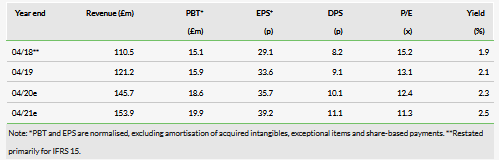

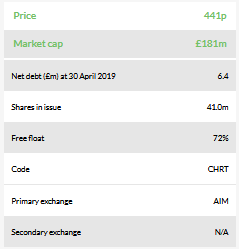

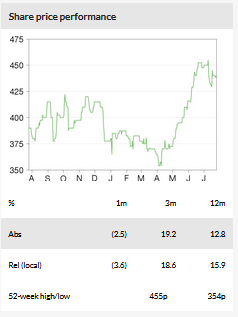

Cohort (LON:CHRT) delivered another year of growth in what remained quite a constrained defence spending environment in its domestic markets. The recently acquired Chess Technologies delivered a stronger than expected performance in its initial period of consolidation, helping to mitigate the slippage of profits into FY20 at EID as an export contract was signed too late to be shipped in FY19. The record order intake and stronger backlogs across the group provide a solid foundation for growth, enhanced by a full-year contribution from Chess. Our EPS estimates are marginally reduced for FY20, but we expect stronger growth and cash flows in FY21. The FY21e P/E of 11.3x remains below UK defence sector peers despite the continued positive progress of the group.

Growth delivered despite challenges

FY19 trading delivered growth once again for the group and, allowing for IFRS adjustments, was broadly in line with our expectations. The initial five months of trading at the recently acquired Chess Technologies was better than expected, and MASS, MCL and SEA all grew profit contributions. The overall profit improvement was despite a weaker than expected H219 contribution from EID in Portugal, where an anticipated export order for armoured vehicle intercoms came too late in the year to benefit profitability. Year-end net debt of £6.4m was much better than expected due to favourable working capital flows over the year end, which have subsequently unwound. The dividend was increased by 11% to 9.1p.

Record orders underpin FY20 growth

The record order intake in FY19 of £189.9m and strong backlog provides c 55% sales cover for FY20. All divisions improved intake and should grow contributions in FY20, with the exception of a flat prospect for SEA, although long-term naval orders are expected in FY20. EID should recover strongly with the benefit of the deferred sales from FY19. EID orders of £16.6m deliverable in FY20 are well above FY19 divisional sales, with further in-year activity expected. Chess will make a full year contribution and appears to have good prospects across its portfolio of activities.

Valuation: Disparity with defence peers

The average of our DCF and peer group SOTP valuation generates a fair value of 616p, an increase on our prior fair value of 530p. If achieved, the fair value gives a 2021e P/E of 15.7x. Although Cohort is developing in line with expectations, it continues to trade on a FY21e P/E discount of c 20% to its UK defence peers. In our view, such a discount is not warranted.

Business description

Cohort is an AIM-listed defence and security company operating across five divisions: MASS (32% of FY19 sales), SEA (32%), MCL (18%), the 80%-owned Portuguese business EID (9%), and the recently acquired 81% owned Chess Technologies based in the UK (c five months 9%).

