Suburban Propane Partners LP (SPH) markets and distributes fuel oil, kerosene, diesel fuel and gasoline to residential and commercial customers, and is now the third largest retail marketer of propane in the United States, measured by retail gallons sold.

On August 1, 2012, SPH consummated its transformative acquisition of the retail propane business of Inergy L.P. (NRGY), effectively doubling the size of its customer base and expanding its geographic reach into 11 more states, including a new presence in portions of the Midwest.

Acquisition consideration consisted of ~$1.9 billion, the principal components of which were (i) ~$1.075 billion in newly issued notes; (ii) ~$185 million in cash to NRGY note holders; and (iii) 14.2 million new SPH units (valued at ~$590 million) distributed to NRGY unit holders. The notes and cash were issued and paid to holders of ~$1.2 billion NRGY notes. In addition, SPH paid ~$65 million to these note holders as a consent payment. Goodwill and other intangible assets totaling ~$1.5 billion were added to the balance sheet following the acquisition, so tangible book value is now negative.

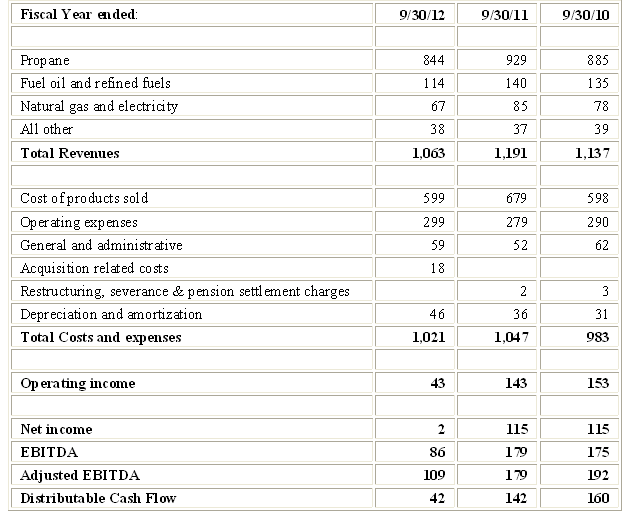

SPH typically sells ~ 2/3 of its retail propane volume and ~ 3/4 of its retail fuel oil volume during the peak heating season of October through March. In an article dated 4/21/12, I noted that fiscal 2012 will not look good compared to fiscal 2011. On November 28, 2012, SPH issued its annual report on Form 10-K for fiscal 2012 (ended September 30, 2012) which includes results of operations of the NRGY retail propane business from August 1, 2012. A review of the numbers illustrates the difficult business environment faced by SPH in fiscal 2012:

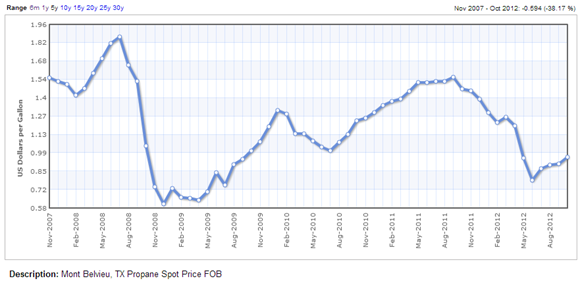

Record warm temperatures across the SPH's service territories were the most significant factors cited by management as impacting volumes sold and overall profitability in fiscal 2012. Management reported that retail propane gallons sold for fiscal 2012 decreased 15.1 million gallons, or 5.1%, to 283.8 million gallons from 298.9 million gallons in fiscal 2011, and that sales of fuel oil and other refined fuels decreased 8.7 million gallons, or 23.4%, to 28.5 million gallons compared to 37.2 million gallons in the prior year. While average posted prices for fuel oil were 7.4% higher than the prior year, average posted prices for propane during fiscal 2012 were 19.7% lower than the prior year and, at the end of September 2012, Mont Belvieu, TX propane spot price was ~ $0.92 per gallon compared to $1.51 a year earlier.

Propane prices increased from August 2010 to August 2011 and then declined sharply in the following 12 months, as shown below:

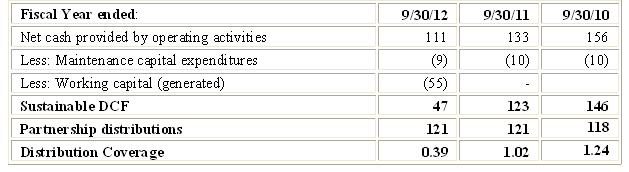

Distributable cash flow (“DCF”) is a quantitative standard viewed by investors, analysts and the general partners of many master limited partnerships (“MLPs”) as an indicator of the MLP’s ability to generate cash flow at a level that can sustain or support an increase in quarterly distribution rates. Since DCF is not a Generally Accepted Accounting Principles (“GAAP”) measure, its definition is not standardized. In fact, as shown in a prior article, each MLP may define DCF differently. SPH reports earnings before taxes, depreciations & amortization (“EBITDA”) but not DCF. The only non-GAAP measure it reports is Adjusted EBITDA which adds back to EBITDA items such as acquisition-related costs ($18 million in 2012), losses on asset disposals ($2.1 million in 2012), legal settlements ($4.5 million in 2012), debt extinguishment ($2.2 million in 2012) and derivatives (a gain of $4.6 million in 2012).

