Cintas Corporation (NASDAQ:CTAS) is scheduled to release first-quarter fiscal 2020 (ended August 2019) results on Sep 24, after the market closes.

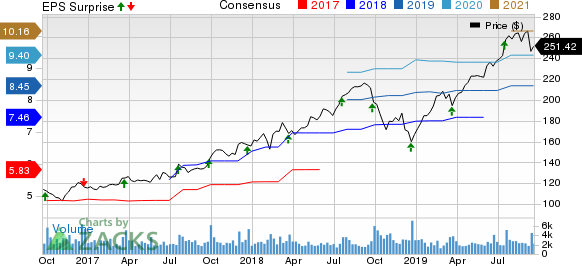

The company delivered better-than-expected results in the last four quarters, the average earnings surprise being 6.27%. In the last reported quarter, its earnings of $2.07 surpassed the Zacks Consensus Estimate of $1.94 by 6.70%.

In the past three months, shares of the company gained 8.2% compared with the industry’s growth of 7.9%.

Let us see how things are shaping up for Cintas this quarter.

Factors to Affect Q1 Results

The company’s results can be influenced by several company-specific matters. Of all, implementation of its new enterprise resource planning system, namely SAP, will be a boon. In fiscal 2020 (ending May 2020), the company will convert 35% of its operations in SAP, while related expenses will be incurred during the year.

In addition, Cintas’ innovative products, efficient services and presence of customers in various markets give it a competitive edge over other industry players. A dedicated management team and acquired assets of G&K Services are added boons. Also, need for companies to provide a safe and clean working requirement to its employee is creating demand for players like Cintas.

The company has not provided any quarter-specific projections but a look at its annual guidance can be helpful. For fiscal 2020, it anticipates revenues of $7.24-$7.31 billion (suggesting growth of 5-6.1% from the year-ago reported figure) and earnings per share of $8.30-$8.45.

On the flip side, the company noted that one less working day in fiscal 2020 will hurt revenues by 0.4%, operating margin by 12.5 basis points (bps), earnings by 6 cents per share and earnings growth by 90 bps. Working days in the fiscal first quarter will be one less than the year-ago quarter. Also, high tax rate of 21% in the fiscal year (versus 19.9% in fiscal 2019) will adversely impact earnings by 14 cents and earnings growth by 180 bps.

On a segmental basis, the Zacks Consensus Estimate for Uniform Rental and Facility Services’ revenues is pegged at $1,451 million for the fiscal first quarter, indicating 5.5% growth from the year-ago reported figure. First Aid and Safety Services’ revenues estimates are pegged at $166 million, suggesting 8.5% growth from the year-ago quarter, and All Other’s revenues are pinned at $177 million, indicating a 4.1% improvement year over year.

Earnings Whispers

Our proven model provides some idea about the stocks that are about to release their earnings results. Per the model, a stock needs a combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for a likely earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The case with Cintas has been provided below.

Earnings ESP: The company has an Earnings ESP of +0.00%, with both the Zacks Consensus Estimate and the Most Accurate Estimate pegged at $2.14.

Cintas Corporation Price, Consensus and EPS Surprise

Cintas Corporation (CTAS): Free Stock Analysis Report

Colfax Corporation (CFX): Free Stock Analysis Report

John Bean Technologies Corporation (JBT): Free Stock Analysis Report

Brady Corporation (BRC): Free Stock Analysis Report

Original post