead

In fourth-quarter 2017, Dominion expects to generate operating earnings of 80 cents to $1.00 per share compared with 99 cents earned in fourth-quarter 2016.

For the full year, Dominion reiterated its earnings guidance in the range of $3.40-$3.90 per share.

Our View

Dominion reported mixed results in the third quarter. Earnings beat the Zacks Consensus Estimate while total revenues lagged the same.

Dominion’s 1,588 megawatt Greensville County combined cycle power station is nearly 60% complete and is expected to begin commercial operations in late 2018 while its Cove Point Liquefaction is expected to start service by the end of 2017. These are likely to boost the company’s performance over the long term. However, lower solar investment tax credit could and planned refueling outage will hurt its earnings.

Dominion Energy has a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Peer Releases

American Electric Power Co., Inc. (NYSE:AEP) reported third-quarter 2017 operating earnings of $1.10 per share, lagging the Zacks Consensus Estimate of $1.19 by 7.6%.

NextEra Energy, Inc. (NYSE:NEE) reported third-quarter 2017 adjusted earnings of $1.85 per share, beating the Zacks Consensus Estimate of $1.75 by 5.7%.

WEC Energy Group (NYSE:WEC) reported third-quarter 2017 adjusted earnings of 68 cents per share, surpassing the Zacks Consensus Estimate of 67 cents by 1.5%.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

American Electric Power Company, Inc. (AEP): Free Stock Analysis Report

WEC Energy Group, Inc. (WEC): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

Dominion Energy Inc. (D): Free Stock Analysis Report

Original post

Zacks Investment Research