Growth delivered again in FY19

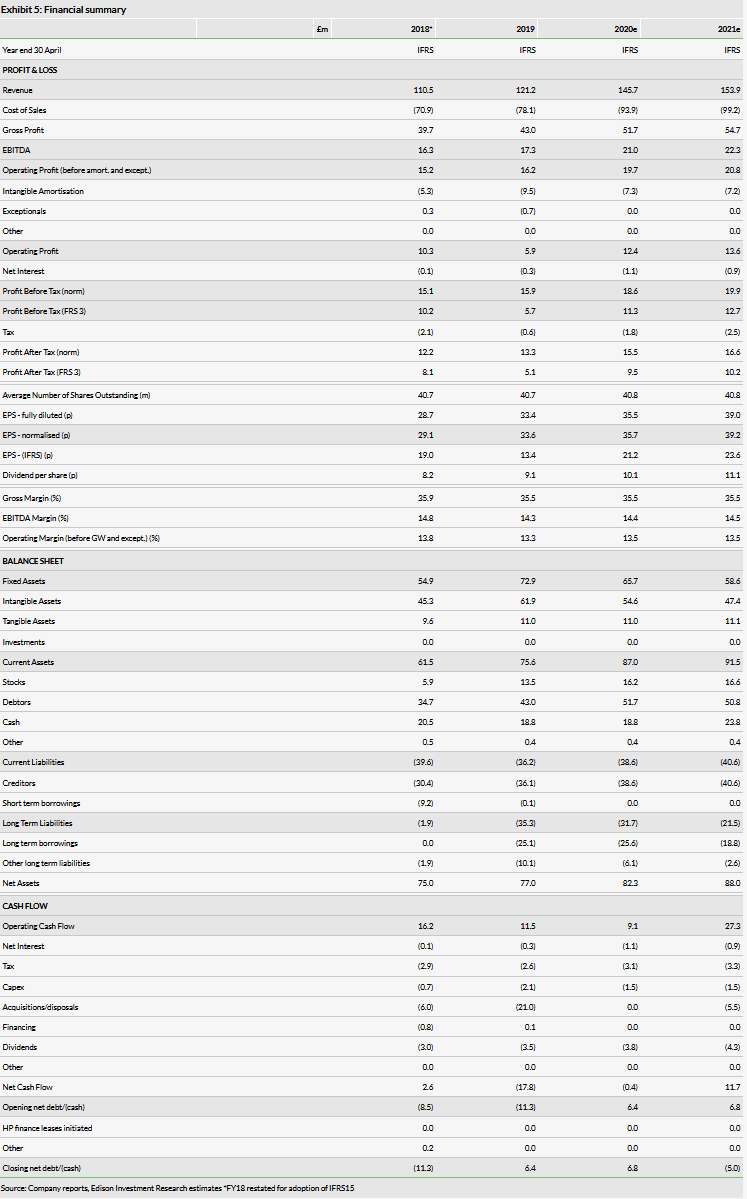

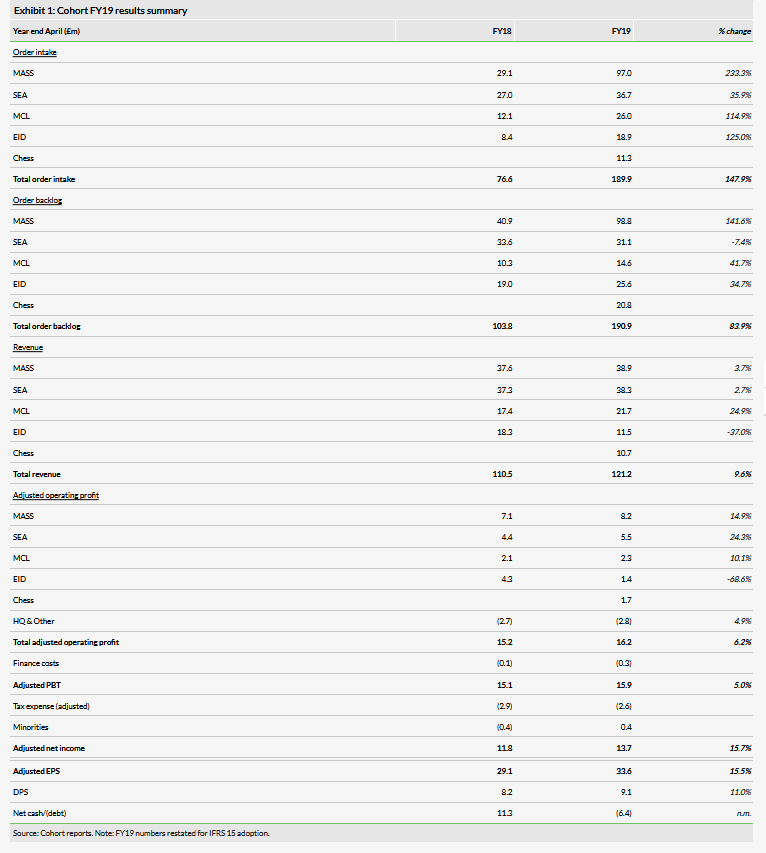

The FY19 results are summarised in Exhibit 1 below. The FY18 results were modestly restated to reflect the implementation of IFRS 15. The impact was to reduce FY18 revenues by £1.3m and adjusted operating profit by £0.4m.

The key features of the FY19 results are summarised as follows:

- The reported closing order book of £190.9m recovered strongly from the H119 report of £108.8m and £103.8m in FY18. Order intake of £189.9m in FY19 was at a record level and included some £70m of contract renewals. All of the continuing divisions increased their intake considerably and Chess booked £11.3m of orders following its consolidation in December, and added £20.8m to the year-end backlog. Alongside the results, the company announced a further electronic warfare operational support (EWOS) export order for MASS of £4.75m.

- Reported revenues were £121.2m (FY18: £110.5m restated). This was slightly below our estimate as EID revenues fell below expectations, partially compensated for by a better than expected performance at Chess (see Exhibit 4).

- Reported adjusted operating profit was £16.2m (FY18: £15.2m restated), broadly in line with our estimate of £16.6m allowing for the impact of IFRS 15.

