Communisis (CMS.L) is on track to meet our FY12 forecasts and has a strong and growing pipeline of new contractual work, which augurs well for 2013 and beyond. The shares have opened 2013 strongly and continue to narrow the discount to the support services sector. This is likely to continue as strategically driven growth is delivered.

Trading in line

In its trading update of 16 January, Communisis confirmed that FY12 trading would meet company expectations. International expansion was strong and overseas sales accounted for 7% of group sales (2011: 4%), reflecting progress made with a major client in the FMCG market in Europe.

Strong pipeline going into 2013

Communisis has already announced major new contracts with BT (November 2012) and Nationwide Building Society (January 2013), which will both begin to contribute in 2013. News of further new business wins is possible as the year progresses.

Net debt better than forecast

Net debt for FY12 was approximately £21m (FY11: £24.7m), which is below our estimate of £24.7m. Compared to our estimates, lower interest paid, tax and capex (slightly offset by higher acquisition spending) saved £1.3m with the balance coming from working capital savings. Timing may be responsible for some of this movement.

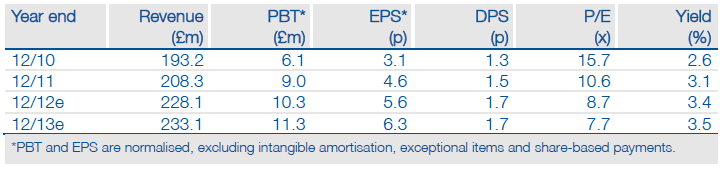

Estimates unchanged ahead of 7 March results

We maintain our FY12 estimates apart from the better year end debt figure, which is heavily second-half weighted, leaving net interest charges substantially unchanged. In FY13, which starts with a lower net debt figure, we assume that the benefits of timing differences are partly reversed. We allow for small interest savings and adjusted PBT estimates are raised from £11.2m to £11.3m. However, the estimated tax charge will be higher than we had forecast (23.5% vs 22%) and shares in issue (and fully diluted) will be slightly higher, leaving the estimated (normalised) EPS at 6.3p.

Valuation: Shares up 21% in 2013 so far

The shares have opened the New Year strongly (up 21% compared to a 3% rise in the FTSE All-Share) and the discount to the sector continues to narrow: Now 47% (for FY12) compared to 61% when we last wrote on Communisis (17 December). As confidence grows in the company’s strategically driven growth, the discount could continue to narrow.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Communisis: On Target With Strong Pipeline

Published 01/31/2013, 06:07 AM

Updated 07/09/2023, 06:31 AM

Communisis: On Target With Strong Pipeline

On target with a strong pipeline

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.