Daily FX Market Roundup March 20, 2019

Kathy Lien, Managing Director of FX Strategy for BK Asset Management

The US dollar sold off sharply against all of the major currencies after the Federal Reserve’s dot-plot forecast revealed that 11 out of 15 US policy makers no longer believe that a rate hike is necessary this year. Going into the FOMC rate decision, investors and economists expected their forecast to drop from 2 rate hikes this year to 1 but it fell to zero – a dramatic change that reflects the severity of the Fed’s concerns. According to the monetary policy statement, some of the main problems include muted inflation, slower household spending and business investment. While the central bank feels that the labor market is strong and job gains are solid, the deeper-than-expected slowdown and decline in inflation allows them to keep monetary policy accommodative for the rest of the year. Fed Chair Powell confirmed that the US economy is in a good place and set to grow solidly in 2019, but trade talks, Brexit, European tariffs, twin deficits and weaker global growth pose risks to growth. Until some of these uncertainties are lifted, Powell feels that “it’s a great time for the Fed to be patient, to watch and wait.” Although the Fed Chair laced part of his speech with optimism, it was overshadowed by their lower interest rate, GDP and inflation forecasts. We expect the dollar to fall further with USD/JPY, which has closed below the 20-day SMA for the first time since January, extending its slide to 110.

Meanwhile, sterling traders are disappointed that UK Prime Minister May asked the European Union for only a short Brexit extension to June 30. In her letter to European Council President Donald Tusk, she said she was not prepared to delay Brexit any further. In doing so, it is clear that she plans to bring the Withdrawal Agreement to a third vote but as the Speaker of the House and the EU has warned, major changes need to be made for it to be considered. She is jamming the twice-rejected agreement down everyone’s throats and both Parliament and the EU are putting up a fight. Parliament is trying to arrest control of the Brexit process and according to France’s foreign minister, if May cannot offer guarantees that a Brexit deal will be passed, the extension request will be turned down. The EU made it very clear that the Withdrawal Agreement will not be reopened under any circumstances so her only option is to gain domestic support. Considering how late the request was made, they won’t be able to make any decisions at Thursday’s European Council meeting. EU President Juncker raised the possibility of an emergency summit next week before the March 29 deadline to decide if the extension request should be approved. They are not pleased that there’s no agreement in May’s Cabinet or in Parliament and don’t see how she can achieve consensus in the next 2 months. The outlook for the British pound remains troubling as the EU prepares for the possibility of a no-deal Brexit and rumors circulate around May’s possible resignation.

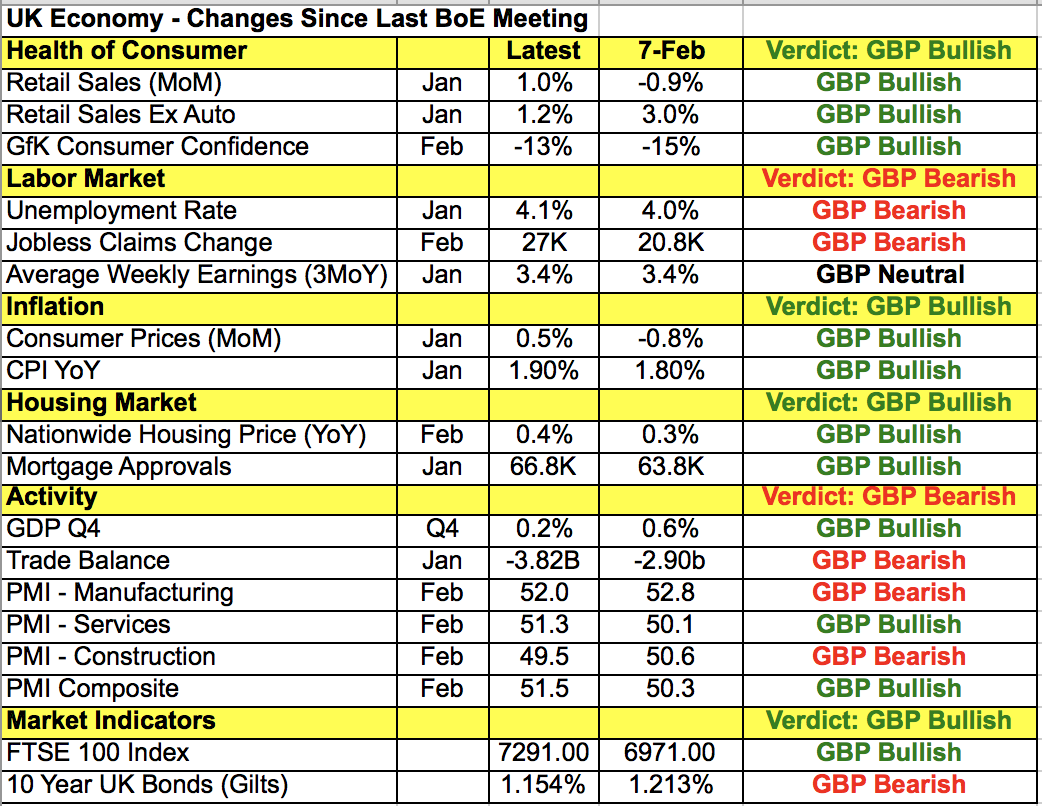

None of this is good for the Bank of England, which has to overlook the improvements in wage growth and consumer prices in favor of ongoing Brexit uncertainty. They had been operating under the assumption that a deal will be reached, but with the March 29 deadline set to pass with no agreement, they must warn against the possibility of market disruption and stress the need for caution. When it met last month, the BoE said the UK is set for its worst year since the financial crisis. The BoE slashed its 2019 GDP and inflation forecast and expressed concerns about weaker growth and Brexit. Unfortunately, improvements since then do not outweigh the uncertainty. We expect GBP/USD to drop to 1.30.

The Swiss National Bank also has a monetary policy announcement but the impact on the Swiss franc should be limited. The New Zealand and Australian dollars will also be in play with NZ Q4 GDP and Australia’s employment report scheduled for release. Stronger numbers are expected all around as New Zealand trade and consumer spending activity picked up toward the end of last year. Job growth in Australia could also beat expectations with the PMIs reporting stronger labor-market conditions in the services, manufacturing and construction sectors.