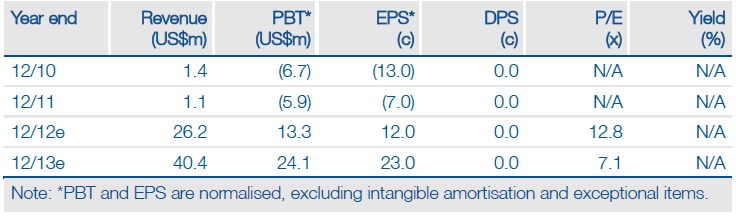

Central Asia Metals (CAML.L) has produced a strong set of interim results for H112. The main takeaways are that it brought Kounrad into production in 20 months, US$8m under budget at US39m, and it achieved copper cathode production of 1,728t to end June with 4,318t to date (from first production on 29 April to 26 September). Being so close to its original production guidance of 5,000t for FY12 already, CAML has raised its guidance to 5,750kt for 2012, a 15% increase. This translates to a potential 60% increase in EPS to 12c, which uses a US$3.44/Ib Cu price for FY12 (vs US$3.00/Ib previously). Our NPV10 rises slightly to £1.13 (vs £1.11 previously) at US$3.00/Ib from 2013. Near-term upside is geared to CAML taking sole ownership of Kounrad, probably now during H113, depending on Kazakh regulatory approvals, which would lift our NPV10 to £1.99/share.

Gross cash costs low at US$0.85/Ib, profit margin 75%

CAML operates at a vastly lower C1 cash cost of US$0.85/Ib compared to its larger peers (Kazakhmys’ C1 costs are US$3.60/Ib and Antofagasta’s US$1.60/Ib, excluding by-product credits). This is a clear indication of CAML’s operational efficiency derived from a simple cheap copper production method via re-treatment of Kounrad’s waste dumps.

Flexible flow rates and heating to minimise effects of winter

Entering into the fourth quarter also sees the onset of the Kazakh winter and the potential for leachate to freeze. However, similar heap-leaching operations in Mongolia operate year round and CAML has operated its pilot plant through winter periods with no such issues and intends to heat its solution to maintain production levels. Keeping leachate flowing will result in production being maintained.

Valuation: 60% increase to EPS, 2% to NPV10

A revised 5,750t of Cu cathode produced for 2012 equates to our raising our EPS guidance from 6.7c (based on our long-term Cu price of US$3.00/Ib and 5,000t copper cathode produced) to 12c (using the average realised copper price achieved to end June of US$3.44/Ib). Our NPV10 increases marginally from £1.11/share to £1.13/share (using a long-term 3.00/Ib Cu price from 2013 onwards).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Central Asia Metals: Strong Interim Results for H112

Published 10/02/2012, 08:59 AM

Updated 07/09/2023, 06:31 AM

Central Asia Metals: Strong Interim Results for H112

Raising guidance

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.