Macy's, Inc. (NYSE:M) is slated to report fourth-quarter fiscal 2017 results on Feb 27, before the opening bell.

In the previous quarter, this department store retailer delivered a positive earnings surprise of 21.1%. The company’s bottom line has also surpassed the Zacks Consensus Estimate in the trailing three out of four quarters.

Analysts polled by Zacks expect fourth-quarter revenues to be $8,707 million, reflecting a year-over-year gain of 2.3%. Earnings are projected to improve roughly 32% to $2.66 from the year-ago period.Let’s analyze the factors influencing the company’s performance.

Factors at Play

Macy’s is likely to witness top- and bottom-line growth year over year, primarily owing to robust digital business and improvement in sales trend at stores. Additionally, it has undertaken a slew of measures revolving around stores closures, cost containment, real estate strategy as well as investment in omni-channel capabilities to enhance sales, profitability and cash flows.

In fact, the company’s holiday season unveils a decent performance as comparable sales (on an owned plus licensed basis) increased 1.1% during the November and December, while comps (on an owned basis) inched up 1%. Moreover, holiday sales showed strength at Macy’s, Macy’s Backstage, Bloomingdale’s, Bloomingdale’s The Outlet and Bluemercury businesses. Active apparel, shoes, dresses, coats, fine jewelry, men’s tailored clothing, children's and home categories led to strong sales as well.

Following modest increase in holiday sales, the company did narrow its sales guidance for fiscal 2017. Macy’s now expects sales on an owned basis to decline in the range of 2.4-2.7% compared with 2.2-3.3% projected earlier. On an owned plus licensed basis, comps are expected to decrease in the band of 2-2.3% compared with previous guidance of 2-3%. However, the company now anticipates adjusted earnings per share in the range of $3.59 and $3.69 (including Federal Tax Reform) compared with the earlier guided range of $3.38 and $3.63.

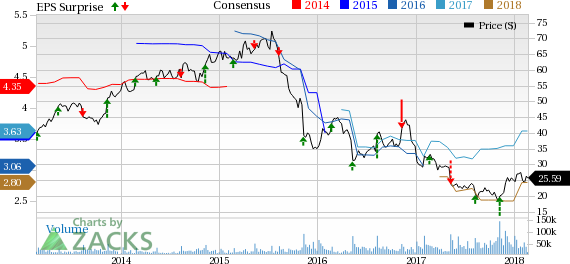

Macy's Inc Price, Consensus and EPS Surprise

What the Zacks Model Unveils

Our proven model shows that Macy’s is likely to beat estimates this quarter as the stock has the right combination of two key ingredients — a positive Earnings ESP and a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen.

Macy’s has an Earnings ESP of +0.92% and a Zacks Rank #2. This makes us reasonably confident of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks With Favorable Combination

Here are three companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Burlington Stores, Inc. (NYSE:BURL) has an Earnings ESP of +0.06% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Wolverine World Wide, Inc. (NYSE:WWW) has an Earnings ESP of +0.63% and a Zacks Rank of 2.

Dillard's, Inc. (NYSE:DDS) has an Earnings ESP of +15.83% and a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Macy's Inc (M): Free Stock Analysis Report

Dillard's, Inc. (DDS): Free Stock Analysis Report

Wolverine World Wide, Inc. (WWW): Free Stock Analysis Report

Original post

Zacks Investment Research