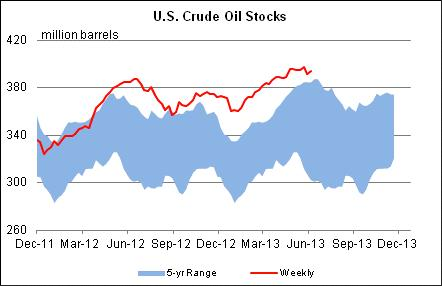

In the last 10 weeks Crude oil has added $12/barrel lifting prices as of this post to four-month highs with August futures flirting with the $100/barrel level. Not that the fundamentals have mattered in the energy complex but Crude-oil inventories are at the highest levels they’ve been in years.

Tight Trading Range

For the last 10 months -- with the exception of a few sessions -- August Crude-oil futures have been contained in an $11 trading range, identified by the horizontal green lines in the chart below. Current trade has futures about $1 below that pivot point and $2 below the psychological $100/barrel mark. Stochastics are showing overbought levels and prices are the furthest they have been above their 100-day MA (light blue line) since reaching an interim top in the first week of April…followed by a collapse of $10/barrel in the span of three weeks. Past performance is not indicative of future results.

$100 Barrel…not this time!

Apprehension

The outside market influence is somewhat supportive with equities advancing off their 50-day MAs last week. The problem I have with this is I suspect stocks are running on fumes. Additionally, if we get a dead-cat bounce in the US dollar, Crude should exhibit an inverse correlation. It is a hurry-up-and-wait situation as ample apprehension exists with market participants waiting for an FOMC decision tomorrow…the Fed will provide more clarity on the path of QE moving forward. To Taper or not to taper? The fact that a fear premium over Syria has been priced in and further conflict does not look imminent one would expect that premium...say $3-4 to be stripped out of the price in the coming weeks.

The Play

As for the trade, my suggestion is short futures in either August or September contracts while simultaneously selling out of the money puts 1:1. A 50% Fibonacci retracement puts August futures $5.75 lower. Confirmation of an interim top would be delivered in my eyes on a settlement under the eight-day MA (orange line) currently just under $97/barrel. I think a reasonable first objective is the 50-day MA (green line), which also is the same level as the 38.2% Fibonacci level.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Crude Oil: Don't Count On $100 A Barrel

Published 06/18/2013, 01:54 PM

Updated 07/09/2023, 06:31 AM

Crude Oil: Don't Count On $100 A Barrel

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.