Celanese Corporation (NYSE:CE) will raise the prices of vinyl acetate-based emulsions. The price hike will be effective from Mar 27, 2018 or as contracts permit.

BASF SE (BASFY): Free Stock Analysis Report

Celanese Corporation (CE): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB): Free Stock Analysis Report

Original post

Zacks Investment Research

The company will increase the price of vinyl acetate-based emulsions by ¥200/MT in Greater China and $50/MT in Asia outside China, respectively.

The company is taking appropriate pricing actions amid a volatile raw material pricing environment. Celanese’s strategic measures, including operational cost savings through productivity actions and pricing initiatives, are likely to provide an impetus to its earnings in 2018.

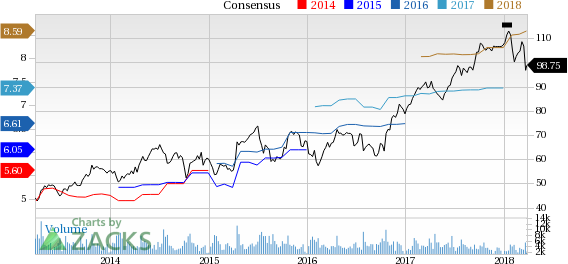

The company shares have moved up 11.4% over a year, outperforming the industry’s 9.2% gain.

Celanese recently raised its earnings guidance for 2018, citing a stronger start to the year across its Acetyl Chain and Advanced Engineered Materials businesses. The company now envisions adjusted earnings per share growth in the 12-16% range from the prior-year quarter, up from its earlier view of 10-14% growth.

Celanese is witnessing better-than-expected performance in all of its businesses. The company’s Acetyl Chain unit continues to gain momentum globally, while improved pricing and strong demand trends in its Advanced Engineered Materials business are contributing to its earnings. Celanese plans to provide more details on the same during first-quarter 2018 earnings call.

Celanese Corporation Price and Consensus

Celanese Corporation Price and Consensus

Zacks Rank & Stocks to Consider

Celanese has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are LyondellBasell Industries N.V. (NYSE:LYB) , Kronos Worldwide Inc. (NYSE:KRO) and BASF SE (OTC:BASFY) .

LyondellBasell has an expected long-term earnings growth rate of 9% and sports a Zacks Rank #1 (Strong Buy). The company’s shares have moved up 14.6% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kronos has an expected long-term earnings growth rate of 5% and flaunts a Zacks Rank #1. Its shares have gained 39.4% over a year.

BASF has an expected long-term earnings growth rate of 6.7% and carries a Zacks Rank #2 (Buy). Its shares have moved up 2.3% in a year.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

BASF SE (BASFY): Free Stock Analysis Report

Celanese Corporation (CE): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB): Free Stock Analysis Report

Original post

Zacks Investment Research