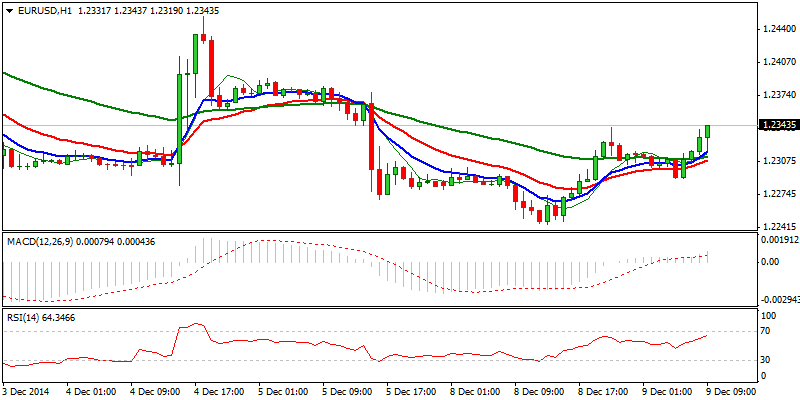

EURUSD

The Euro stabilizes above 1.23 handle, extending corrective rally from fresh low at 1.2244. Yesterday’s positive close suggests further near-term recovery, following higher low formation at 1.2290. Next strong barriers lay at 1.2360, former base and 1.2390 lower platform, reinforced by daily descending 10SMA, clearance of which is required to improve still negative 4-hour structure, for possible attack at pivotal 1.2435/55 barriers, daily 20SMA / 04 Dec lower top. However, overall picture remains bearish and sees limited corrective action, ideally to be capped under 1.24 handle, before fresh attempts lower.

Res: 1.2360; 1.2390; 1.2435; 1.2455

Sup: 1.2290; 1.2270; 1.2244; 1.2200

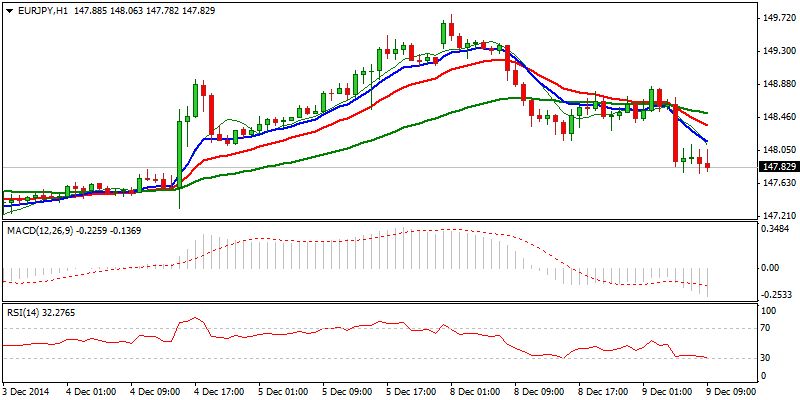

EURJPY

The pair extends pullback from yesterday’s fresh high at 149.76, signaled by Dark Cloud Cover pattern, on yesterday’s close. The second bear-leg, which commenced from 148.85 lower top, is testing daily 10SMA, with close below the latter to confirm further delay of the attack at psychological 150 barrier. Overall picture remains bullish and favors fresh attempts higher, after completion of near-term corrective action. Dips should be ideally contained at 147.00 higher low, reinforced by ascending daily 20SMA. Otherwise, break here would undermine bulls and expose key near-term support at 145.57.

