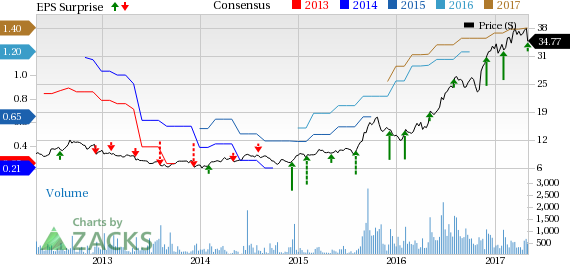

Central Garden & Pet Company (NASDAQ:CENT) continued with its positive earnings surprise streak for the eleventh consecutive quarter, when it reported second-quarter fiscal 2017 results. The company posted adjusted earnings of 67 cents per share that beat the Zacks Consensus Estimate of 64 cents and also increased 3.1% year over year.

Organic growth, value accretive acquisitions such as that of the pet bedding business and Segrest along with divestment of non-strategic assets have been aiding the company to enhance portfolio, consequently resulting in improved performance.

Net sales of this leading producer of branded lawn & garden and pet supplies products grew 5.3% year over year to $569.9 million and coming marginally ahead of the Zacks Consensus Estimate of $566 million. Revenue growth was driven by the company’s recent Segrest acquisition.

Gross profit increased 8.4% to $183.5 million, while gross margin expanded 90 basis points (bps) to 32.2%. Central Garden & Pet reported operating income of $63.9 million, compared with $59.4 million in the year-ago quarter. Operating margin expanded 20 bps to 11.2% in the quarter under review.

Following the results, not much movement was noticed in after-hours trading session. However, in the past one year, the stock has displayed a tremendous run in the index, soaring 88.6% compared with the Zacks categorized Consumer Product-Miscellaneous Discretionary industry’s gain of only 1.3%.

Segment Details

The Pet segment’s net sales gained 8.4% year over year to $298.4 million on the back of acquisitions as well as organic growth. Sales across the segment’s branded product and other manufacturers’ products came in at $240.5 million and $57.9 million, reflecting an increase of 10.9% and decline of 0.9%, respectively. Moreover, Pet organic sales increased 1.3%.

The segment’s operating income rose 6.9% year over year to $34.6 million, while operating margin contracted 20 bps to 11.6%.

Net sales at the Garden segment were up 2.1% to $271.5 million. The segments revenues were driven by increase in sales of other manufacturers’ products rise in control and fertilizer sales. Sales across the segment’s branded product came in at $216.7 million, up 0.4% year over year, while other manufacturers’ reported revenues of $54.8 million, up 9.4% year over year.

The segment recorded an operating income of $46 million, in comparison with $44.4 million recorded in the prior-year quarter.

Financial Details

Central Garden & Pet ended the quarter with cash and cash equivalents of $11 million, long-term debt of $495.9 million and shareholders’ equity of $593.2 million, excluding non-controlling interest of $1.3 million.

2017 Guidance

In an effort to deliver sustainable growth, the company is increasing investment. However, costs related to initiatives may hurt 2017 net income but will drive top-line growth in second-half fiscal 2017.

Central Garden has raised earnings projections. The company expects fiscal 2017 earnings per share of $1.37 or higher, up approximately 8.7% or above from the prior year. The company had earlier projected 2017 earnings per share of $1.34.

Other Stocks to Consider

Central Garden currently carries a Zacks Rank #2 (Buy). Other top ranked stocks, which warrant a look includes The Children's Place, Inc. (NASDAQ:PLCE) , PCM, Inc. (NASDAQ:PCMI) and Essendant Inc. (NASDAQ:ESND) . All these three stocks sport a Zacks Rank #1 (Strong buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Children's Place has an average positive earnings surprise of 39% in the trailing four quarters. The stock has a long-term growth rate of 8%.

PCM has a long-term earnings growth rate of 30% and the company’s earnings have surpassed the Zacks Consensus Estimate in the trailing four quarters, with an average beat of 74.4%.

Shares of Essendant have gained 16.5% in the past one month.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Central Garden & Pet Company (CENT): Free Stock Analysis Report

PCM, Inc. (PCMI): Free Stock Analysis Report

Essendant Inc. (ESND): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Original post

Zacks Investment Research