- Reported adjusted EPS was 15.5% higher at 33.6p (FY18: 29.1p restated), both of which exclude research and development tax credits (RDEC) following an accounting change that now includes this in reported operating profit. We treat it as exceptional in both years, to align it with our previous preferred adjustment to exclude the credits from the tax line.

- Reported DPS was 9.1p (FY18: 8.2p), an 11.0% increase, in line with the group’s progressive dividend policy and continuing the positive track record since flotation in 2006.

- Following payment of the initial consideration for Chess Technologies of £21m (including debt acquired), Cohort ended the year with net debt of £6.4m (FY18: net cash £11.3m). However, this was much better than expected due to some favourable timing of supplier payments and debtor receipts around the year end. These effects unwound early in FY20.

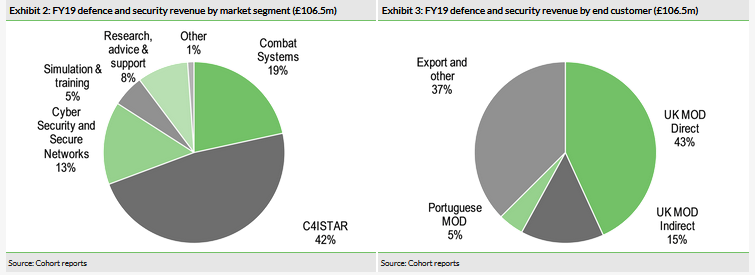

Defence and security revenues accounted for 88% (FY18: 89%) of the group total in FY19. These can be split further by customer and market segment as shown in Exhibits 2 and 3, respectively.

By segment, the most significant proportional increases came in C4ISTAR, largely due to MCL. A recovery in research advice & support services at SEA was largely neutralised by a similar decline in sales of simulation and training (mainly at SEA and MASS, respectively).

End-customer changes can be summarised as a modest decline in both domestic markets, with strong improvements in security and export markets (each up £4.8m), including the inclusion of Chess.

The slight increase in the proportion of group sales to commercial markets (FY19: 12%) was due to a strong performance in SEA’s transport segment. Record deliveries of traffic and rail control and safety monitoring systems were made, helping to increase the group’s non-defence revenues by almost 20% in the year. Transport alone accounted for 7% of group sales (FY18: 4%).

Overall group revenues were split 54:46 between products and provision of services.

MASS (FY19 sales: £38.9m; 32% of group sales) continued to grow, with revenues up 4% and adjusted operating profit of £8.2m (FY18: £7.1m), a 15% increase and a 21% margin (FY18: 18.9%. growth). The strong margin performance was due to increased EWOS export work as well as completion of a support contract allowing contingencies to be released. Order intake was £97.0m, a divisional record, centred on the long-term £50m UK MOD support contract signed in H219. Although order intake and margins are expected to return to more normal levels in FY20, further profit growth is expected. The expected progress is underpinned by a backlog of £98.8m (FY18: £40.9m), of which orders deliverable in FY20 are £29.1m, representing order cover of our divisional sales estimate of c 67% (FY18: 52%).

SEA (FY19 sales £38.3m; 32% of group sales) returned to growth in FY19, and benefited from a restructuring in H119 that delivered £0.6m in H219 of a total anticipated annual cost reduction of £1.0m. Sales rose 3% and the adjusted operating margin rose 250bp to 14.3%, delivering adjusted operating profit of £5.5m, 24% higher than FY18. Margins also benefited from the absence of a loss-making contract that depressed the prior year. While UK submarine activity remains in a lull with FY19 revenues of just £4.7m (FY18: £7.3m), sales in other areas continued to increase. Transport had a strong year and there was modest growth in the research activity. FY20 is expected to see good naval order intake for export and domestic markets for products including communications systems and torpedo launch systems, as navies refresh and recapitalise their fleets. While the order of backlog of £31.1m included deliverable sales of just £12.3m for FY20 compared to £15.7m at the start of FY19, this had increased to £16.6m at the end of June, providing cover of our estimated FY20 sales of c 43%. Management expects a flat performance from the division in FY20.

EID (FY19 sales £11.5m; 9% of group sales) had a disappointing year. An export order from the Middle East for armoured vehicle intercoms had been expected to be received early enough to provide a significant contribution in Q419, but failed to materialise in time. The result was inadequate overhead coverage, which saw full-year margins drop to 11.3% (FY18: 23.5%) as revenues fell almost 40%. It was eventually signed and will boost current year performance. The £7m decline in revenues was split between the tactical and naval divisions, of which the tactical decline largely related to the deferred order. The naval division saw a fall in radio deliveries to the Portuguese Navy, as well as some programme deferral for the M-Class frigate programme for Portugal, Belgium and Holland. The division is entering a period where management expects lower levels of naval support work, whereas lower-margin intercom and radio system deliveries are expected to increase, meaning divisional margins return to a more normal 18–20% range. The order cover for our expected recovery in sales in FY20 is a healthy 85%, with further export and domestic opportunities in prospect.

