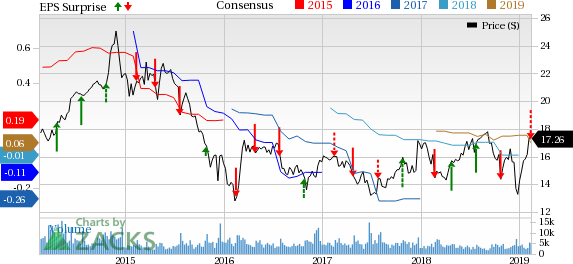

Covanta Holding Corporation (NYSE:CVA) delivered fourth-quarter 2018 earnings of 4 cents per share, missing the Zacks Consensus Estimate of earnings of 7 cents by 42.86%. However, the figure declined 55.5% on a year-over-year basis.

Revenues

In the quarter under review, Covanta Holding’s revenues amounted to $500 million, which beat the Zacks Consensus Estimate of $479 million by 4.41%. Also, the top line improved 1% on a year-over-year basis.

In 2018, the company posted revenues of $1,868 million, up from $1,752 million in 2017.

Operational Update

In the reported quarter, Covanta Holding’s total adjusted operating expenses were $441 million, up 0.9% year over year.

Interest expenses were $34 million, down 17% year over year.

Financial Condition

Covanta Holding had cash and cash equivalents of $58 million as of Dec 31, 2018 compared with $46 million as of Dec 31, 2017.

Long-term and project debt was $2,327 million as of Dec 31, 2018 compared with $2,339 million as of Dec 31, 2017.

Net cash from operating activities at the end of 2018 was $238 million, lower than $242 million in 2017.

Guidance

Covanta Holding projects 2019 adjusted EBITDA in the range of $440-$465 million and cash available for distribution (CAFD) in the band of $120-$145 million.

Zacks Rank

Covanta Holding currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Oil & Energy Releases

Murphy Oil Corporation (NYSE:MUR) delivered fourth-quarter 2018 adjusted earnings of 31 cents per share, beating the Zacks Consensus Estimate of 26 cents by 19.2%.

Buckeye Partners, L.P. (NYSE:BPL) posted fourth-quarter 2018 earnings of 90 cents per unit, beating the Zacks Consensus Estimate of 69 cents by 30.24%.

NextEra Energy (NYSE:NEE) Partners, LP (NYSE:NEP) incurred fourth-quarter 2018 loss of 39 cents per unit, against the Zacks Consensus Estimate of earnings of 48 cents.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

See Stocks Today >>

Buckeye Partners L.P. (BPL): Free Stock Analysis Report

Murphy Oil Corporation (MUR): Free Stock Analysis Report

NextEra Energy Partners, LP (NEP): Free Stock Analysis Report

Covanta Holding Corporation (CVA): Free Stock Analysis Report

Original post

Zacks Investment Research