Market movers today

Today the German Bundestag will start debating the 2020 budget. As we argue in Research Germany - Loosening the brake, 5 September, with the advent of the constitutional 'debt brake', the scope for additional fiscal spending in Germany has been significantly limited to some extra EUR5bn (0.14% of GDP) in 2020. In that light we will look out for any signs of a softening of the government's stance on Germany's strict fiscal rules or headlines about the creation of a "shadow budget" to boost public investments and 'green initiatives'.We also get July industrial production figures out of France and Italy. The German ones brought nothing to cheer last week, so focus will be whether the Italian and French ones can defy the German downtrend. France in particular, has been one of the rays of light lately in the Eurozone, with manufacturing confidence actually recovering some ground in Q2. In Sweden we expect CPIF and CPIF excluding energy to print a tenth below the Riksbank's new forecasts, while Danish CPI figures for August should also show a slight increase to 0.5%.It's a crucial session for Norwegian markets today with the release of both inflation and the Regional Network Survey. In short we expect both releases to support the case for a Norges Bank rate hike next week. In comparison markets only price a roughly 50% probability of this hike materialising.

Selected market news

The German Bundestag will start discussing the budget for 2020 today and yesterday we had two interesting stories out. First the Reuters story that Germany is considering a 'shadow budget' to circumvent the 'black zero' and the 'debt brake'. Later in the day Bloomberg reported that the Finance Minister has written to lawmakers in the Bundestag arguing that budget changes are possible if there should be a need due to overall economic developments or external factors. European yields continued to move higher and the curve bear steepened yet again as markets increasingly starts to price in higher bond supply next year and a QE disappointment from the ECB on Thursday. The negative bond sentiment was also fuelled as German export surprised on the upside in July rising 0.7% m/m. Risk appetite almost remained positive as Treasury Secretary Mnuchin said that US and China have made 'lots of progress' on trade-talks.

The probability of a no-deal Brexit also continue to diminish as the Parliament yesterday passed the 'no-deal legislation' and made it into law. The law states that Johnson must ask the EU for a Brexit extension if no agreement is reached with the EU. The Parliament has now been prorogued (sent home) and will return 14 October. It still points to a new election after 31 October as Johnson does not have a majority in Parliament.

Scandi markets

Sweden: We expect CPIF and CPIF excluding energy to print 1.4% y/y and 1.7% y/y, respectively, a tenth below the Riksbank’s new forecasts. One reason for our lower forecasts may be that we expect food prices to fall back after two months of higher than normal price gains. August is a month with big price changes going in opposite directions: big prices increases on clothing versus significant price cuts on charter travel and foreign airline tickets. In addition, a new chemical tax on electronics may show up in prices.

The July consumption indicator is set to bounce back sharply to 2.0% y/y on the back of car registrations (+89% y/y, a base effect due to new taxation in 2018) and retail sales (4.3% y/y, also a base effect due to sharply different weather conditions).

Prospera’s quarterly inflation expectations is released at 08.00 CET. We expect the decline in inflation expectations visible over the past couple of quarters and over all horizons to have continued in Q3. Extra attention will be given to Social Partners’ wage expectations ahead of the next wage round (starting in Q1 20).

Norway: While both releases today are important the most important of the two is Norges Bank’s Regional Network Survey, the central bank’s preferred economic indicator. Last time, the aggregated output index surprised by pointing to growth accelerating. This time, we expect to see a more obvious slowdown in export-related industries, which in isolation will pull the output index down. However, there are few signs of any softening in oil-related industries and government investment in infrastructure, investment in the power sector and a slight increase in housebuilding should prop up construction. The retail trade also seems to be over the worst, so there is no reason to expect any great deterioration in the service sector either. Overall, we expect a moderate fall in the aggregate output index from 1.57 to around 1.30 but this still signals above-trend growth over the next 6 months. We will also be keeping an eye out for signs of growing pressures in the labour market.

Core inflation can fluctuate wildly in the summer months, so there is real uncertainty here. We believe the surge in food prices in July was just a rebound from weak growth in the spring and will not reverse fully in August. In addition, we do not expect airfares to fall as far as they did in August 2018. We also expect the underlying trend in prices for imported goods such as clothing, footwear and furniture to start pushing up gradually on the back of a weaker NOK. On balance, we expect core inflation to edge up to 2.3% y/y in August, with the risk slightly on the upside.