A review of its cash flows and the sustainability of SPH’s distributions can still be performed, albeit without a comparison to reported DCF (as mentioned above, SPH does not provide this metric). Comparing sustainable cash flow to partnership distributions is a good starting point to ascertaining whether distributions are sustainable DCF and whether they were funded by additional debt, by issuing additional units or other sources of cash that I consider non-sustainable:

I generally do not include working capital generated in the definition of sustainable DCF because I do not regard it as a sustainable source. Over reasonably lengthy measurement periods, working capital generated tends to be offset by needs to invest in working capital. Therefore I ignore $55 million of the net cash provided by operating activities in calculating sustainable DCF as it was generated primarily by a reduction in accounts receivable and inventories due to the decline in sales volumes.

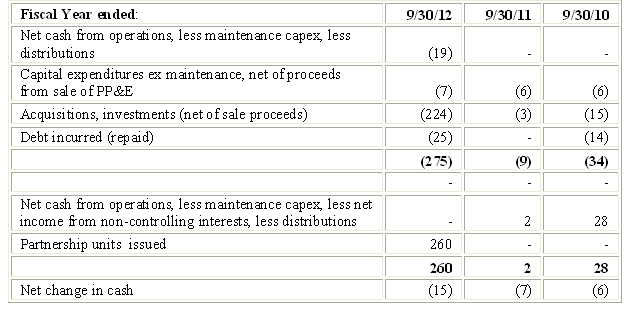

Table 2 indicates that for the fiscal 2012 sustainable DCF fell significantly short of covering distributions. A simplified cash flow statement is provided in Table 3 below.

Simplified Sources and Uses of Funds:

Table 3 indicates that in fiscal 2012, unlike prior years, SPH funded distributions partially through issuance of additional partnership units (in August 7.245 million units were issued in a public offering at a price per unit of $37.61 realizing net proceeds of ~$260 million). SPH has maintained its distribution per unit at $3.41 ($0.8525 per quarter) for the last 8 consecutive quarters despite deteriorating business fundamentals. At 8.7%, SPH offers an enticing distribution yield. However, investors should review SPH’s results of operations in fiscal 2012, and the implications of its $1.9 billion acquisition of NRGY’s propane business consummated on 8/1/12, in attempting to ascertain whether the distribution is sustainable.

Management anticipates greater cash requirements in fiscal 2013 as result of this acquisition. Specifically, ~$51 million (~$48 million more than in fiscal 2012) on maintenance and growth capital expenditures, ~$100 million (~$60 million more than in fiscal 2012) on interest and income tax payments; and (iii) ~$198 million ($77 million more than in fiscal 2012) more on distributions as a result of the larger number of units outstanding (currently ~57 million) and the previously announced intent to raise distributions from $3.41 to a $3.50 annualized rate beginning with 1QFY2013 (quarter ending 12/31/12). Based on resources available as of 9/30/12 (cash of ~$134 million and unused borrowing capacity of ~$253 million under the Revolving Credit Facility), SPH should have sufficient funds. However, these do not constitute sustainable sources of DCF.

For distributions to be sustainable, operating cash flow in 2013 need to be ~$200 million. At the time of the acquisition, management estimated the NRGY propane business could generate $185 million of incremental EBITDA and that it would realize cost savings and other synergies of $50 million. Whether the $235 million estimate is realistic depends on the weather (the peak heating season of October through March is critical) and on the ability of SPH to integrate the acquired assets into its system while extracting operating efficiencies from the combined businesses. This will not happen overnight. Cost savings and other synergies in the first year of combined operations are expected to be $10-15 million and management expects the integration process to take up to 3 years. Results for the quarter ended 12/31/12 will provide a first real look at how this is shaping up.

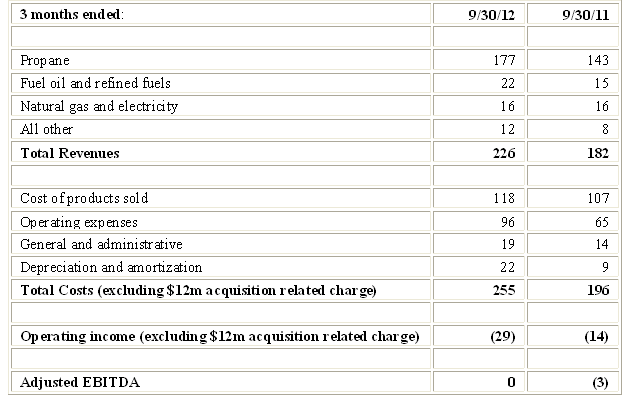

In the meantime, an even more preliminary view can be obtained by comparing 4QFY12 to 4QFY11 because the quarter ended 9/30/12 included the results of operations for NRGY’s propane business for the two months since the date of acquisition. Note that it also included 14 weeks of operations compared to 13 weeks in the prior-year period and that consistent with the seasonal nature of its business, SPH typically reports losses for its fiscal fourth quarter. A comparison of some of the key parameters is set forth in Table 4 below:

SPH’s current yield is at the high end of the MLP universe. Table 5 below compares SPH’s current yield of some of the other MLPs I follow:

I consider my SPH position speculative. My hope is that management scrubbed the balance sheet and that charges taken in fiscal 2012 (acquisition-related costs, losses on asset disposals, legal settlements, debt extinguishment) were indeed one-time. While the very low leverage and high distribution coverage ratios achieved in prior years (pre-acquisition) were, to an extent, due to a much more favorable price and demand environment, they also reflected a careful and conservative management style. I also hope this approach was applied to the acquisition of NRGY's retail propane business and will be reflected in the results. If it is, SPH may provide investors significant upside potential.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Closer Look At Suburban Propane Partners' FY '12

Published 12/04/2012, 04:00 AM

Updated 07/09/2023, 06:31 AM

Closer Look At Suburban Propane Partners' FY '12

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.