Deutsche Beteiligungs AG (DBAG) is a private equity firm listed in Frankfurt since 1985. Listed private equity (LPE) funds, like DBAG, provide broad access to an asset class that has performed well over the long term in a tradable form with a low minimum investment size. DBAG is differentiated from most of its peers due to its geographic and sector focus. DBAG combines the LPE model with access into the German Mittelstand, the core of Germany’s ongoing success. DBAG has a long and successful track record of performance and the current net discount to NAV of 26% (ex cash and listed securities) could prove unjustified if the underlying companies are more resilient than is being priced in or if markets recover faster than expected.

Strong long-term value creation

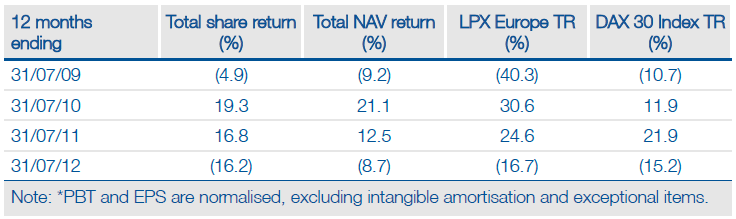

DBAG has built up a wealth of experience since 1965 and has become the largest listed private equity player in Germany, being involved in more than 300 private equity deals since inception, and with current assets under management (including co-investment funds) of around €1.2bn. With a market cap of c €230m and average annual turnover of c 34%, DBAG is one of the more liquid European based LPE funds. Performance has compared favourably with both Germany equities and its peers, with a total return on NAV of 208% over 10 years (DAX Index: 94%) to 3 August 2012

Unique access to the Mittelstand

DBAG has focused in recent years on mid-market German management buyouts (MBO) in its core Mittelstand market, a broad range of small-to medium-sized privately owned companies which have widely been credited with being a core strength of the German economy. Its primary focus is on the mechanical and industrial engineering, automotive suppliers, chemicals and industrial services. With credit markets remaining tight, DBAG expects more opportunities for expansion financing going forward.

Large underlying discount

DBAG has generally traded at a premium to other listed PE funds. We ascribe this to its robust balance sheet, strong long-term track record, regular dividend and its focused investment mandate. DBAG’s 10-year NAV growth of 208% is strong, although its share price performance has been less robust (c 86%). Amid the eurozone turmoil its discount to NAV has increased to c 12%, or c 26%, excluding net cash of €113m and its listed investment in Homag, which appears anomalous for a company with such strong historical NAV growth.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Deutsche Beteiligungs AG Initiation Of Coverage

Published 08/08/2012, 07:34 AM

Updated 07/09/2023, 06:31 AM

Deutsche Beteiligungs AG Initiation Of Coverage

Accessing Germany’s Mittelstand

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.