Fixed income markets

Today, we have Netherlands in the market with a EUR 2bn tap in the NETHER 0.25% 07/29 bond. Netherlands have widened some 3bp vs DBR 08/29 since the beginning of August as speculations regarding a Dutch EUR 50bn investment fund emerged. We think it is likely that if the fund is in fact established that it will be funded over 5 to 10 years and that we will see no prefunding. Hence, we recommend to buy the 10Y Nether at the auction today vs Bunds or the NETHER 2037 bond.

Ireland yesterday said as expected that they will tap EUR 1bn in the 10Y benchmark bond. Ireland has been trading as a hard-Brexit proxy, but has recently been lagging the recovery in sterling. We see value in 10Y Ireland vs 10Y France. See Government Bonds Weekly, 6 September.

Note in respect of fiscal spending that Reuters yesterday reported that Germany is considering a “shadow budget” (similar to Netherlands) with the purpose of boosting public investments in infrastructure and climate. In that way Germany should be able to circumvent the tight constitutionally debt restrictions. If Germany is ready to do this the room for fiscal spending is quite sizeable. In Research Germany: Loosening the brake, 5 September we argue that Germany has a fiscal space of EUR 27bn under the fiscal compact and no less than EUR93bn under the Maastricht criteria. The so-called ‘debt brake’ only allows for a EUR5bn extra spending.

FX markets

We anticipate a busy day in Scandi space, with lots of potentially market moving data. While there’s much uncertainty in terms of the Norwegian inflation print our base case is an above-consensus print. More importantly the details of the Regional Network Survey should confirm that markets underappreciate the probability of a Norges Bank rate hike next week. In isolation that should drive higher short-end NOK rates and support a stronger NOK as long as the global environment does not deteriorate. We see a tactical case for a lower EUR/NOK, see here. For SEK, inflation (both actual and expectations of) take centre stage as the Riksbank cannot afford to see CPIF undershooting their already quite moderate forecast. We, however, believe it will. In addition, we find it likely that recent economic developments will have had a negative impact on inflation (and wage) expectations, which will add to the headwinds facing the Riksbank.

In majors, EUR/GBP moved lower (again) yesterday, in to 0.89s. We continue to expect the cross to trade in 0.88-0.90 on the back of politics moving towards an election and delay of Brexit. In our view, the positive drivers for the GBP are (1) postponing a UK recession and (2) postponing tariffs. EU have yet to align with the idea of a further extension but we believe they should come around on that. The consequences of an election will be the next topic to discuss but that’s too early as of now. EUR/USD was briefly spooked yesterday by new headlines hinting at the possibility of German fiscal stimulus, which took the pair above 1.1050 as German bond yields rose.

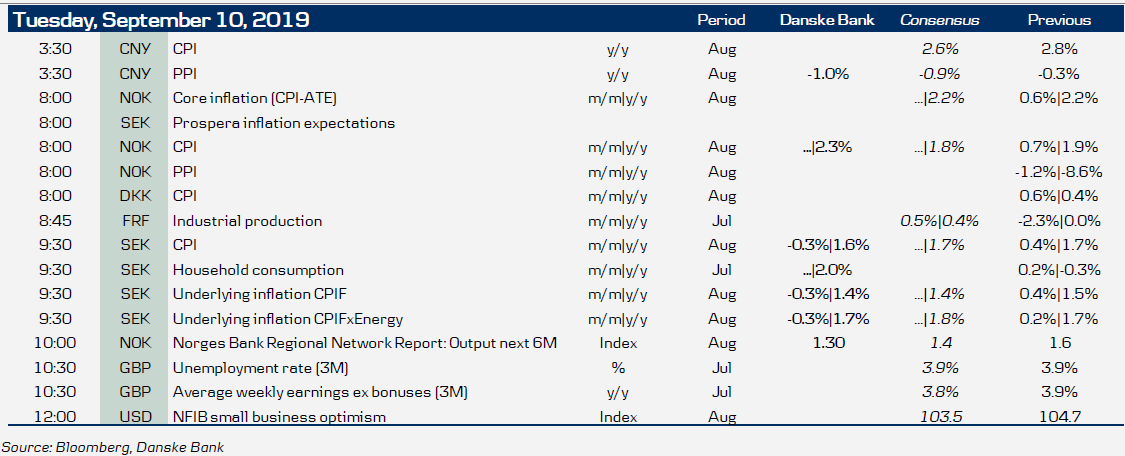

Key figures and events