Res: 148.17; 148.65; 148.85; 149.10

Sup: 147.65; 147.31; 147.00; 146.72

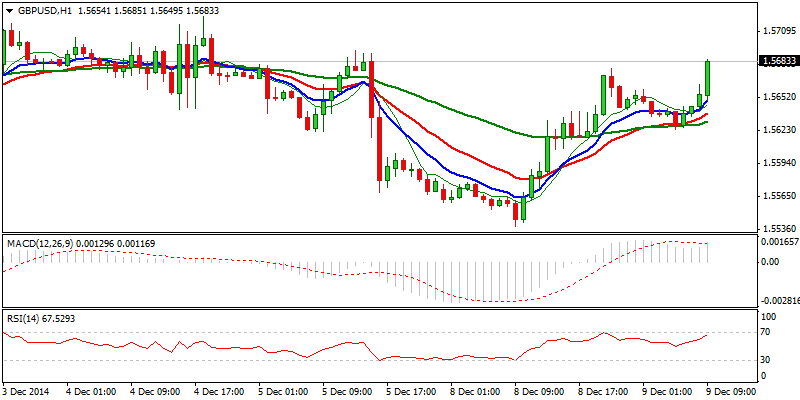

GBPUSD

Cable trades in near-term corrective phase off yesterday’s fresh low at 1.5539, with dynamic barriers of daily 10 / 20 SMA’s / Tenkan-sen line, also yesterday’s high, at 1.5680, being tested. Near-term technicals are gaining traction, however, daily close above pivotal 1.5680 barrier, is required to confirm resumption of near-term bulls for further recovery. Lower tops at 1.5720 and 1.5761, also Fibonacci 61.8% / 76.4% of 1.5823/1.5539 downleg, offer resistances, ahead of pivotal 1.5823, 27 Dec high. Alternatively, downside pressure is expected to increase, if 20SMA stays intact.

Res: 1.5680; 1.5720; 1.5761; 1.5800

Sup: 1.5624; 1.5600; 1.5577; 1.5539

USDJPY

The pair corrects last week’s acceleration, which peaked at 121.83, with extended pullback, probing below psychological 120 support. Dark Cloud Cover pattern formation, signals corrective action, as daily RSI starts to reverse from overbought territory and the price approaches significant supports at 119.52/32, daily Tenkan-sen line / 10SMA. Close below here to confirm near-term correction and open 119.00, previous peak / Fibonacci 61.8% of 117.22/121.83 ascend, with pivotal support at 117.22, 27 Nov higher low, expected to come in near-term focus. Conversely, bounce through 121 lower top, to sideline immediate downside risk.

Res: 120.20; 120.50; 121.00; 121.30

Sup: 119.52; 119.32; 119.00; 118.56

AUDUSD

The pair remains under pressure and extended descend close to psychological 0.8200 barrier, after leaving a lower platform at 0.83 zone. The pair travels on extended third wave from 0.8794, which now focuses 0.8178, its 161.8% Fibonacci expansion, with psychological 0.8000 support, coming in near-term focus. Overall negative structure favors further downside, however, oversold larger timeframe’s studies suggest corrective action in the near term.

Res: 0.8314; 0.8354; 0.8415; 0.8465

Sup: 0.8222, 0.8200; 0.8178; 0.8122

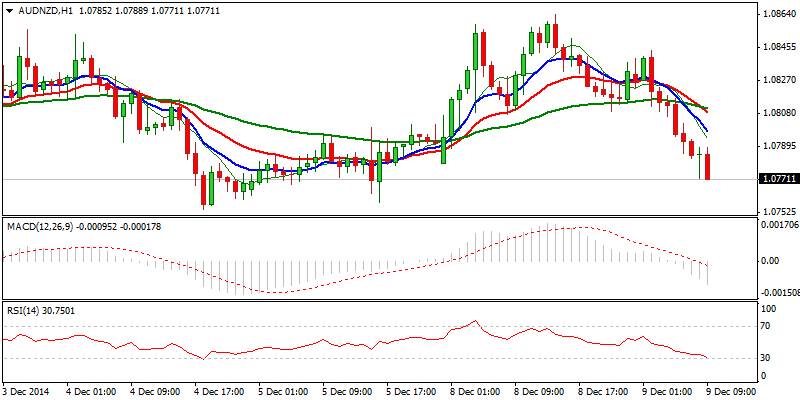

AUD/NZD

Near-term bears returned to play after yesterday’s brief attempts above consolidation range tops stalled and subsequent acceleration lower re-focused key support and range floor at 1.0754. Yesterday’s close in red offsets the influence of previous two days positive candles and shifts the focus lower, as overall picture remains bearish and looks for full retracement of 1.0619/1.1301.

Res: 1.0790; 1.0808; 1.0843; 1.0864

Sup: 1.0754; 1.0700; 1.0650; 1.0619

XAUUSD

Spot Gold probes above 1200 barrier, above which yesterday’s positive close occurred. Higher base was left at 1186 zone, where bull-trendline contained dips, as fresh push higher penetrates daily Ichimoku cloud base and re-focuses barriers at 1214 and pivotal 1220, 01 Dec high. Near-term studies are gaining traction, with overall bullish tone, seeing the upside favored in the near-term. Corrective actions should be contained above 1194 higher low, to kkep bulls intact and prevent re-testing of pivotal 1186 support.

Res: 1214; 1220; 1228; 1235

Sup: 1191; 1186; 1181; 1172

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Market Outlook: December 9, 2012

Published 12/09/2014, 04:01 AM

Updated 02/21/2017, 08:25 AM

Daily Market Outlook: December 9, 2012

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.