Cigna Corp. (NYSE:CI) came up with adjusted earnings per share of $2.46 in fourth-quarter 2018, missing the Zacks Consensus Estimate by 2.8%. However, the same was up 26.8% year over year.

A rise in operating expenses which more than offset the increase in revenues led to the earnings miss.

Cigna posted revenues of $13.75 billion, surpassing the Zacks Consensus Estimate by 21.7%. Revenues also grew 29% year over year, led by higher premium and fee income.

Premiums were up 11% year over year to $9.1 billion while fees increased 12% to $1.49 billion.

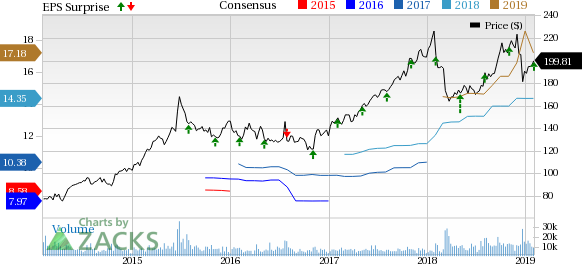

Cigna Corporation Price, Consensus and EPS Surprise

Operating expenses grew 39% year over year to $13.7 billion, due to higher medical costs, pharmacy and other service cost, along with amortization of intangible assets.

The company’s medical enrollment grew by 584,000 lives from the prior-year quarter to 16.96 million customers, driven by growth in Government, Commercial and International markets. Moreover, the acquisition of Express Scripts (NASDAQ:ESRX), completed in December, led to an increase in Pharmacy and Medicare Part D members.

Strong Segmental Performance

Integrated Medical: Operating revenues of $8.3 billion were up 12.6% year over year, driven by Commercial customer growth, expansion of specialty relationships, as well as premium increases, consistent with the underlying cost trends.

Adjusted operating earnings were $643 million, up 23.6% year over year due to medical and specialty business growth, along with a strong medical cost performance.

Health Services: Operating revenues of $3.31 billion were up 196% year over year due to accretion from Express Scripts.

Operating income increased 103% from the year-ago quarter to $153 million due to contributions from Cigna's mail order pharmacy operations and Express Scripts acquisition.

International Markets: Operating revenues of $1.36 billion were up 7% year over year, reflecting the company’s differentiated health and life solutions for individual consumers, provided through diversified distribution channels as well as strong global health benefits contributions.

Adjusted operating income decreased 13.7% year over year to $120 million due to seasonally higher claims expenses, as well as strategic investments for long-term growth.

Global Disability and Life: Operating revenues of $1.25 billion were down 2.1% year over year. However, operating income increased 1.8% year over year to $109 million, led by strong life results, offset by unfavorable disability claims.

2019 Guidance

For 2019, the company expects earnings in the range of $16-$16.50 per share basis.

Total revenues are expected in the range of $131.5-$133.5 billion and medical customers are projected to grow within 0.3-0.4 million lives.

Medical care ratio is expected in the range of 80.5-81.5%.

Our Take

Despite the earnings miss, we remain bullish on Cigna due to its recent acquisition of pharmacy benefit manager, Express Scripts, which provides a nice diversification to the company’s existing businesses, namely administrative services, international operations, and disability and life insurance, which are already performing strongly.

The combination of Express Scripts’ pharmacy benefit business with Cigna’s health insurance business will help control drug pricing cost to a large extent, which is one of the biggest components of soaring medical cost. Cigna has a better control over its medical cost compared with other players in the industry. The decline in medical costs should further aid its margins.

Another distinguishing feature of the company is the international business, which provides additional diversification opportunities. Its strong balance sheet is another positive.

Zacks Rank and Other Releases

Cigna currently carries a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among the other health care companies that have reported fourth-quarter earnings so far, the bottom line of Anthem, Inc. (NYSE:ANTM) , HCA Healthcare (NYSE:HCA) and UnitedHealth Group Inc. (NYSE:UNH) beat estimates by 10.9%, 15.44%, 2.5%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Cigna Corporation (CI): Get Free Report

Anthem, Inc. (ANTM): Get Free Report

UnitedHealth Group Incorporated (UNH): Get Free Report

HCA Healthcare, Inc. (HCA): Get Free Report

Original post

Zacks Investment Research