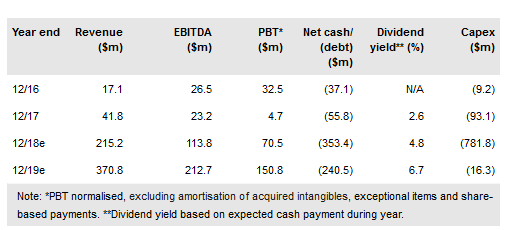

Diversified Gas & Oil (AX:DGO) has grown exponentially since listing on AIM in February 2017. The company’s acquisition-led strategy has enabled it to amass over 6.5m net acres in the US Appalachian Basin, taking net production to 32.5kboed in FY18, underpinned by a 1P PDP 393mmboe net reserve base. We see potential for further inorganic growth, diligent management of existing well stock and infill drilling in the event of a gas price recovery to provide a platform for further growth. DGO trades below our base case valuation of 138.1p per share, which excludes asset consolidation and the infill drilling option value. A 2019 6.6% dividend yield supports the current share price and investment risk/reward is skewed to the upside given the potential for further value accretive M&A. Key sensitivities include gas price realisations and cash operating costs.

Assiduous management of overlooked assets

DGO’s ability to extract residual returns from acquired mature production rests on the empowerment of production supervisors enabling them to extract maximum value, rather than volume, from their well stock. Unhindered by bureaucracy and layers of management, well tenders are able to optimise wells in real time. DGO’s ability to maximise shareholder returns will be driven by its proficiency in managing lease operating expense (LOE) and the deferment of abandonment costs through extended well life as production declines.

To read the entire report Please click on the pdf File Below: