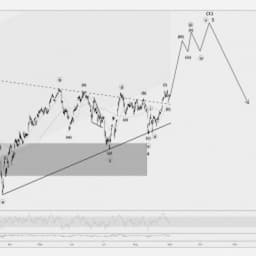

Crude has been correcting as we expected. However, the resulting really, which we also expected, has not started. Instead crude is hanging around just at the pale green trend channel support. The crude Elliott wave structure leaves many options open short-term. The main argument against a straight home run rally is its bullish sentiment. Positioning and sentiment continue to show elevated readings. Market participants are excited about crude and expect it to rally despite the latest correction. That's in contrast to what we have observed at the onset of rallies historically. Therefore, we assess the upside potential in crude as limited short-term.

It wouldn't be crude if things were simple... There are a bunch of bullish arguments for an extension to the upside remaining. We see a divergence in price movements to the downside for the past few weeks. Moreover, we are expecting the reversal for the US dollar within the next few weeks. Both factors were tailwinds for crude traditionally. Additionally, these bullish observations are in line with the long-term crude Elliott wave picture. A complex sideways correction is most probable long-term and has ample of room to the upside. Last but not least, crude has been a late cycle performer historically. Its positive performance reached often into recession territory in contrast to equities.

All in all, we expect the current correction to persistent. Eventually, it will probably resolve into a rally extending the current cycle. However, sentiment needs to cool down before the rallying takes off. A violation of the $58 mark invalidates our mid-term assessment and probably implies that the bull cycle has ended already.