Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL) reported better-than-expected fourth-quarter fiscal 2019 results. With this, the company’s earnings surpassed the Zacks Consensus Estimate for the fourth straight quarter.

Adjusted earnings came in at $2.70 per share, which outpaced the Zacks Consensus Estimate of $2.43. The bottom line also increased 23.3% year over year on high expenses.

Revenues of $787.1 million surpassed the consensus mark of $774 million but declined 3% from the prior-year quarter. The downside was primality due to the inclusion of the 53rd week in the prior-year quarter.

Comps Details

Comparable store restaurant sales increased 3.8% in the reported quarter, courtesy of a 3.6% uptick in average check and a 0.2% increase in comparable store restaurant traffic. Also, the average menu price rose about 2.3%. Moreover, comps compared favorably with the third quarter’s 1.3% rise.

Comparable store retail sales in the fiscal fourth quarter rose 0.4% compared with a 2.6% decline in the third quarter.

Operating Highlights

Operating income in the fiscal fourth quarter totaled $79.4 million, down 4% year over year. Operating margin was 10.1%, down 10 basis points from the prior-year quarter.

As a percentage of total revenues, rise in other operating expenses, and general and administrative expenses were overshadowed by a decline in cost of goods sold and labor and other related expenses.

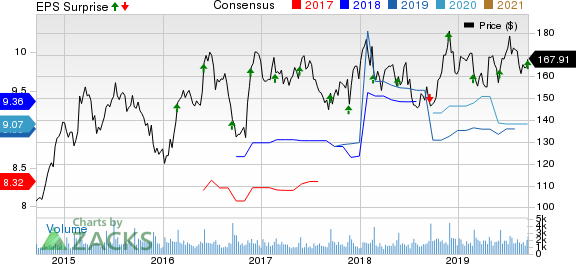

Cracker Barrel Old Country Store, Inc. Price, Consensus and EPS Surprise

Balance Sheet

As of Aug 2, 2019, cash and cash equivalents were $36.9 million, down from $114.7 million as of Aug 3, 2018. Long-term debt remained at $400 million in the reported quarter, in line with the prior-year quarter.

Inventory at the end of the quarter under review amounted to $155 million, down from fourth-quarter fiscal 2018 value of $156.3 million.

Net cash provided by operating activities was $362.8 million as of Aug 2, 2019, compared with $330.6 million as of Aug 3, 2018.

Fiscal 2019 Guidance

Cracker Barrel expects total revenues in the range of $3.15-$3.2 billion. Comparable store restaurant sales and retail sales are expected to grow 2-3%. The company also aims to open six Cracker Barrel stores in fiscal 2019.

Management continues to project earnings per diluted share of $8.8-$8.95 (including the impact of investment in Punch Bowl Social) for fiscal 2020 compared with $9.27 in fiscal 2019.

Cracker Barrel currently carries a Zacks Rank #3 (Hold). You can the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

Darden (NYSE:DRI) reported fourth-quarter fiscal 2019 results, wherein earnings surpassed the Zacks Consensus Estimate but revenues lagged the same. Adjusted earnings of $1.76 per share outpaced the Zacks Consensus Estimate of $1.73. The bottom line also increased 26.6% year over year on higher revenues.

Domino’s (NYSE:DPZ) reported mixed second-quarter 2019 financial numbers, wherein earnings exceeded the Zacks Consensus Estimate but revenues missed the same. Adjusted earnings of $2.19 per share outpaced the Zacks Consensus Estimate of $2.00. The metric also increased 19% on a year-over-year basis. The bottom-line improvement was driven by higher net income and lower diluted share count as a result of share repurchases.

Chipotle (NYSE:CMG) reported better-than-expected results in the second quarter of 2019. Its adjusted earnings of $3.99 per share surpassed the Zacks Consensus Estimate of $3.69 by 8.1%. The bottom line also grew 39% from the year-ago quarter number backed by solid revenues and strong operating margins.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

Cracker Barrel Old Country Store, Inc. (CBRL): Free Stock Analysis Report

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

Original post

Zacks Investment Research