Crown Holdings, Inc. (NYSE:CCK) has concluded the previously announced acquisition of Signode Industrial Group Holdings (Bermuda) Ltd. — a unit of The Carlyle Group L.P. (NASDAQ:CG) — for $3.91 billion. This buyout will add a portfolio of premier transit and protective packaging franchises to Crown Holdings’ metal packaging business and significantly boost its free cash flow as well.

Crown Holdings, Inc. (CCK): Free Stock Analysis Report

Mobile Mini, Inc. (MINI): Free Stock Analysis Report

AptarGroup, Inc. (ATR): Free Stock Analysis Report

The Carlyle Group L.P. (CG): Free Stock Analysis Report

Original post

Zacks Investment Research

Signode Adds Transit and Protective Packaging Capabilities

Based in Glenview, IL, Signode operates in three segments — Industrials Solutions, Protective Solutions, and Equipment & Tools. This $2.4-billion company operates 88 manufacturing facilities across six continents. Signode generated pro forma sales and adjusted EBITDA of $2.3 billion and $384 million, respectively, for the 12 months ended Nov 30, 2017.

The company boasts a diversified product offering offerings including strap, stretch and protective packaging consumables. Signode’s products secure and protect industrial and consumer goods during warehousing and shipment. It caters to primary metals, food and beverage, corrugated, construction, and agricultural end markets.

Post buyout, Crown Holdings will be able to supply complete solutions to meet customers' transit packaging needs utilizing Signode's products. Additionally, Signode's geographic and product mix will provide Crown Holdings a solid platform for value-creating growth. Moreover, the buyout will broaden and diversify Crown Holdings’ customer base, facilitating growth in cash flow.

To fund the deal, Crown Holdings issued €500 million of 2.875% senior unsecured notes due 2026, €335 million of 2.250% senior unsecured notes due 2023, and $875 million of 4.750% senior unsecured notes due 2026. In addition, the consumer packaging company entered into an agreement for €750 million and $1.25 billion of Term loans.

Acquisitions Drive Growth

The Signode acquisition is in sync with Crown Holdings’ strategy to evaluate select growth opportunities through capacity additions in its existing plants and new plants in existing markets. The addition of EMPAQUE — a leading manufacturer for the beverage industry in Mexico — has significantly fortified Crown Holdings’ presence in the Mexican market, along with substantially bolstering its strategic position in the beverage cans segment, both regionally and globally.

Consequently, Crown Holdings is aimed at making potential acquisitions in geographic areas and product lines in which it already operates or that complement its existing businesses. Furthermore, the buyouts are anticipated to fuel the company’s growth.

However, the Signode buy brings a higher degree of risk due to its cyclical nature. Further, its go-to-market strategy is different from Crown Holdings.

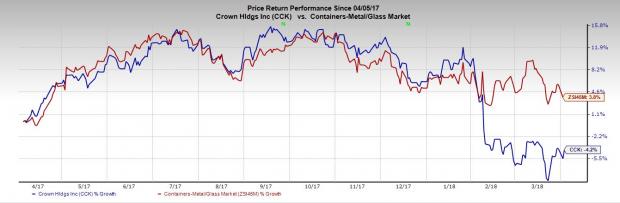

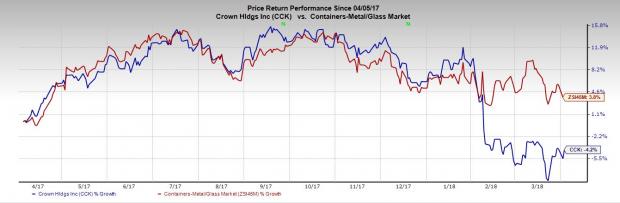

Share Price Performance

Over the past year, Crown Holdings has underperformed the industry with respect to price performance. The stock has dipped 4.2% while the industry grew 3.8%.

Zacks Rank & Stocks to Consider

Currently, Crown Holdings carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the sector include AptarGroup, Inc. (NYSE:ATR) and Mobile Mini, Inc. (NASDAQ:MINI) . Both stocks carry a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AptarGroup has a long-term earnings growth rate of 9%. The company’s shares have gone up 17% in the past year.

Mobile Mini has a long-term earnings growth rate of 14%. The company’s shares have rallied 46% during the past year.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Crown Holdings, Inc. (CCK): Free Stock Analysis Report

Mobile Mini, Inc. (MINI): Free Stock Analysis Report

AptarGroup, Inc. (ATR): Free Stock Analysis Report

The Carlyle Group L.P. (CG): Free Stock Analysis Report

Original post

Zacks Investment Research