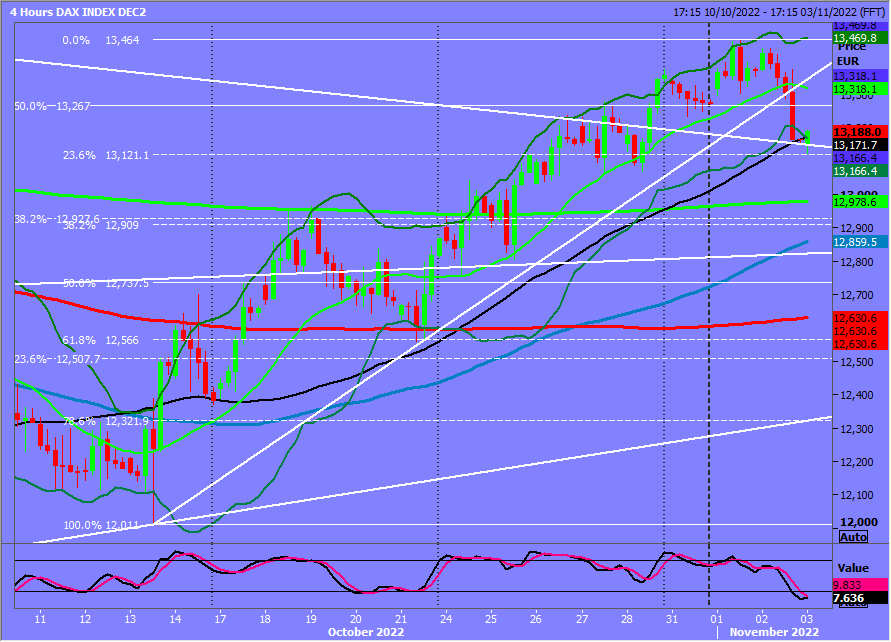

DAX 40 December futures hit my targets of 13370/380 and 13450/500 with a high for the day exactly here before prices collapsed to 13123.

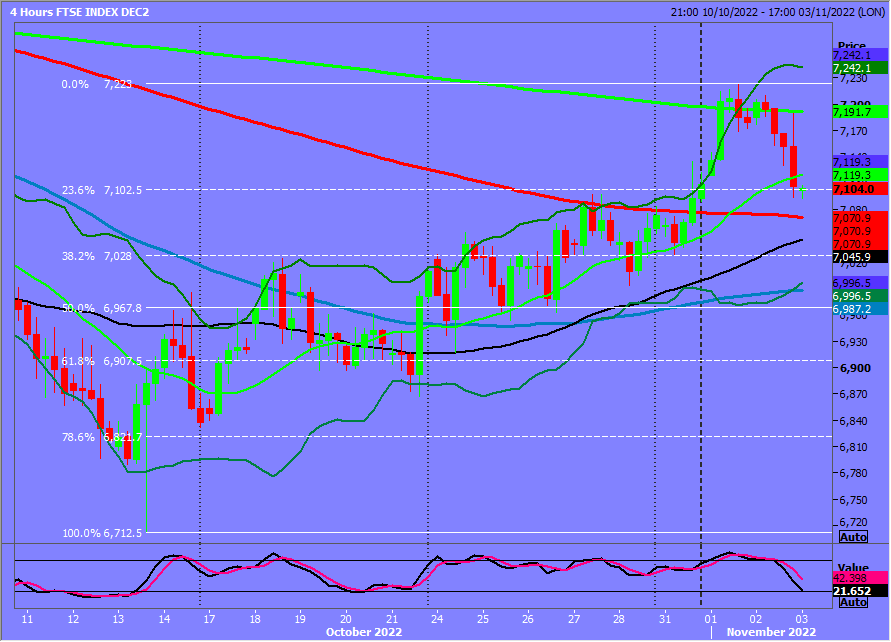

FTSE 100 December reversed from the 7190/7200 targeting minor support at 7170/50 then strong support at 7110/7090 with a low for the day exactly here. Longs need stops below 7070.

Today's Analysis

DAX December broke the 3 week rising trend line, from the October recovery - a counter trend move. So it is likely that the 2022 bear trend has resumed. However best support at 13150/100 today. Holding here allows a recovery to first resistance at 13250/350. Shorts need stops above 13400.

First support at 13150/100 but longs need stops below 13050. A break lower targets second 12950/900. A break below 12850 is a medium term sell signal and confirms the resumption of the bear trend. A weekly close below tomorrow night is further confirmation of course.

FTSE December a low for the day exactly at strong support at 7110/7090. Longs need stops below 7070. A break lower is a sell signal targeting 7030/20 then 6970/60.

Longs at strong support at 7110/7090 can target 7180/90.