The Q3 earnings season is in full swing, with results from 23.2% of the S&P 500 Index members already on board (as on Oct 21). These 116 members (accounting for 30% of the index’s total market capitalization) are up 3.3% on 1.8% higher revenues.

After five back-to-back quarters of earnings declines for the S&P 500 index, we are finally seeing a marginally positive overall growth trend for the index. On the whole, our latest data projects that the earnings for S&P 500 companies are now on track to grow 0.1% from the year-ago period. This is comparable to a decline of 2.9%, expected a few weeks ago.

Further, the encouraging growth angle is being supplemented by a higher number of positive surprises compared to the recent quarters. If this trend continues, it will likely paint a recovering growth picture for the times to come.

However, with macroeconomic conditions still soft, earnings growth is projected to be negative for seven of the 16 Zacks sectors. (For more details, read our Earnings Preview article).

The construction sector is one of the few bright spots in the dull picture. The sector is expecting solid growth this quarter, with earnings expected to improve 6.9% on 7.1% higher sales from the last year.

The Construction space has major players like Chicago Bridge & Iron Company N.V. (NYSE:CBI) , EMCOR Group Inc. (NYSE:EME) , TRI Pointe Group, Inc. (NYSE:TPH) and Simpson Manufacturing Co., Inc. (NYSE:SSD) reporting numbers on Oct 27. Other players like Primoris Services Corporation (NASDAQ:PRIM) , Orion Group Holdings, Inc. (NYSE:ORN) , Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD) are expected to report next week.

Let’s have a look at how Chicago Bridge & Iron, EMCOR, TRI Pointe and Simpson Manufacturing are poised ahead of their scheduled announcements tomorrow.

Chicago Bridge & Iron: This company designs, builds, repairs and modifies steel tanks and other steel plate structures and associated systems. It ranks among the world’s leading integrated engineering, procurement and construction service provider and major process technology licensors.

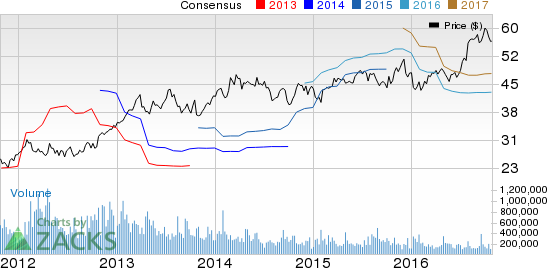

The company has recorded a dull earnings beat history over the trailing four quarters, with two misses, along with two in-line earnings. The company has posted an average negative surprise of 3.9% over the trailing four quarters. Last quarter, it had missed estimates by 4.1%.

Our proven model does not conclusively show that Chicago Bridge & Iron is likely to beat on earnings in the to-be-reported quarter. Chicago Bridge & Iron presently has an Earnings ESP of -0.86% and a Zacks Rank #4 (Sell). The Zacks Consensus Estimate for the quarter is pegged at $1.17.

CHICAGO BRIDGE Price and EPS Surprise

Please check our Earnings ESP Filter that enables you find stocks that are expected to come out with earnings surprises.

EMCOR: EMCOR is one of the leading providers of mechanical and electrical construction, industrial and energy infrastructure, and building services for a diverse range of businesses. The company serves commercial, industrial, utility and institutional clients.

The company recorded a mixed surprise history over the trailing four quarters, having missed estimates twice for as many beats. The company has an average positive surprise of 7.4% over the trailing four quarters. Last quarter, it had surpassed estimates by 33.8%.

Our proven model does not conclusively show that EMCOR is likely to beat on earnings in the to-be-reported quarter. EMCOR presently has an Earnings ESP of 0.00% and a Zacks Rank #3 (Hold). The Zacks Consensus Estimate for the quarter is pegged at 76 cents.

Despite a favorable rank, the company’s 0.00% Earnings ESP makes surprise prediction inconclusive. Note that stocks with a Zacks Rank #1 (Strong Buy), or 2 (Buy) or 3 have a significantly higher chance of beating estimates.

EMCOR GROUP INC Price and EPS Surprise

TRI Pointe: This company is involved in the design, construction and sale of single-family homes. TRI Pointe has had an impressive earnings history in recent times, with consecutive, huge earnings beats over the four trailing quarters, for an average positive surprise of 34.6%. Last quarter, it had beaten estimates by a whopping 64.3%.

Our proven model does not conclusively show that TRI Pointe is likely to beat on earnings in the quarter. The company has an Earnings ESP of -4.35% and a Zacks Rank #3. The Zacks Consensus Estimate for the quarter is pegged at 23 cents. Despite a favorable rank, the company’s negative Earnings ESP makes surprise prediction inconclusive.

TRI POINTE GRP Price and EPS Surprise

Simpson Manufacturing: This company designs, engineers and manufactures wood-to-wood, wood-to-concrete and wood-to-masonry connectors.

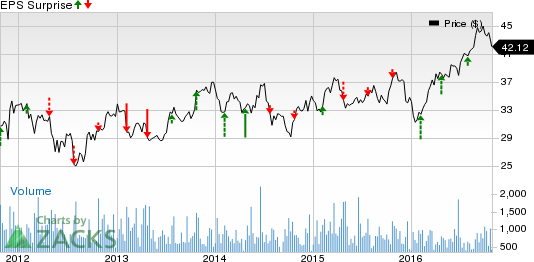

The company has recorded a decent surprise history over the trailing four quarters, having beaten estimates thrice. The stock has an average positive surprise of 15.5% over the trailing four quarters. Last quarter, it beat estimates by 8%.

Our proven model does not conclusively show that Simpson Manufacturing is likely to beat on earnings in the quarter to be reported. The company has an Earnings ESP of 0.00% and a Zacks Rank #3. Despite a favorable rank, the company’s 0.00% Earnings ESP makes surprise prediction inconclusive. The Zacks Consensus Estimate for the quarter is pegged at 56 cents.

You can see the complete list of today’s Zacks #1 Rank stocks here.

SIMPSON MFG INC Price and EPS Surprise

Keep an eye on our full earnings articles to see how these players finally fared in quarter.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

SIMPSON MFG INC (SSD): Free Stock Analysis Report

CHICAGO BRIDGE (CBI): Free Stock Analysis Report

EMCOR GROUP INC (EME): Free Stock Analysis Report

GREAT LAKES DRG (GLDD): Free Stock Analysis Report

ORION GROUP HLD (ORN): Free Stock Analysis Report

PRIMORIS SERVCS (PRIM): Free Stock Analysis Report

TRI POINTE GRP (TPH): Free Stock Analysis Report

Original post