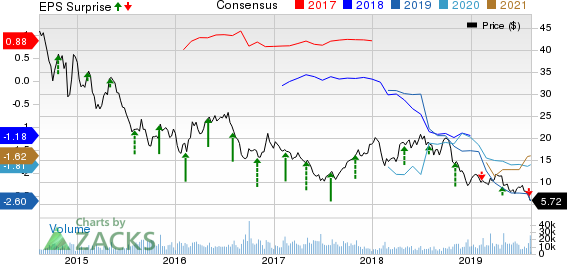

Diamond Offshore Drilling Inc. (NYSE:DO) incurred second-quarter 2019 adjusted loss of 99 cents per share, wider than the Zacks Consensus Estimate of a loss of 89 cents and the year-ago loss of 33 cents as well.

Moreover, total revenues amounted to $217 million, down from $269 million in the year-ago quarter. The figure also missed the Zacks Consensus Estimate of $227 million.

These weaker results were primarily caused by reduced average day-rates and lower rig utilization.

Operational Performance

Rigs recorded an average day-rate of $273,000, lower than $317,000 in the prior year. Moreover, rig utilization slipped to 51% from 53% a year earlier.

In the second quarter, revenues in the Contract Drilling segment dropped 21.8% year over year to approximately $207.3 million.

Transportadora earnings beat the Zacks Consensus Estimate in the last four quarters.

Halcon Resources earnings beat the Zacks Consensus Estimate in three of the previous four quarters.

World Fuel Services earnings beat the Zacks Consensus Estimate in the trailing four quarters.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

World Fuel Services Corporation (INT): Free Stock Analysis Report

Diamond Offshore Drilling, Inc. (DO): Free Stock Analysis Report

Transportadora De Gas Sa Ord B (TGS): Free Stock Analysis Report

Halcon Resources Corporation (HKRSQ): Free Stock Analysis Report

Original post

Zacks Investment Research