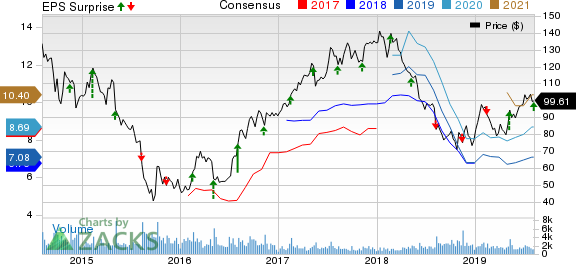

Copa Holdings, S.A.’s (NYSE:CPA) second-quarter 2019 earnings of $1.20 per share beat the Zacks Consensus Estimate of $1.05. Moreover, the bottom line improved year over year on impressive revenue growth.

Quarterly revenues inched up 1.7% to $645 million, above the Zacks Consensus Estimate of $627 million. The upside was owing to 1.5% increase in passenger revenues.

Following this outperformance, shares of the company surged more than 9% in after-hours trading on Aug 7.

Operational Statistics

While passenger unit revenue per available seat mile (PRASM) ascended 6.1%, yield per passenger mile was up 4.1%. However, on a consolidated basis, traffic (measured in revenue passenger miles or RPMs) dipped 2.5% while capacity (or available seat miles/ASMs) slid 4.3% (due to the MAX groundings) in the reported quarter. As capacity decline was more than the contraction in traffic, consolidated load factor improved 160 basis points (bps) to 85.1%.

Meanwhile, unit revenue per available seat mile (RASM) augmented 6.3%. However, operating cost per available seat mile (CASM) inched up 2.5% in the reported quarter due to the grounding of the MAX fleet. The metric excluding fuel costs increased 5.7% on account of lower capacity from the aforementioned headwind. Also, average fuel price per gallon escalated 5.3% year over year to $2.22. With the ongoing groundings, the company has removed all MAX flights from its schedule through Dec 15, 2019.

Liquidity

The company exited the second quarter with cash and cash equivalents of $226.14 million compared with $156.16 million at the end of 2018. Long-term debt amounted to $1 billion compared with $975.28 million at the end of last December.

Dividend Update

The company’s board has cleared a quarterly cash dividend of 65 cents per share, payable Sep 13, 2019 to shareholders of record as of Aug 30.

2019 Outlook Revised

Due to the prolonged period of MAX groundings, Copa Holdings now anticipates capacity to slip 2% year over year compared with an increase of 1% expected previously. However, with fuel prices at modest levels and rising revenue trends, the company expects operating margin in the 15-17% range, up from the band of 12-14% estimated previously. This indicates a favorable comparison with 13% achieved in 2018. Meanwhile, effective price per gallon of jet fuel is predicted at $2.15 compared with $2.25 forecast previously.

Zacks Rank & Other Key Picks

Copa Holdings carries a Zacks Rank #2 (Buy). Some other top-ranked stocks in the same space are Delta Air Lines, Inc. (NYSE:DAL) , Gol Linhas Aereas Inteligentes S.A. (NYSE:GOL) and JetBlue Airways Corporation (NASDAQ:JBLU) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Delta Air Lines, Gol Linhas and JetBlue have gained more than 7%, 100% and 4%, respectively, in a year’s time.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

JetBlue Airways Corporation (JBLU): Free Stock Analysis Report

Gol Linhas Aereas Inteligentes S.A. (GOL): Free Stock Analysis Report

Copa Holdings, S.A. (CPA): Free Stock Analysis Report

Delta Air Lines, Inc. (DAL): Free Stock Analysis Report

Original post

Zacks Investment Research