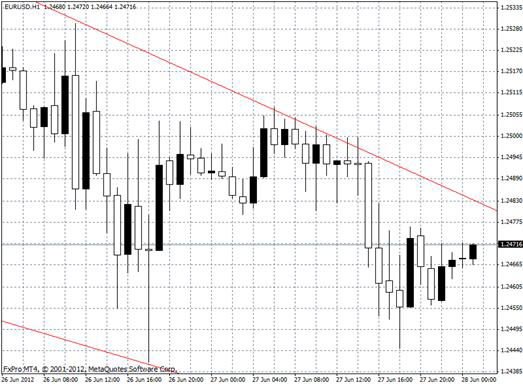

The euro traded down against the U.S. dollar Wednesday, as hopes that an upcoming European Union summit would deliver concrete steps to deal with the region’s debt crisis dimmed, as well as strong housing numbers in the U.S. boosting the greenback Hopes that European leaders would make headway on dealing with the debt crisis in the region faded after German Chancellor Angel Merkel reiterated her opposition to the idea of joint eurozone bonds earlier in the day. Elsewhere, Italy saw borrowing costs climb to the highest level since December at an auction of six-month government bonds, as investor sentiment towards Italy continued to deteriorate.

Italy’s Treasury sold the full targeted amount of EUR 9 billion of six-month government bonds at an average yield of 2.95%, up from 2.10% at a similar auction last month. In the U.S., a report by the National Association of Realtors showed that pending home sales jumped 5.9% in May, blowing past expectations for a 1% increase, to match a two-year high hit in March. Investors were anticipating the outcome of talks between Chancellor Merkel and French President François Hollande later in the day, ahead of the summit meeting on Thursday and Friday. EUR/USD" title="EUR/USD" width="523" height="385">

EUR/USD" title="EUR/USD" width="523" height="385">

GBP/USD

The pound remained lower against the U.S. dollar on Wednesday, following the release of positive U.S. economic reports as skepticism over the outcome of this week’s highly anticipated European summit continued to dominate market sentiment. A report by the National Association of Realtors showed that pending home sales jumped 5.9% in May, blowing past expectations for a 1% increase, to match a two-year high hit in March. Meanwhile, investors remained cautious ahead of the E.U. summit on Thursday and Friday amid growing doubts that leaders would make progress on greater fiscal integration and allowing the bloc's rescue funds to buy government debt.

Sentiment on the pound was also weighed by mounting speculation that the Bank of England will implement fresh quantitative easing measures to shore up growth. industry data showed that U.K. mortgage approvals fell to 30,200 in May, the lowest level since April 2011, from 32,100 the previous month, disappointing expectations for a 32,800 rise. A separate report showed that an index of realized sales in the U.K. rose unexpectedly to 42 in June from a reading of 21 the previous month. GBP/USD" title="GBP/USD" width="520" height="390">

GBP/USD" title="GBP/USD" width="520" height="390">

USD/JPY

The U.S. dollar edged slightly higher against the yen on Wednesday, as investors remained cautious ahead of a key European Union summit this week amid sustained concerns over the handling of the region’s financial crisis. Market sentiment remained fragile ahead of an E.U. summit due to begin on Thursday, amid worries the talks will not result in any effective steps to strengthen fiscal integration and allow the eurozone’s rescue funds to buy government debt. Moody’s ratings agency downgraded 28 Spanish banks earlier in the week, after the country formally requested up to EUR 100 billion to recapitalize its struggling banking sector.

In addition, Cyprus became this week the fifth eurozone country to request financial aid from the E.U. The amount required was expected to be negotiated in the coming days. Later in the day, the U.S. was to publish official data on durable goods orders, as well as industry data on pending home sales and a government report on crude oil stockpiles. USD/JPY" title="USD/JPY" width="520" height="390">

USD/JPY" title="USD/JPY" width="520" height="390">

USD/CAD

The U.S. dollar advanced to a session high against its Canadian counterpart in subdued trade on Wednesday, as hopes that an upcoming European Union summit would deliver progress on the debt crisis dimmed. Hopes that European leaders would make headway on dealing with the debt crisis in the region faded after German Chancellor Angel Merkel reiterated her opposition to the idea of joint eurozone bonds on Tuesday. Meanwhile, investors were looking ahead to the outcome of talks between Chancellor Merkel and French President François Hollande later in the day, ahead of the summit meeting on Thursday and Friday.

In the U.S., official data showed that durable goods orders rose by a seasonally adjusted 1.1% in May, beating expectations for a 0.4% increase, indicating that the manufacturing sector is stabilizing following a 0.2% drop in May. However, core durable goods orders, which exclude transportation items, rose by a seasonally adjusted 0.4% in May, missing expectations for a 0.7% gain. Later Wednesday, the U.S. was to release industry data on pending home sales. USD/CAD" title="USD/CAD" width="520" height="390">

USD/CAD" title="USD/CAD" width="520" height="390">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dollar Trades Up On Positive U.S. Economic News

Published 06/28/2012, 06:48 AM

Updated 04/25/2018, 04:40 AM

Dollar Trades Up On Positive U.S. Economic News

EUR/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.