MCL (FY19 sales £21.7m; 18% of group sales) delivered a strong performance, with a 25% increase in revenues largely due to initial deliveries of tactical systems to the UK submarine fleet, with higher bought-in content and lower margins. Combined with the full impact from some investment in overheads during FY18, adjusted operating profit rose by 10%. MCL also had a strong year of order intake, booking £26.0m of new and repeat business, a book to bill ratio of 1.2x and generating a year end backlog of £14.6m (FY18: £10.3m). Of this, £7.7m is for delivery in FY20, providing sales cover of 35%, but visibility is normally only three to six months. Management expects modest growth in the current year

Chess Technologies (FY19 £10.7m; 9% of group sales) made its initial circa five-month contribution to the group in H219. Chess was acquired in December 2018 and provides specialist products and technologies in the areas of electro-optics, tracking and fire control to customers around the world. It performed better than had been anticipated in the period, generating an adjusted operating profit contribution of £1.7m on sales of £10.7m at a margin of 15.8%. The company benefited in the period from deployment of its counter unmanned aerial vehicle (C-UAV) technology at two UK airports due to a high-profile drone incursion. We assume this would have been very high-margin work due to its urgency. We would expect margins to moderate to low to mid-teens in the coming years. Chess has strong positions and order prospects on a range of naval and land programmes with significant customers. Of its £20.8m order backlog at the start of the year, £15.0m is deliverable in FY20, providing order cover of 68% for our divisional sales estimate of £22.0m for FY20.

Outlook

Clearly, the political environment is in turmoil in the UK, and remains focused on Brexit. Despite this and the continuing constraints in UK defence budgets, the external climate suggests to us that increased spending is likely to be sought. As well as its more stable long-term programmes, Cohort appears to be well positioned with its portfolio of activities to take advantage of other likely areas of increased resource, such as maritime security and anti-submarine warfare (ASW), counter UAS (unmanned air systems = drones) and cybersecurity. There are also good export prospects in these areas as defence and counterterrorism spend increases round the globe, augmented by the addition of the more export-oriented activities of Chess. In Portugal, defence spending is on the increase, which should help EID to recover as deferred and new export business is won and executed.

Overall, management states that order cover for FY20 was 55% of consensus sales of £146.7m at the start of the year, which returns it to the more normal 55–65% range from which it slipped in FY18. Our estimate is marginally below this. While SEA’s contribution is expected to remain broadly flat, EID should bounce back strongly, MCL is expected by management to grow modestly, MASS should continue its growth and Chess looks set to make a strong full-year contribution.

Earnings revisions and FY21 estimates

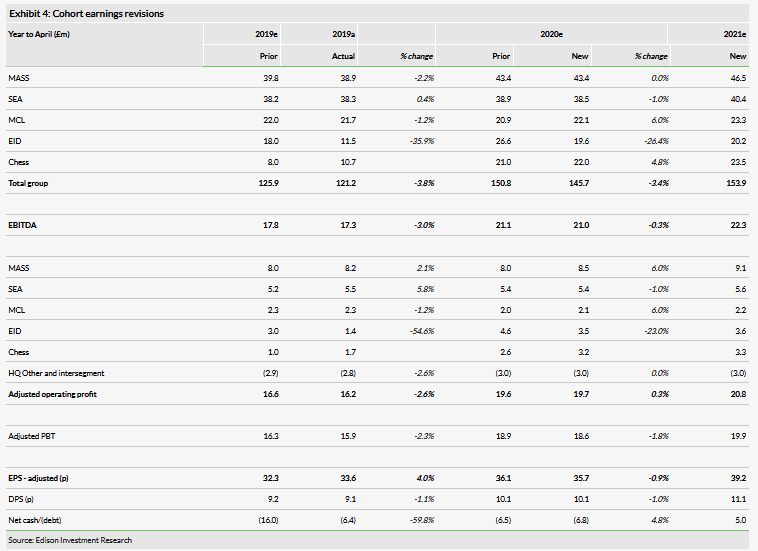

To reflect the updated trading prospects of the divisions, we have revised our estimates for FY20 as follows:

It can be seen that the overall impact is modest, with a less than 1% reduction in EPS expectations for FY20e. In addition, our newly introduced FY21 estimate shows good growth of around 10% in adjusted EPS, and a return to a net cash position as the company continues to execute its increased order backlog.