Choice Hotels International, Inc. (NYSE:CHH) reported better-than-expected results in second-quarter 2019. Both the top and bottom lines not only surpassed the Zacks Consensus Estimate but also grew on a year-over-year basis. The upside was mainly attributable to solid progress on its flagship Comfort brand, renovated hotels that are capturing more business travel via strong developer demand and rapid growth in upscale Cambria brand across the country.

This notable lodging franchisor reported adjusted earnings of $1.19 per share, beating the consensus mark of $1.14 by 4.4% and increasing 7.2% year over year. Notably, this marked its sixth straight quarter of earnings beat.

In the quarter under review, total revenues came in at $317.7 million, which increased 8% from the year-ago period and topped the consensus mark of $303 million by 4.8%.

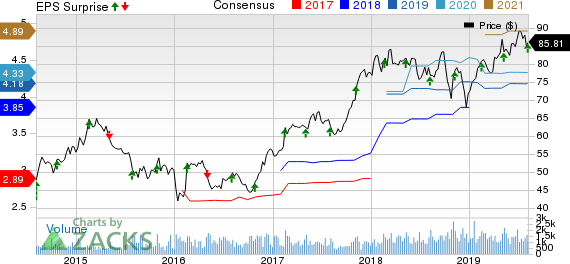

Choice Hotels International, Inc. Price, Consensus and EPS Surprise

Let’s delve deeper into the numbers.

Franchising & Royalties

Domestic royalty fees totaled $100.8 million, up 3% year over year. However, domestic system-wide RevPAR declined marginally by 0.1% year over year. Average daily rate (ADR) declined 0.1% and occupancy remained flat with the prior-year quarter.

The company’s newly executed domestic franchise agreements were 181 in the second quarter, of which 107 was awarded in June. This marked the largest number of agreements awarded in June in its history.

As of Jun 30, 2019, the number of domestic franchised hotels and rooms rose 2% and 2.1% year over year, respectively.

Operating Results

Total operating expenses during the quarter increased 13% from second-quarter 2018 to $210.5 million. Nonetheless, adjusted operating margin expanded 120 bps year over year. Adjusted EBITDA also increased 6.5% from the prior-year period to $100.4 million.

Balance Sheet

As of Jun 30, 2019, the company had cash and cash equivalents of $34.4 million compared with $26.6 million on Dec 31, 2018.

Long-term debt in the same period was $784.3 million, up from $753.5 million at 2018-end. Goodwill — as a percentage of total assets — was 13.1% at the end of the second quarter, down from 14.8% at 2018-end.

In the first six months of 2019, Choice Hotels paid cash dividends of $24 million. Based on the current quarterly dividend rate of 21.5 cents per share, the company expects to pay dividends worth approximately $48 million in 2019. Meanwhile, management repurchased roughly $0.5 million shares for nearly $42 million under the share repurchase program during the said period. On Jun 30, 2019, it authorized up to 1.7 million additional shares of common stock under the share repurchase program.

Third-Quarter Guidance

For the third quarter, adjusted earnings per share (EPS) are anticipated within $1.25-$1.29, up from $1.11-$1.15 expected earlier. Notably, the guided range is considerably below the Zacks Consensus Estimate of $1.31. Domestic RevPAR is expected between 0% and 2%.

Full-Year 2019 Guidance

Choice Hotels now expects EPS between $4.16 and $4.22, down from prior expectation within $4.06-$4.18. The mid-point of the guided range is marginally higher than the current Zacks Consensus Estimate of $4.17.

Zacks Rank

Choice Hotels, which share space with Hilton Worldwide Holdings Inc. (NYSE:HLT) , Hyatt Hotels Corporation (NYSE:H) and Marriott Vacations Worldwide Corporation (NYSE:VAC) in the Zacks Hotels and Motels industry, currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Choice Hotels International, Inc. (CHH): Free Stock Analysis Report

Marriot Vacations Worldwide Corporation (VAC): Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT): Free Stock Analysis Report

Hyatt Hotels Corporation (H): Free Stock Analysis Report

Original post

Zacks Investment Research