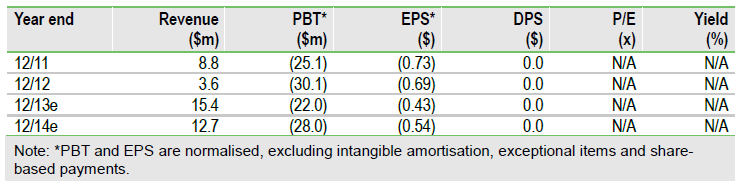

Cleveland BioLab’s (CBLI) near-term investment case rests on its ability to successfully develop Entolimod (CBLB502) as the first FDA-approved medical countermeasure to reduce death from total body irradiation. A major near-term catalyst, and critical to Entolimod’s chances of securing substantial US government procurement contracts in 2015, is a BARDA development contract award in Q213. The BARDA contract, worth up to $50m, would fund the final pivotal studies (animal efficacy and human safety) required to submit a BLA in Q414. We value Cleveland at $102m ($2.30/share), mainly based on winning a BARDA supply contract in 2015 worth >$200m.

Animal efficacy, human safety required

Entolimod (a Salmonella flagellin derivative that inhibits apoptosis in healthy cells) is being developed under the FDA’s Animal Efficacy Rule, created in 2002 to encourage and enable the development of products when human efficacy studies are not ethical or feasible. Cleveland has conducted extensive animal efficacy studies and human safety trials with Entolimod, the most advanced radiation countermeasure candidate.

US government = gatekeeper

Over the next few years Cleveland is heavily reliant on winning development and procurement contracts from the US government, specifically the Department of Defense (DoD) and BARDA. The Project BioShield Act (2004) has provided $1.8bn to support the development of, and $2.6bn to purchase, medical counter-measures (mainly for anthrax/smallpox). Entolimod already has a $30m purchase order from the DoD and we estimate a three-year BARDA procurement contract of $240m.

A future in oncology

Entolimod’s mechanism of action as a TLR5 agonist, with an ability to mobilise an innate immune response especially against TLR5+ tumours, indicates potential as a targeted anti-cancer agent. A Phase I study of Entolimod in 48 patients is ongoing (results H114), while a Russian subsidiary is conducting Phase I studies with two further anti-cancer candidates, pointing to Cleveland’s long-term future in oncology.

Valuation: $102m ($2.30/share) with upside potential

We value Cleveland at $102m, or $2.30 per share, based on a sum-of-the-parts DCF valuation. We use a standard 12.5% discount rate and include end-2012 consolidated net cash of $28m. The bulk (80%) of this valuation is derived from Entolimod’s potential as a biodefence agent, with the key sensitivities being the timing and size of the BARDA development and procurement contracts.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Cleveland BioLabs: A Future In Oncology

Published 03/26/2013, 07:09 AM

Updated 07/09/2023, 06:31 AM

Cleveland BioLabs: A Future In Oncology

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.